In Parts 1 & 2, I looked at how the Roaring Twenties led to the Wall Street Crash and the Great Depression. In Parts 3 & 4, we discover how the past can cast shadows on our future.

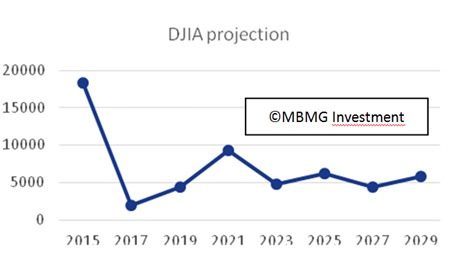

Taking the post-1929 situation as a benchmark, let’s have a look at two possible future scenarios. First of all, imagine the pre-crash peak is 18,289 – the highest price reached in March of this year – this is how the next fourteen years could look if history did indeed repeat itself (see graph 1):

Graph 1 – Source: Author.

Graph 1 – Source: Author.

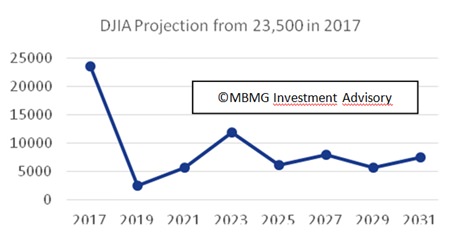

However, in a perfect mirror of history, today might equate more closely to 1928 than to 1929 and therefore the DJIA could be expected to rise as high as 23,500 points in a re-run of the precursor to ‘The Crash’. In which case a similar pattern over a prolonged period might look something like this (see graph 2):

Graph 2 – Source: author

Graph 2 – Source: author

An accident waiting to happen

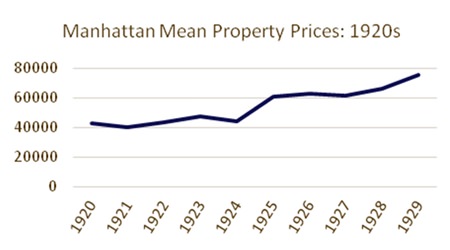

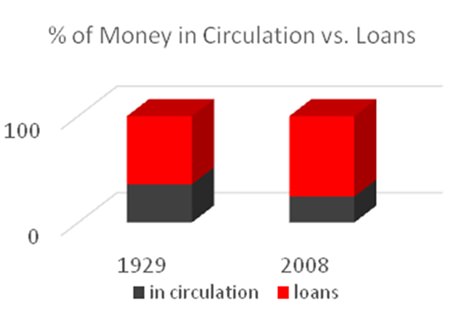

If the timing of the Wall Street Crash was blamed on the Hatry fraud (mentioned in Part 2 last week) or any other trigger, the fact that the market was so fragile came from the speculative boom of the late 1920s. Key indicators, such as property, show significant price rises and the amount of money borrowed was an astounding 1.8 times greater than the real money in circulation (see graphs 3 & 4).

Graph 3 – Source: Harvard Business School.

Graph 3 – Source: Harvard Business School.

Graph 4 – Sources: Federal Reserve, San José State University, Financial Times.

Graph 4 – Sources: Federal Reserve, San José State University, Financial Times.

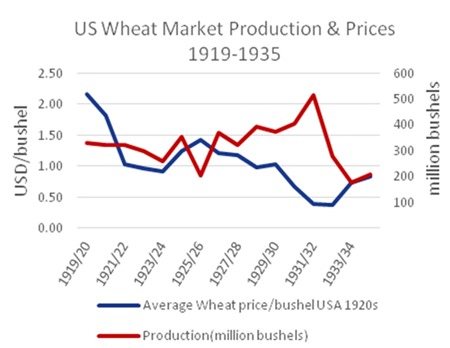

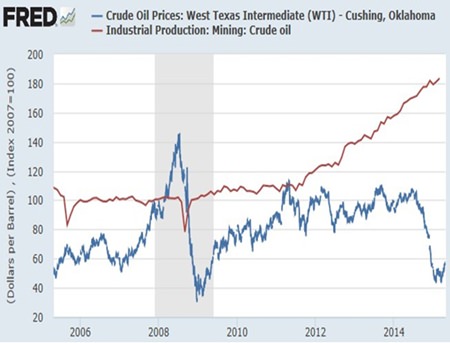

One product where the prices did go down in the 1920s was wheat (see graph 6). However, this was due to oversupply, meaning that farmers were becoming considerably poorer. Similarly, oil prices have taken a nosedive over the past year: on 20th June 2014, WTI prices hit USD 107.95 a barrel; eleven months later they were at USD 56.25 and have hovered between USD 55 and USD 60 ever since, going into mid-May 2015 (see graph 5). This dramatic drop and subsequent low level has far-reaching repercussions; not least for the shale gas market.1

Graph 5 – Source: USDA.

