Gold prices recently hit a five-year low. So what’s happened to the precious metal and how are its chances of recovery?

How the mind plays tricks. If I think of summers in my youth, an image of cricket in the sunshine springs to mind. Then, on the occasions I visit my native Yorkshire in the summer months, I realise once more how few sunny days there really are there. At least the standard of cricket’s back to where it was though!

Next to the mythology of long English summers, we can file the old adage that gold is valuable. Whether this comes from legends of gold rushes, bullion bars stored at Fort Knox or personal jewellery collections, it’s fair to say that the precious metal carries with it a certain mystique. Probably because of its historical role it sometimes appears to be treated as a currency. For example, its purchasing power is often charted against the US Dollar, the Yen, Sterling and the Euro.

That goes some way to explaining the noise made in the press when gold recently fell to its lowest US Dollar price since March 2010: 37% down on its high point in late 2011. The headlines included It’s time to rethink your approach to gold1, Gold loses its glitter2 and A Gold Flash Crash happened Yesterday3. Not highly emotive stuff I concede; yet I can’t imagine similar headlines for other commodities such as bauxite, frozen orange juice or pork bellies.

The old faithful

The thing is, gold is old school: a quasi-currency trusted by those who haven’t quite accepted the abandonment of the gold standard by central banks, governments, politicians and the financial system which occurred, in instalments, from the 1920s to 1971.4 This lack of confidence is understandable given events since the Global Financial Crisis hit in 2008. By late 2011, concerns about debt levels in the US and Europe pushed the price of gold up to new heights.5

The downs follow the same logic: once other investments – such as stock market or house prices – boom, the price of gold drops. This happened at least eight times in the 20th century6 and, judging by the trends in the S&P 500 and US house price index over the last three years, is happening now.

So what next?

It’d be easy to declare that gold will rise again in the near future, merely because it’s so low now. However that would be facile.

It’s fair to say that things have become a little more complicated in recent years with the advent of cryptocurrencies, such as Bitcoin. These currencies compete for some of gold’s investors, as they also offer an alternative to conventional currency exchange markets and are used to hedge against inflation.7

Chart 1 Source: World Gold Council.

Chart 1 Source: World Gold Council.

That doesn’t necessarily mean that the days of trading in gold are numbered, though. A bit like the group Nick Cave & the Bad Seeds, gold may never again reach previous heights of popularity but it will likely maintain a decent number of hard-core fans.

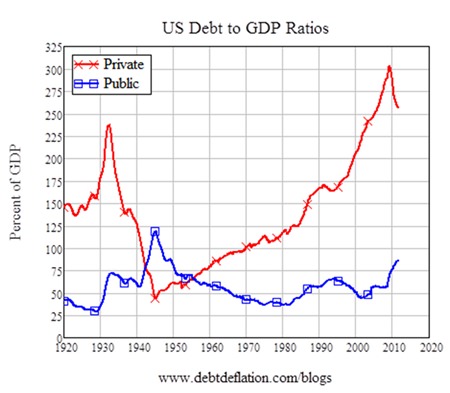

Added to that, floating gold investors start to come back once fears return that markets have started to take a downturn. My feeling is that such an event may not be far away – in fact I think it’ll be more of a nosedive than a downturn. The above charts don’t just indicate potential trends in gold prices; quickly rising stock and house prices indicate we’re in bubble territory. However, any initial stock sell-off may as likely as not also drag gold down too in its earliest phase. It may take the realization of the severity of the correction to become apparent before divergence favours gold.

This is because, whilst private debt in the US has dropped somewhat in recent years, it is still alarmingly high. Not only that, America looks like it will follow the Japanese vicious cycle of debt deflation;8 meaning that as profits and salaries don’t increase, nor does the capacity to pay off debt.

One widespread misconception is that gold is a hedge against inflation. This is wrong on 2 counts: 9

* Gold is actually a poor hedge against most levels of inflation; historically it performs well only during periods of extremely elevated inflation; stocks and property tend to be better hedges against other levels of inflation.

* Gold is historically a strong performer during debt deflation.

(See chart 2.)

In keeping markets on life support, the Federal Reserve has kept the base interest rate at 0.25% since 2008, as well as ploughing a colossal USD 4 trillion into its QE programme.10 Now the Fed is hoping that it will soon be able to raise its rates11 in September this year. At that point we’ll have some inclination as to how well the markets – and more importantly the global economy – will hold up without artificial support.

Chart 2

Chart 2

A significant prolonged drop in stocks, house prices and other markets could cause another financial crisis and, this time around, the Fed will be out of ammunition. Not only that, given the huge drop in value in the Shanghai and Shenzhen stock markets, the Chinese economy may not be positioned to come to the rescue as it did in 2008.

All that means that the crisis could be much more prolonged than the GFC, causing some investors to rush desperately back to gold.

When this will happen and whether gold will actually provide any protection is impossible to predict.

Footnotes:

1 Livemint.com

2 Citywire

3 moneymorning.com

4 http://www.marketwatch.com/story/why-gold-is-falling-and-wont-get-up-

again-2015-07-20?mod=MW_story_ recommended_default&Link=obnetwork

5 http://money.cnn.com/2011/08/22/markets/gold_prices/

6 http://www.marketwatch.com/story/why-gold-is-falling-and-wont-get-up-again-

2015-07-20?mod=MW_story_ recommended_default&Link=obnetwork

7 http://www.forbes.com/sites/louiswoodhill/2013/04/11/bitcoins-are-digital-collectibles-not-real-money/

8 Steve Keen’s 2015 Outlook, www.ideaeconomics.org

9 Claude B.Erb, CFA AND Campbell R. Harvey, The Golden Dilemma, Financial Analysts’ Journal, Volume 60 Issue 4, July/August 2013 DOI: http://dx.doi.org/10.2469/faj.v69.n4.1

10 http://www.economist.com/blogs/economist-explains/2015/03/economist-explains-5

11 http://money.cnn.com/2015/06/17/news/economy/federal-reserve-interest-rate-janet-yellen/

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |