Focus: Cash continues to gain strategic importance as an investment asset class in the current deflationary stage of the long term economic cycle which has persisted, in indebted developed western markets, since the turn of the millennium.

As one of only three asset classes expected to outperform during this 15 to 25 year phase, it has become increasingly important not only to allocate an adequate proportion of investment portfolios to cash but also to actively manage that money in order to achieve optimal returns in a low or zero interest rate environment against a backdrop of ongoing fears of a global depression.

Implications: During such a deflationary period, two key issues come to the fore:

* Strategically managing asset allocation with due regard to the risks and rewards of each asset class – recognising the three most suitable asset classes for this long term phase (namely gold, bonds and cash), whilst exploiting tactical allocation to other assets, notably risk assets such as equities and property, so as to capture counter trend reversals.

* Maximising the potential returns of each of these three strategically appropriate asset classes.

These issues need to be considered from a wide range of currency perspectives and all investment criteria, in terms of the global asset and currency opportunity set, noting that the most favourable long term returns and investment opportunities are likely to be found within un-indebted, higher growth economies, such as those in South East Asia. Although a short term US Dollar rally seems likely, international assets will become consequently less attractive. Depositors need to be aware of this from a currency perspective and choose the optimal exit point from any international currencies.

Outlook: A sharp retrenchment is expected in the value of risk assets throughout 2012 and 2013. Currency volatility is also expected to increase, leading to both elevated levels of risk and greater opportunities.

Executive summary

Zero interest policy causes problems for investors: all that’s gold, does not glitter – The consequence of uninhibited lust for credit, which has defined economic and capital market activity for the last thirty years, is slowly, inch by agonising inch, reaching its inevitable conclusion as both people and nations are starting to learn the hard way about the need to live within their means. Yet the UK, the US and Europe continue pumping billions more Dollars into their economies in a bid to stimulate a recovery, while many other countries have started to follow suit. Most notable and most alarming of these is China, in view of both the sheer scale of its capital base and the worrying inadequacy of Chinese regulatory oversight or transparency.

Capital flows have caused unintended consequences increasing the daily cost of many consumer staples beyond the ability of many societies to cope, constrained as they are by their increasingly unequal income and wealth dispersion characteristics. Evidence of this has spread from Athens, through the still continuing Arab Spring, via the streets of many UK cities to the Jasmine riots in China.

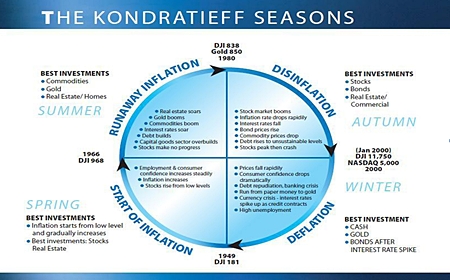

An intellectual debate continues to rage about what actions the Fed, IMF, ECB and all central banks or supra-national bodies can or should take; whether Federal Reserve Chairman Ben Bernanke’s handling of the Global Financial Crisis (GFC) – based on the narrow and seemingly incorrect historical perspective of monetarist economic theory – can win the day. Investors could learn a great deal about the current situation and future outlook by studying long term market cycles – especially MBMG’s Kondratieff Seasons (see graph above).

The policies that have been adopted are justified with reference to economic theory but the justifications provided are spurious and, therefore, investors should not expect better or different outcomes to the previous instances of the global ‘Winter’ phase of the economic cycle.

Accepting that cash, gold and bonds are the three strategically appropriate assets for this phase, investors need to understand the challenges associated with each of these. For bonds and gold that challenge is not to get caught holding the time bomb when these asset values fall off a steep cliff, although that may not be imminent. For cash, the test ahead is to get any kind of returns in a zero interest environment.

This is a very challenging investment environment but awareness of the larger context will help investors to find the most appropriate solutions.

To be continued…

| The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected] |