Graph 5 – Source: USDA.

Two dramatic days on Wall Street in October 1929 saw the Dow Jones Industrial Average drop by 12.82% on Black Monday and a further 11.73% on Black Tuesday. Whilst the Wall Street Crash may be seen as lighting the blue touch paper to the Great Depression, we mustn’t forget that, back in the late 1920s, only around 16% of American households owned stocks and shares.2 Nowadays, that figure is around 48%,3 meaning that a future crash could have far wider consequences than that of 1929.

Graph 6 – Source: St Louis Federal Reserve.

Graph 6 – Source: St Louis Federal Reserve.

After the 1929 crash, measures were taken by governments and stock market authorities4 to protect markets against such collapses thereafter – including halting trading during particularly turbulent times and regulating the activities of banks (separating commercial and investment banking).5

Over time the regulatory landscape based on the Glass-Steagall Act of 1933 eroded, as financial products evolved to circumvent the Act which wasn’t updated or revised accordingly6 meaning that by 1999, when Glass-Steagall was finally repealed, it had become largely marginalized and toothless; plus, the Bank Holding Company Act was amended. This change came after Citigroup and Travelers merged7 and it allowed affiliations between financial services companies; such as banks, securities firms and insurance companies. The new regulations therefore removed the very barriers that Glass-Steagall had erected.8

In the aftermath of the 2008 Global Financial Crisis, the US government implemented the Dodd-Frank Act, giving itself more powers against banks in areas such as mortgage-lending and derivatives trading.9 Part of this Act was the Volcker Rule, which banned proprietary trading and was designed to curb risky trading activities by banks.10

Consequently there has been a move towards restricting certain aspects of financial activity. However, that doesn’t mean that bubbles will no longer occur. The crash of October 1987, for example, saw a 34% drop in the DJIA in just 2 weeks,11 yet Glass-Steagall was still 12 years away from being fully repealed.

Not only that: in its QE and its near-zero-interest-rate programmes,12 one of the Fed’s stated objectives is to encourage the public to borrow more money.13 That seems a strange move, given that household debt was at its peak of 135% of disposable income14 when the GFC began in 2007. It also raises the question as to whether this is purely a coincidence.

To be continued…

Footnotes:

1 http://business.financialpost.com/news/energy/how-falling-oil-prices-will-

bring-u-s-shale-output-back-to-earth-this-year?__lsa=591c-cb8e

2 Russell Napier, Anatomy of the Bear: Lessons from Wall

Street’s four great bottoms, CLSA Books, 2005

3 http://www.bankrate.com/finance/consumer-

index/money-pulse-0415.aspx

4 For example: by the NYSE in line with

the US Securities and Exchange Act 1934

5 Banking Act 1933, often referred to as the Glass-Steagall Act

6 Barry Ritholtz, A Brief History Lesson: How we ended Glass-Steagall

http://www.ritholtz.com/blog/2012/05/how-we-ended-glass-steagall/

7 idem

8 http://topics.nytimes.com/top/reference/timestopics/subjects/g/

glass_steagall_act_1933/index.html

9 http://www.investopedia.com/terms/d/dodd-frank-

financial-regulatory-reform-bill.asp

10 http://topics.nytimes.com/top/reference/timestopics/

subjects/g/glass_steagall_act_1933/index.html

11 See http://www.thebubblebubble.com/1987-crash/

for the story of the 1987 Crash

12 http://www.bloombergview.com/quicktake/federal-

reserve-quantitative-easing-tape

13 https://research.stlouisfed.org/publications/

review/13/01/Fawley.pdf

14 http://www.wsj.com/articles/americans-wealth-

dips-amid-stock-volatility-1418317233

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook:/MBMGGroup |