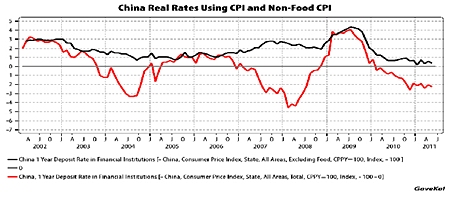

The Chinese recently raised rates again by 25bps to 6.65%, the fifth time since initially starting to raise rates in October of 2010. This has been as a result of rising inflationary pressures, with the whisper number that CPI for June will come in at 6.2%. Rising inflation has been a problem for a while now in China, with the graph on this page indicating that real rates are actually negative when one includes food prices.

Many now feel that the Chinese central bank has done enough and this will be the final rate increase for the year, but having now read copious views on the subject, it is not clear to me whether this is actually the final rate increase for the year or not. If I had to hazard a guess it would strike me that we are very near the end of interest rate tightening, if not the end itself. Why do I make this bold statement, given that most economists usually get these things wrong?

Firstly and most importantly, raising rates is not the only tool that the Chinese have in their arsenal when it comes to controlling the supply of money and what they seem to prefer to do is increase the required reserve ratio of the banks. Currently this sits at 21.5% for the big bank and 18% for the small banks, which effectively means that it has got a lot harder for banks to lend money. This difficulty in lending is seen in the amount of lending dropping from an official 7.95 trillion last year to current levels of 6.7 trillion. Couple this with evidence that the housing market appears to be rolling over, as seen by inventories in China’s biggest cities set to rise to over six months worth of supply by the end of 2011, and transaction volumes continue to tumble (down over 15 percent YTD in major cities such as Beijing).

Secondly, if inflation does continue to rise, then the central bank can increase the RRR again, given that the central bank is loathe to raise high interest rates, because this attracts hot money as investors await the inevitable Reminbi appreciation.

Does that mean, with the latest rate increase, we are worried about a hard landing in China? We do not believe another 25bps is the tipping point, but on balance this cannot be good for economic growth. However, with GDP growth rates still much higher than nominal interest rates it is hard to believe this latest rate hike will make much of a difference.

It’s how much the banks are able to lend, rather than the cost of that debt that matters and in that respect this latest interest rate hike does not make much difference.

For now we remain sanguine about China’s growth rates, but should we see a further increase in reserve requirements, we will start to get a little more cautious about global growth and start to get a lot more nervous about commodities and commodity currencies.

The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on graham@mbmg-international.com