Following on from my look at the effects of the UK’s referendum result on currency markets, it’s now worth checking out equity markets, the UK and global economies.

In terms of equity markets, it seems fair to assume that the FTSE has, as expected – if not even more quickly – shrugged off the impact of the UK exit vote, despite hysteria about American banks relocating to Paris1 (I’ll believe that when I see it), Virgins feeling safer on the continent2 and Mark Carney3 doing his best impersonation of the character Private Frazer from ‘Dad’s Army’, whose catchphrase was “We’re doomed!” (and by the way the new big screen version is good family infotainment on the topic of the UK’s relationship with Europe4).

In the fullness of time I expect the FTSE to ultimately fall further from here but not initially by any more than it would have done had the UK remaindered. In terms of the UK property market, the widening of discounts in properly structured property investment trusts is exactly as I’d anticipated and has more to do with the overvaluation of the UK property market. The referendum has let some air out of this bubble which is ultimately beneficial. The suspension of open-ended property funds is an inevitable occurrence for this kind of inanely, almost criminally, mis-structured investment product which really should have been banned following the debacle of 2008 for this asset underclass.5 It speaks more to the marketing capabilities of big asset managers and the huge blind spots that too many advisors and investors have developed in the desperate search for yield at any cost. This accident was waiting to happen. That it happened now may be able to point to the Breferendum as a proximate catalyst, rather than cause, but in so doing it has spared the greater pain that would have come from delaying this.

Much has been made about the political complications surrounding Scotland and Northern Ireland. I can see absolutely no economic significance in either of these situations that won’t, in all probability, be overtaken by much more significant economic events. In fact, that also applies to the UK as a whole. One of the more thoughtful analyses of the result announced in the early hours of June 24th was by Irish Economist David McWilliams6 who was at pains to point out that this isn’t a ‘Sarajevo moment’. However, his article concludes that “It will only become a monumental historical event if, like the Bourbons, the EU – and by extension the Irish elite – choose to ignore this warning. They can’t be that remote, can they?”

Anyone familiar with David or his work might suspect that he’s firmly convinced that they are indeed that remote and therefore this will become a monumental historic event.

In which case, the real importance of the Referendum result will be if genuine democracy is allowed to return to Europe and the EU is broken up. One of the main challenges to this may well be the anointing of Theresa May as the UK’s next PM. Ironically for a clergyman’s daughter, Ms. May is a protégée of the Bullingdon Boys. She is also an (albeit new) Oxford alumnus. More alarming is perhaps the way that the Parliamentary Tory Party so quickly adopted Ms. May, a deeply committed remainderer, as the overwhelmingly popular candidate. The expectations should be for a very ambivalent approach to pursuing exit designed to promote delays, confusion and ultimately a change in the direction of travel away from the exit door.

The key issue is whether this strategy is able to succeed in not only preventing the UK’s exit but moreover deterring the vast majority of long-term EU member nations whose constituents favour a referendum and an exit. I wouldn’t be surprised if the May Government is able to prevaricate so long that Article 50 is never invoked. I would, however, be surprised if populist anti-EU sentiment across the continent fails to materialize in a way that leads to the break-up of the EU. The June referendum’s main significance is that it opened this door.

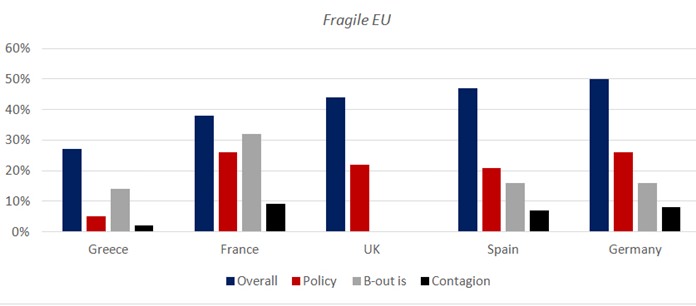

Prior to the Referendum, I produced this comparison based on the results of research from Pew (see chart 1):7

However, the very tiny amounts of contagion resistance are from EU citizens – not the political classes. Yanis Varoufakis has already discovered just how difficult the EU’s self-preserving political machinery can be at preventing the right thing actually coming to pass8. Therefore, the period during which electorates and governments battle over the ‘failed construct’9 that makes up the EU, could in and of itself be sufficiently destabilizing to provoke the EuroZone’s Minsky Moment.10

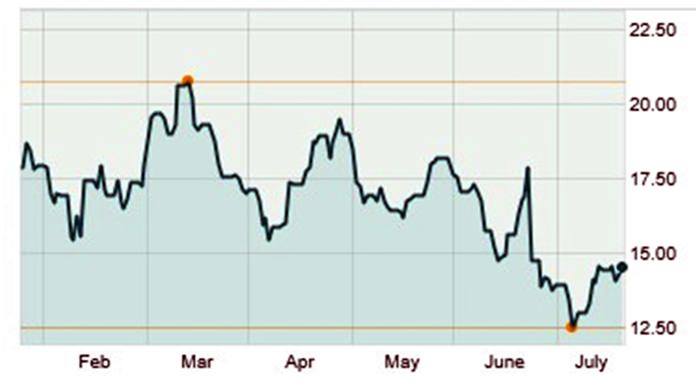

If the break-up of the whole EU doesn’t happen, the separation of the twenty-something supposedly single but increasingly non-fungible federal currencies will certainly do so. Again this is something that I laid out in advance of the Referendum11 and it seems that the markets are now also taking this seriously judging by the price action of the European banking sector and Deutsche Bank in particular (see chart 2), as well as the sudden rush of negative news flow12.

Deutsche Bank Share Price 2016

The pain wouldn’t end there if this Minsky Moment led to the demolition of China’s economic house of cards13 and the consequential purging of the global debt system would endure for a number of years. But finally then we’d be able to ultimately burst the credit bubbles of the last 30-40 years, which are currently destroying the financial prospects of the large majority of the 7 billion people whose present and future is otherwise blighted.

The UK’s exit may have been brought about for the wrong reasons but it’s the first step towards a painful but necessary global economic healing.

Footnotes:

1 https://next.ft.com/content/a3a92744-3a52-11e6-9a05-82a9b15a8ee7

https://next.ft.com/content/e0a5af3a-3ddd-11e6-8716-a4a71e8140b0

2 http://money.cnn.com/2016/06/28/news/companies/richard-branson-virgin-jobs-brexit/

4 https://www.youtube.com/watch?v=HaxkLVtRY1U

5 http://www.ft.com/cms/s/0/5c1be46c-4456-11e6-b22f-79eb4891c97d.html

7 http://www.pewglobal.org/2016/06/07/euroskepticism-beyond-brexit/

8 And the Weak Suffer What They Must?: Europe’s Crisis and America’s Economic Future by Yanis Varoufakis, Nation Books, 1568585047

9 https://twitter.com/CapitalJon/status/746588316288458753

10 http://www.investopedia.com/terms/m/minskymoment.asp

12 http://www.cnbc.com/2016/07/06/european-bank-stocks-tumble-again-amid-brexit-fears.html

13 http://www.zerohedge.com/news/2014-03-19/chinas-minsky-moment-here-morgan-stanley-finds

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |