The last time that we were in debt-deflation was the 1930s. It took extreme policy measures to end debt deflation back then. Not the New Deal, not the Rentenmark but rather a policy, or at least an outcome, called World War II.

So not only are we in debt-deflation now, but we could be in it for years to come. This means that we should recognize that Thailand’s export-driven miracle phase is coming to an end – or at least a multi-year if not multi-decadal pause or hiatus. If that gap isn’t filled with something else then, just as export economies have suffered the most in major downturns previously, Thailand has a pretty rough few years ahead. That said the glass is still half full because there are 2 sensible ways to fill the export gap:

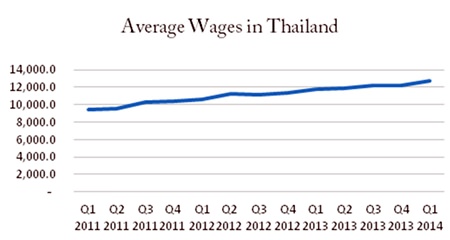

1) Domestic spending – in economies like America, consumer spending accounts for around the 70%1 of GDP that exports make up in Thailand. Give Thai consumers money to spend and we could move to a more balanced, more developed looking economy – the problem is Thailand has virtually full employment (unemployment rates in 2013 and 2014 were both 0.6%2) but, despite or maybe partly because of minimum wage policies, real wages remain stubbornly too low and Thailand is still caught in the middle income trap (see chart 1).

Chart 1, Source: Bank of Thailand.

Chart 1, Source: Bank of Thailand.

I call this the ‘Thai Disease’ – if you’re born and raised in a land of plenty, in one of the most fertile, resource-rich regions of the world, you don’t have much incentive to do too much. Every entrepreneur needs to know how hunger feels. I’m not really talking about Bangkok and other urban areas, but Thailand has an extremely ruralized population mainly living in badly-connected small villages that institutionalize sub-standard education, lack of opportunity and marginalization from participating in the socio-economic development of the Kingdom.

Thailand’s urban dominance keeps most of its population under-skilled, underpaid and underrepresented in the politics of the country. When the likes of Jonathan Head on the BBC mock Thailand’s elite for concerns about how democracy can work in the Thai landscape, they’re only showing their ignorance of Thai realities.

There is a genuine problem in terms of the marginalization of vast swathes of the Thai population, one that is best solved by finding a way to include the vast majority of Thai people in the socio and political economy. If we recognize their marginalization and its root causes, we stand some chance of dealing with it.

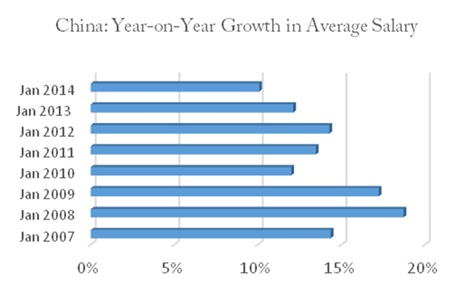

In China the equivalent of more than the entire population of America will have moved from rural populations to urban ones by 2033.3 While there are many, many problems with the Chinese growth model, increasing average salaries at over 10% per year (see chart 2) for several years and largely absorbing these extra costs through increased productivity is a salutary lesson as to what can be achieved.

Chart 2, Source: MOHRSS

Chart 2, Source: MOHRSS

Of course, as mentioned earlier, one impediment to consumption is high consumer debt. Interestingly Thailand’s consumer debt increased very significantly during the last government (for a lot of reasons) but there’s definitely not a consumer debt problem in most income sectors – in fact it’s only the lowest 20% of earners who are heavily indebted4 – which is sad on an individual level but on an economic level, it means that the most powerful 80%5 of consumers are still able to increase consumption and also that the problem is more easily remediable (see chart 3).

Chart 3, Sources: BOT Paper “Rising Household Debt: Implications for Economic Stability” & SES (October 2014)

Chart 3, Sources: BOT Paper “Rising Household Debt: Implications for Economic Stability” & SES (October 2014)

For one thing, it tends to be easier to increase average incomes and enable debt repayment amongst the lowest paid sectors of society. Also other effective policy tools are available. My colleague at IDEA Economics6, Prof Steve Keen, often talks about a debt jubilee7 – governments cancelling consumer debts – a policy that not only has a very sound historical justification but actually was implemented just the other week by the Croatian government8. It’s also believed to be a populist policy that actually does have a positive economic impact; Thailand take note!

2) The second way to fill the export gap would be for the government to actually implement the much needed infrastructure reforms. While I welcome some initiatives that have seen the Chinese and Japanese encouraged to open their governmental wallets to help improve Thai infrastructure9 and while I very much welcome the fact that Prime Minister Prayuth has committed to save 30% of the cost of infrastructure projects,10 speed is of the essence and disbursement is in danger of missing the critical point in time when it’s most needed.

So, the world has a problem – a huge problem and finding a better economic solution than another World War is a really difficult challenge – one that sadly looks beyond the grasp of the policy makers that I’ve met or spoken to from developed countries, especially in Europe.

Thailand is very much affected by that problem. It also has homemade problems of its own. The good news is that they are remediable but the bad news is that there’s not much time left. We have some very impressive individuals in Thailand – Dr. Prasarn at the BoT is for me the standout global central banker.11 The current ruling administration isn’t short of talent either and it certainly seems to know the right policy measures and direction – but it needs to get a move on – or else things could turn very dark indeed.

Footnotes:

- 168% in USA: OECD, Household final consumption

expenditure, etc. (% of GDP) USA (2013) - Bank of Thailand

- UNDP & China Translation and Publishing Corporation (2013),

China Human Development Report - BOT Paper “Rising Household Debt:

Implications for Economic Stability” (October 2014) - idem

- http://www.ideaeconomics.org/

- http://www.debtdeflation.com/blogs/manifesto/

- http://www.cnbc.com/id/102388026

- http://www.bangkokpost.com/news/transport/450907/thailand

-china-sign-railway-deal and http://www.business-in-asia.com/

thailand_infrastruture.htm - http://www.nationmultimedia.com/politics/

NCPO-aims-to-avoid-debt-30241210.html - See MBMG Article for The Nation Newspaper, Experts discuss

outlook for Thailand, ASEAN and China, September 2013

| Please Note:While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup : |