Despite many apocalyptic words on the subjects, inflation refuses to rise for the moment. Is this likely to remain the case or could it rise quickly and affect investments?

‘Winter is Coming’ one recent commentary dramatically stated1, making reference to the pessimistic proclamation used in George R.R. Martin’s A Game of Thrones, to describe the global economic outlook. It went on to qualify that although its authors didn’t believe things were so bleak just yet, there are numerous investment risks apparent. One of those risks, the commentary suggested, was inflation.

Inflation is a strange subject: we assume it has certain implications and that particular things cause it; yet both can be wildly off-target. For example, it may be considered a good thing when inflation is extremely low. On the face of it, it is. After all, if the cost of living remains the same, or even falls, then everyone can afford more. In macroeconomic terms, that can mean that we consume more, causing businesses to make more money and governments to receive more VAT and corporate income tax. That’s not necessarily the case though. To begin with, if prices remain the same, there’s little motivation for consumers to buy straight away – they’ll likely hang on until later, which further constrains not only greater inflation but also economic growth.

Central banks such as the Bank of Japan, the Federal Reserve and the ECB, embarked on their zero-interest-rate and the negative interest rate policies to encourage the circulation of money and to try to increase sub-par inflation to the levels of the central bank benchmark. They did this partly by trying to encourage more borrowing.

The idea that more borrowing is required comes from Irving Fisher and Milton Friedman’s revised quantity theory of money (QTM). It suggests that the amount of money in the economy is the main influence of economic activity. If the amount of money increases at a faster rate than the quantity of goods and services being made available, then prices increase. So, if the central bank increases the money supply (by buying commercial banks’ assets, i.e. quantitative easing) and encourages banks to lower their interest rates (by putting its own base rate at close to zero), the public will borrow more and, consequently, start spending more. Also, with low interest rates, the idea is that people will not be inclined to keep money lying around in savings accounts.

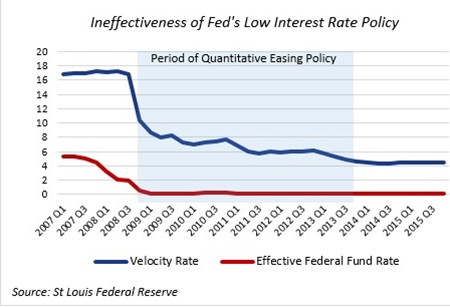

But this approach concentrates purely on prices – the consumer price index or producer price index – and assumes the speed with which money changes hands is constantly at the same rate. It also assumes uniform behaviour that is the strand point of the late but not lamented Prof. Friedman. It’s clear that this isn’t the reality. What if, despite this sudden easy access to money, people decide they’ve had enough of raking up huge debts and don’t want to borrow; even if the money is practically interest-free? This is what has been happening for the last seven years. Even though the Fed has kept its rates at emergency levels, the rate of velocity has also decreased: the exact opposite of what’s supposed to happen, according to the theory (see chart 1).

Chart 1

Chart 1

The thing is that there are far more factors involved in determining the velocity of money than mere access to cash and loans. To start with it’s certainly understandable that, after the effects of the 2008-2009 global financial crisis, there is a general malaise about the state of the economy. Also the huge decrease in interest rates itself has forced investors to readjust their portfolios toward liquid money and away from interest-bearing assets such as government bonds.

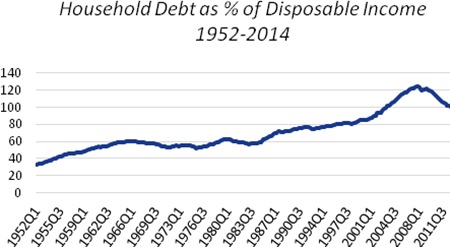

Surely the most decisive factor, though, is the sheer amount of private debt that’s out there today. Household debt levels in the US have reduced somewhat since the GFC – showing that debt is less popular than it was. But these levels had been rising quickly since 1984 and even now Americans still have debts that amount to almost 100% of their disposable income (see chart 2).

Chart 2

Chart 2

The correction process that stated in 2008, and would have seen a more crash reduction in private debt, was put on hold by the response of central banks and policy makers.

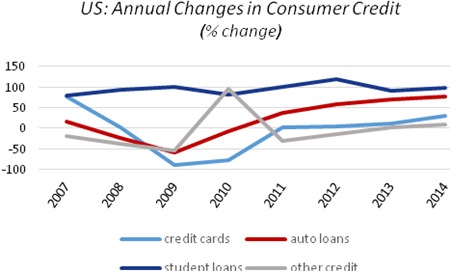

So why isn’t velocity in the US higher? The reality is that since 2011 borrowing has been dominated by two types of loan: vehicle loans and student loans (see chart 3).

Chart 3

Chart 3

This is not the multi-faceted borrowing that will lead to consumption across a wide range of sectors within the economy.

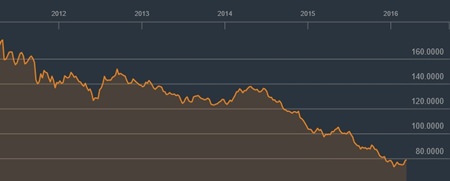

Thus huge amounts of debt still linger but it’s not the type of debt the Federal Reserve was hoping would kick-start demand. Consequently prices remain low, reducing company profit margins and thus wages. Added to that, there has been a massive downturn in commodities prices (see chart 4), which is now into its sixth year.

Chart 4

Chart 4

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |