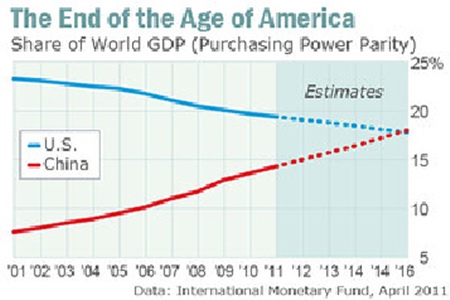

The International Monetary Fund (IMF) produces many reports every year for public consumption. One that was snuck away at the back of a report on Asia repeated previous claims that China will overtake the USA as the world’s leading economy. This is not news. However, what is new is that they gave a date for the first time. And it is only five years away – 2016.

Assuming the IMF is correct in its forecast how will it affect the world economy? The most obvious thing that will be affected is the US Dollar. If China has the No. 1 economy, which country will have the world’s reserve currency – if there is one? Will a new global security system have to be created?

Although this transfer of power was expected, many did not think it would happen until 2025 at least. However, there is a potential problem. They are comparing apples and pears. When you look at this in detail you can see they are measuring the Gross Domestic Product of the US and China using the present exchange rates.

The dilemma is that exchange rates change from one moment to the next. On top of this there is the undeniable truth that Chinese rates are made to suit China’s policies at any one given time. The Renminbi is normally undervalued at the best of times due to massive intervention in the markets.

This could cause the research to be questioned. However, the IMF also took into account the “Purchasing Power Parities” (PPP) of both countries. This compares what people actually earn in America and China and spend in their own economy.

Now things start to get interesting. If you consider the PPP as the guide then it is forecast the Chinese economy will go from just over USD11 trillion this year to USD19 trillion in 2016. Over the same five year time span, the US will go from USD15 trillion to almost USD19 trillion. This translates into the America’s share of world output falling to 17.7% and China’s increasing to 18%. It was only ten years ago that America’s economy was three times that of China’s.

As regular readers of this column know, I am a great believer in lies, damned lies and statistics. It will be fascinating to see how the IMF prediction works out. There are many pitfalls ahead and the unforeseen will doubtless happen. The forecast could well be out by many years but the end will come for the US. It happened before to Rome, Spain, France and England. In the 19th century Great Britain was the world’s economic leader. They passed the baton onto America in the early part of the 20th century and now it is the turn of the Chinese. Sometime in the future they will hand over to some other country.

There is a difference though. Both Britain and America are democracies. China is not and the leaders do not have to answer to the population or the rest of the world. Whether countries round the world like it or not, China is planning for the future and stuff anyone else. They are buying up massive amounts of land in Africa and South America. They only worry about their own.

Ralph Gomory, a professor at New York University’s Stearn Business School, stated, “They have a state-guided form of capitalism, and we have a much freer former of capitalism.” Gomory goes on to say there has been “a massive shift in capability from the U.S. to China. What we have done is traded jobs for profit. The jobs have moved to China. The capability erodes in the U.S. and grows in China. That’s very destructive. That is a big reason why the U.S. is becoming more and more polarized between a small, very rich class and an eroding middle class. The people who get the profits are very different from the people who lost the wages.”

Given all of this it makes it even more mystifying that the US tries to spend itself out of trouble and carries on printing money at a rate that even Robert Mugabe would be proud of. The situation cannot continue without something snapping.

Cris Odey of Odey Asset Management said as much recently when he said, “Markets are reasonably efficient, most of the time, at setting prices. Where they are most likely to fail, though, is in correctly anticipating and pricing big, revolutionary, ‘paradigm’ shifts – whether a rise of disruptive technologies or revolutionary changes in geopolitics. We are living through one now.”

One of the main problems that people all over the world are worried about is the fact that the US Treasury still thinks it will always be in charge of the world’s reserve currency. People involved in the real world realize this is nothing more than fanciful thinking and is why they are buying such things as gold. These folk understand that the US Dollar will not rule the world forever. No-one knows what will replace it yet but it will be replaced by either gold, a basket of currencies or the Renminbi.

So, China. What to do? Well, as we all know, good china increases in value but it can break easily. It certainly makes sense to have China as part of your portfolio but take care and make sure the funds or shares you have are liquid and can be sold quickly should there be a sudden market downturn.

The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected]