Territorial Restrictions: Around the world, the cost of healthcare varies considerably. And healthcare insurance companies make it their business to keep abreast of rising healthcare charges so as to ensure premiums charged for those expensive areas will not land them with unexpectedly large bills. To which end, expats should expect to find different premiums charged for the following three zones: Europe, North America (including the Caribbean) and the rest of the world.

It is essential that travelling expats check which regions they are covered for and ensure that if they do travel to areas outside those included in their policy conditions then top-up cover for the time spent away is arranged appropriately. It is also obvious that you should clarify if your insurance covers you in war zones.

Heath insurance is often seen as one of those boring topics that is easy to put off for another day – especially when in good health. In a country like Thailand, where healthcare is seen as cheap compared to countries in the west, this is very easy to do. Unfortunately, this stereotypical view of health insurance has its pitfalls, which often don’t become apparent until it is far too late.

How much does medical care cost in Thailand?

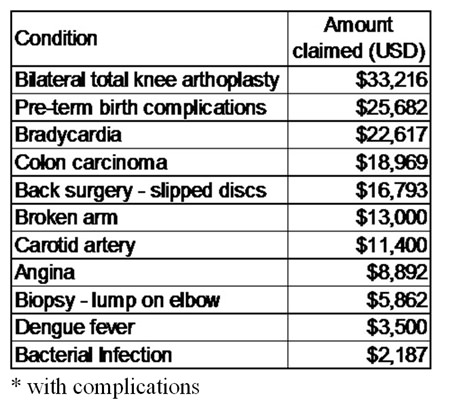

While Thailand is well known as a medical tourism hub – with high quality private care available at low cost by international standards – the cost of serious conditions is still enough to blow a big hole in an ex-pat’s finances. The table on this page shows the actual cost of a range of health insurance claims in Thailand, both from MBMG’s own experience and data provided by insurance companies.

Importantly, most of these claims would have been too large to be covered by some of the more basic local insurance policies.

Need to think carefully about employer-provided cover

We touched on this last week. While many employers provide a basic level of health insurance as part of the employment package, it is important to at least be aware of how much cover is provided. Local insurance policies can be inexpensive which is an obvious attraction, but can come with limitations. For instance, a cap on surgical cover of US$1000-$2000 is not uncommon, and while the daily allowance for hospital costs may be ample for a low-cost hospital, it is unlikely to cover the higher charges at a private hospital in, for example, Bangkok. In these circumstances, it may be worth considering taking out a “top up” policy if available.

The “extreme” claims – emergency repatriation, and the “C” word

Touch wood, the probability of needing an emergency repatriation back home is unlikely – with costs ranging from $50,000 to $200,000 or more putting it beyond the reach of most local insurance policies, and into “remortgage the house” territory. However, many are surprised to learn that the likelihood of developing cancer is as high as one in four – making it another factor well worth considering for long-term expats.

The best time to buy insurance is when you don’t need it

It is easy to put aside thinking about insurance when you are healthy. But the sad reality is that once issues arise insurers will refuse to cover them, potentially leading to significant ongoing costs. To be sure, you are less likely to claim if you are young and healthy – so that’s the best time to take out cover! You can guarantee that you will not use medical insurance if you have it, but you will need it if you do not have the right cover.

| The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected] |