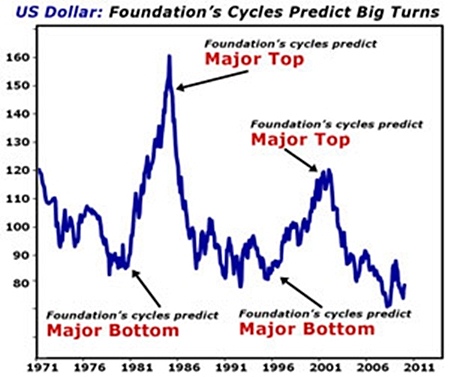

We now move onto currencies and it is interesting to see how the Foundation for the Study of Cycles (FSC) comment on this. As I write, William Hague, the UK Foreign Minister, has just commented on the potential collapse of the Euro and the potential for its coming demise.

The FSC is not quite so pessimistic about the US Dollar but it is not exactly complimentary either. It forecast further decline for at least the next fifteen months and possibly a lot longer. Wisely, it will not predict anything longer than this as it depends on how central Asian banks respond to the forthcoming weakening of the US Dollar. It is only after this that we can judge how weak it will end up and for how long.

This is also the case for all western currencies and it will be a lot clearer after gold has reached its peak as discussed earlier. When compared against gold then the US Dollar, GB Sterling, Euro at al will look very sick indeed. In fact, the Euro may be terminal. What is beyond doubt though is that the US Dollar buying power will more than halve due to the price of gold and the amount of worldwide selling that the currency will suffer from.

One thing though, whilst we all expect gold to do well, the FSC does not expect all commodities to do the same. For example, it does not think that oil will go back to the highs of a couple of years ago. This is because it is much more dependent on demand from industry and the individual consumer than gold is.

Even though the western economies have done a lot better this year than most people thought, including me, the likelihood is that demand will not carry on into next year as the west will start to suffer again. Indeed, the FSC is forecasting the US and other western countries to suffer from a double-dip next year. Earlier this year it accurately analysed the figures they had on consumer consumption and GDP and so they went on to say there would be a good improvement on the first half of 2011. However, they then stated that by the end of the year things will have started to go downhill and 2011 could well be a year of negative growth which will lead into a dreadful year in 2012.

The reasons for this are manifold but chief amongst them are the massive levels of unemployment which will only get worse in the months to come – especially in Europe. Financial companies are still very parsimonious when it comes to lending, despite what the governments say, and so people, the corporate world and even countries are now finding it increasingly difficult to get any money from anywhere.

On top of this you can also see the lack of faith in the American administration. It was only two years ago they predicted the federal deficit would be almost USD250 billion in 2010. They are now saying it will be around USD1.6 trillion which is six times more than they thought it would be. This does not exactly inspire confidence in the US government’s financial people.

This will only get worse. Even though they have made massive errors in recent forecasts the US Government is continuing to state that the deficit will only be around USD830 billion in 2012!

Anyway, back in the real world people with an IQ of three or more are predicting it will be more like a minimum of USD2 trillion. This will result, as already stated above, in massive selling of the US Dollar but it will not stop there. People will also sell assets they own – even if they are valued in US Dollars. This means US Treasury bonds as well. Once this happens then bond prices will dive. In turn this could well mean there is a big upward spike in yields which may appeal to investors seeing a major buying opportunity to get these higher yields for years to come. That is the theory. However, the reality which will hold many people back is the threat of rampant price inflation and people still having faith in the US Government and its ability to actually pay out.

So there we have it so far. It does not look good, does it? Well all of that is the good news. I hope you are sitting down because the FSC goes on to say that 2012 will be the year of the Perfect Storm as there will be a convergence of cycles. The stock market cycle, the consumption cycle, the US Dollar and GDP cycle will all bottom out at the same time – 2012. On top of this, 2012 is right in the middle of the FSC’s 500 year geo-political cycle which shows power and financial strength shifting from one area of the world to another – in this case West to East. This will end up in old money giving way to new and this goes for countries, corporation and individuals.

This is backed up in a report by Standard Chartered Bank and reported on by Fuller Money: “While earlier super-cycles were driven by the comparatively small populations in the West, the current super-cycle will involve 85 percent of the world population. Financial markets have not fully factored in either the scale or the profound changes that will likely take place, the report concludes. This provides plenty of opportunities across all asset classes for investors and companies. For long-term investors, the super-cycle points to greater allocation of capital into equities, especially those benefitting from the strong growth in the emerging markets, rapid urbanisation and the growing middle classes. Equities, commodities and real estate investments are also likely to do better than fixed income assets. Dr. Gerard Lyons, Chief Economist and Group Head of Global Research, commented, ‘The concept of a super-cycle builds on a major theme that we have talked about for many years, namely: a New World Order, a phrase that has become more widely used. Our view of the New World Order was that it reflected the shift in the balance of economic and financial power from the West to the East. A super-cycle builds on this concept, reflecting both the potential upside in terms of strong global growth as well as the fact that, whilst emerging economies will be the main drivers of growth, the West, too, has the ability to benefit from the changing global economy by adapting and changing.’”

In the words of that famous old song, “It’s the end of the world as we know it.”

However, the end of the world in not nigh – not if you prepare yourself for what the FSC is predicting.

What to do

– If you invest in the stock market and have shares in particular companies then put a stop-loss mechanism in place. If you find out you are wrong about a company, ETF, bond or fund then set a limit which is acceptable to you and sell immediately if the price falls under this self-imposed guideline – even if it means you lose money as it could end up saving you a lot more.

– Use the downside of a market to invest. I know people think this is risky but the potential is there to make a lot more money than being part of an ‘up’ market. It is now so much easier than it used to be as ETFs are there for everyone to take advantage of in rising AND falling markets.

– Finally, my old chestnut: DIVERSIFY across ALL the asset classes. Don’t just stay in bonds and equities. Above all, remain liquid and allow yourself to jump around a bit. Do not just keep a fixed amount is each asset class. If it looks like gold is going to shoot up for a short while then bung a whole load of money into it and then take it out when you have achieved what you want. And always look to rebalance your portfolio. For example, if you did shift a large proportion of your money into property, say twenty-five percent, and then it jumps up in value to twice as much as the initial investment this means that half of your entire portfolio is in one asset class. Do not be greedy; this is the time to re-balance what you have. Sell high and buy low.