Like the man parading up and down the high street with a sandwich board, for most of 2014 I’ve been harping on about us coming to the end of the financial world as we know it.

But maybe not just yet. This tends to spark the obvious question “when?”

Obvious question maybe but one for which we’ve had no obvious answer. Until now that is. We may now have stumbled upon the catalyst of this great change.

ETFS WTI Crude Oil prices Last 5 years

Source: Bloomberg

Source: Bloomberg

The end of the financial world is rather different, however. I see it as an opportunity as well as a threat. It may actually make economists and people in finance realize that we need a complete re-think of how to structure the global economy.

The global financial crisis (GFC) of 2008 is, in my view, a precursor to a far more severe and far more protracted slump. If you don’t think that can happen, take a look at how Japan’s ‘lost decade’ has become a ‘lost generation’.1 The latest Japanese government employment statistics (July-September 2014) show that nearly 35% of those in jobs work on a part-time or temporary basis.

ETFS WTI Crude Oil prices 11th Nov-9th Dec 2014

Source: Bloomberg

Source: Bloomberg

Major central banks have been seemingly oblivious at best, or burying their heads in the sand at worst, persisting with austerity measures (ECB), which will only cause stagnation; or expensive and ineffectual quantitative easing as with the Bank of Japan; and back door stimulus, as with the Fed2.

Meanwhile, the economies of Japan, the US and the Eurozone have been stuttering along helplessly awaiting the trigger of the next financial crisis – and the latest ‘shot heard around the world’ could have already happened in late November, with the plunge in crude oil prices.

Some analysts believe that the oil price will bottom out as people start to use the fuel more, because of lower prices and the oncoming winter months in the US3; others see lower crude oil prices as a catalyst to make the booming US shale oil industry more efficient.4

However, these commentaries are missing an important point: this rise in the shale oil industry has been financed by junk bonds.5

Junk bonds. Remember those? High-yield bonds with a high risk of default. In 2008, illiquidity of junk bonds – repackaged and backed by overvalued subprime mortgages – led to the GFC. A J.P. Morgan analyst estimates that, should prices for crude oil remain at the relatively low level of around US$65 a barrel for the next three years or so, up to 40% of all energy junk bonds could default.6 He added that even if default rates hovered at 20% to 25%, the consequences would be “dire”.

Source: OECD

Source: OECD

While 40%, even 20%, default rates may seem high, 2008 shows us that such disaster can happen – default rates on global speculative-grade financial products was at 38% by 2009.7 In fact it doesn’t necessarily take actual default to trigger a crisis. Merely the threat of default can make bonds illiquid: if everyone is trying to get out of them at the same time, no-one wants to buy them.

Of course, it’s easy to say “Don’t panic” if you don’t hold junk bonds. But if you are sat on them, what else would you do? Seemingly, the only way to avert a personal financial crisis is not to buy high-yield bonds in the first place. After all, if they’re high yield, chances are they’ll be high risk.

On a global level, I’m not sure there’s any way we can avoid the looming crisis. If it’s not oil prices that light the blue-touch paper, it’ll be something else. If not now, then at some point. While government and central bank economists continue to ignore an important part of the whole picture, there is little chance of avoiding another shock.

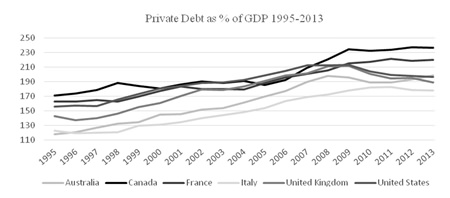

Steve Keen, chief economist for IDEA (where I’m an advisory board member) and head of Economics, History and Politics at Kingston University London, has long expressed dismay that, when analyzing economic performance, economists completely ignore private debt levels.

It is a sad irony of today’s global economy that something as remote as the mere threat of some junk bonds defaulting in America can cause consternation, and large-scale government intervention in many developed economies; yet few people even look at more direct threats such as private debt, which has soared in the last 20 years or so.

On his current visit Steve highlighted how the change in rate of private debt is a leading indicator of imminent debt deflation and crisis. Of course it is a volatile indicator so decreases can be followed by increases and investors can bounce between outing risk and taking it off again like a ball on a pin table; but this may be the best predictive indicator that exists today, for next year and beyond.

Surely tackling debt issues closer to home will generate longer-term recovery; help people gain more control over their wallets; or failing all that, at least by monitoring the change in debt, we can gain a rounded perspective of what is actually happening, so our portfolios can do something about it.

Enjoy your day.

Footnotes:

1 http://www.japantimes.co.jp/news/2014/01/25/national/media-national/age-brings-no-respite-from-hard-times-for-the-lost-generation/#.VIfC6TGUeSo

2 See my comments on CNBC http://video.cnbc.com/gallery/?video=3000335426

3 http://www.cnbc.com/id/102246693

4 http://fortune.com/2014/12/08/oil-prices-drop-impact/

5 http://blogs.wsj.com/moneybeat/2014/12/01/falling-oil-prices-could-lead-to-massive-junk-bond-defaults/

6 ibid

7 http://www.standardandpoors.com/ratings/articles/en/us/?articleType=HTML&assetID=1245331158575

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |