The last 12 months has thrown up a cornucopia of opportunities for global value investors. Gold, US Treasuries, minimum volatility/high dividend equities and US Dollar strength have all yielded not only handsome rewards but also diversification that has hedged equity Beta – the measure of volatility – in a way that has generated attractive risk-adjusted returns.

However, these have now performed so strongly that the time seems to have come to either sell or pare all of these and frustratingly there don’t seem to be any equally strong candidates to replace them.

The two equally dangerous consensus views seem to be that:

- Asset prices may be unjustifiably expensive, yet while policy conditions remain supportive and arguably become even more so, a rising tide will continue to lift all asset boats.

- Old assumptions no longer apply and under this new paradigm, asset values are somehow justifiable after all.

The former may well seem to be true for a while, until suddenly and devastatingly it quite clearly isn’t. But what about the second argument? Whilst cyclically adjusted P/E ratios (CAPE) indicate that markets are so overvalued that they are susceptible to falls of 50% or more, that may take decades to recover. Eminent commentators such as Carmignac’s Didier Saint-Georges talk of equity investing as ‘dancing on a volcano’1; yet the ardour of equity cheerleaders continues unabated. However, MBMG’s recent research has unearthed another, slightly unusual, indicator that might just help convince them that this bull run could be in its final stages.

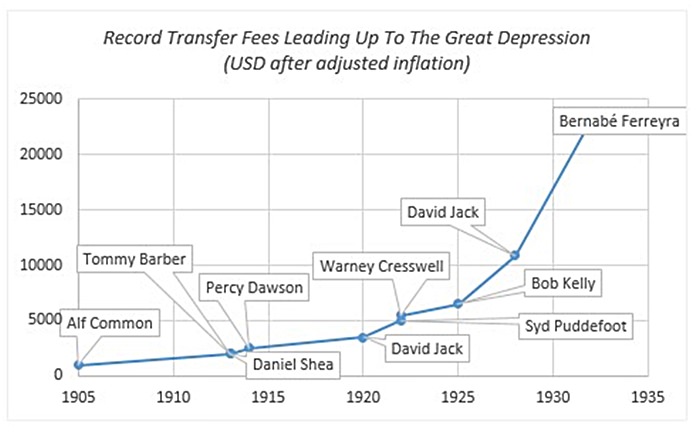

In the world of football, Juventus recently sold star midfielder Paul Pogba to Manchester United for a record fee of €110 million (US$122 million).2 Given the economic situation of the real world, football can often seem like it’s on a different planet. Having said that, be it coincidental or not, there’s a raft of historic precedent that footballers’ valuations run wild at the same time that stock markets set themselves up for a major fall that dates back to the earliest days of transfer fees (see chart 1):

The 1932 transfer of Bernabe Ferreyra between Buenos Aires-based teams Tigre and River Plate3 marked the peak of an overvalued market and in an echo of the 25 years that the Dow Jones took to recover,4 from its 1929 peak, wasn’t surpassed (in inflation adjusted terms) until the 1954 transfer of Juan Alberto Schiaffino from Uruguayan club Pe๑arol to Italy’s AC Milan for 52 million Lire.5

More recently, the mid-1970’s oil crisis was followed by a new transfer record in 1976 when Paolo Rossi moved between Italian clubs Juventus and Vicenza for 2.6 billion Lire.6 Again this was followed by a crash in transfer values reminiscent of that in equity markets, until the phenomenon that was Diego Maradona came along in the mid-1980s and broke the record twice within just three years7 (see chart 2).

That’s astonishing enough but especially so considering that the reason for his second move (from FC Barcelona to Napoli) was largely down to the Argentine’s involvement in a brawl in the Spanish Cup Final – under extreme provocation from Athletic Bilbao players; and his organisation of an all-night team tour of Parisian nightclubs following a friendly match.8

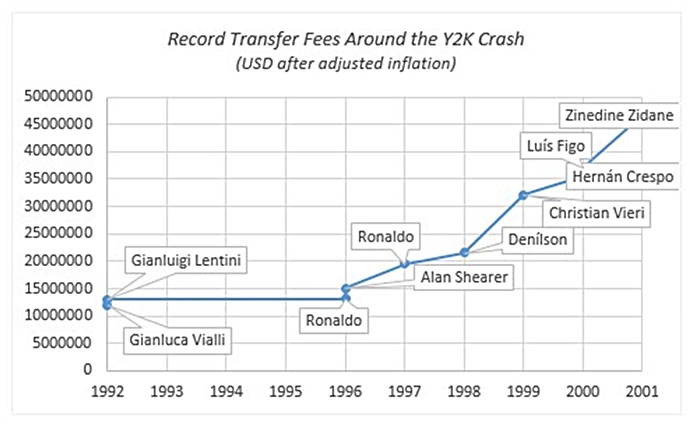

The turn of the millennium saw a pattern reminiscent of 70 years earlier, when a sharp rise in equity markets9 was paralleled by a sharp rise in transfer prices. The March 2000 peak in US indices was mirrored by a new record transfer fee of 150 billion Lire when Zinedine Zidane moved from Juventus to Real Madrid.10

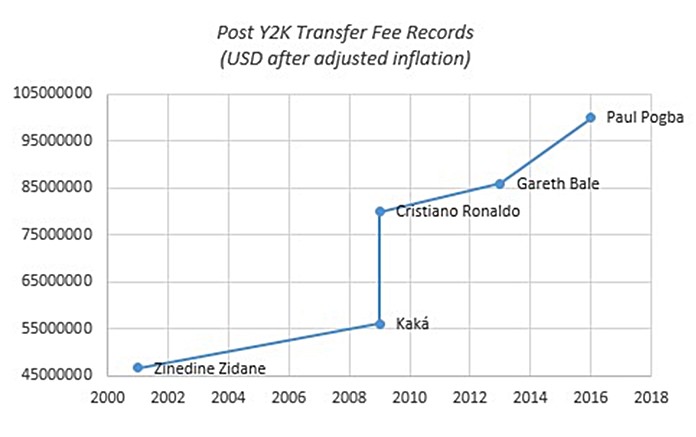

However, football markets took longer to recover than equity markets and the world record wasn’t broken in nominal terms until Kakแ made the same move 8 years later, in early June 2009.11 The record in real terms was broken later that month, when Cristiano Ronaldo also joined Madrid from Manchester United later that year.12

The Global Financial Crisis had ensured that this remained the inflation-adjusted high watermark (although Gareth Bale’s move to Madrid in 2013 saw a new nominal high13). However, Pogba moving for US$122 million could be a sign of a contagion from the asset bubble in equities to transfer values once again (see chart 3).

As it has done since the turn of the last century, this might be a sign that the bubble in valuations for both is once again about to burst.

Footnotes:

1 https://www.carmignac.co.uk/node/4345/

2 http://www.bbc.com/sport/football/37016170

3 World Soccer Magazine

4 http://www.macrotrends.net/1319/dow-jones-100-year-historical-chart

5 http://www.bbc.co.uk/sport/football/23903470

6 idem

7 idem

8 Jimmy Burns, Maradona: The Hand of God, A&C Black 2011

9 http://www.macrotrends.net/1319/dow-jones-100-year-historical-chart

10 Juventus FC

11 Transfermarkt

12 idem

13 BBC

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |