It isn’t just the UK’s referendum that has depressed markets – they’ve been bearish for a while, in spite of desperate attempts to revive them.

So Europe may be about to enter a new era in actually losing a member state. Let’s hope that this grows into a truly brave and eventually more economically stable new world. My reasoning is that after the UK’s exit and break-up, the EU will crumble under pressure from other countries and ultimately cease to exist. These shocks would then cause a Minsky Moment, forcing governments and central banks to finally change tack.

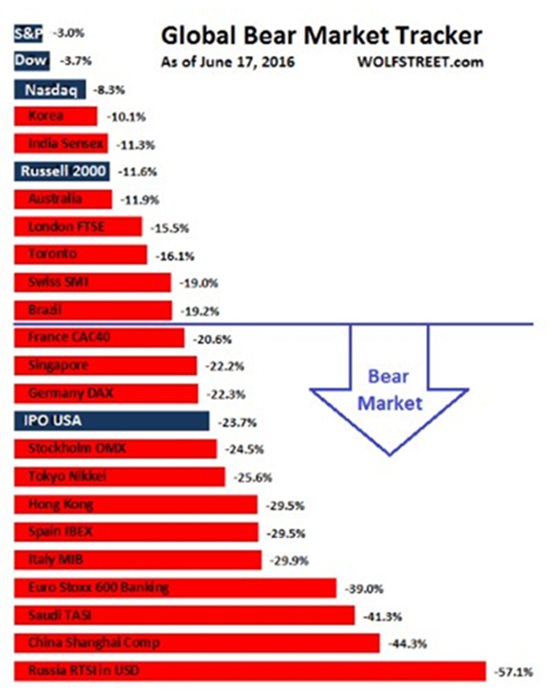

Stock Market Performances since peak of May 2015

All that may seem too radical; but I honestly feel a huge shake-up is necessary because so many of the world’s richest economies are mimicking the example of Japan, in trying to bring about economic recovery. The slight flaw in their plan is that Japan has had over 25 years of recession.1 But this hasn’t stopped the Federal Reserve, the Bank of England, the Bank of Canada and others from persisting with ultra-low base interest rates; and the ECB and Switzerland, Denmark and Sweden have even introduced negative rates.2 To add to the madness, all of these have implemented bond-buying schemes at some point. Bond prices have soared to where many government bonds and even some corporate bonds are trading with negative yields.3

According to former Fed chairman Ben Bernanke, this approach was designed to “Ease financial conditions”, which “will promote economic growth.” In his opinion “higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.”4

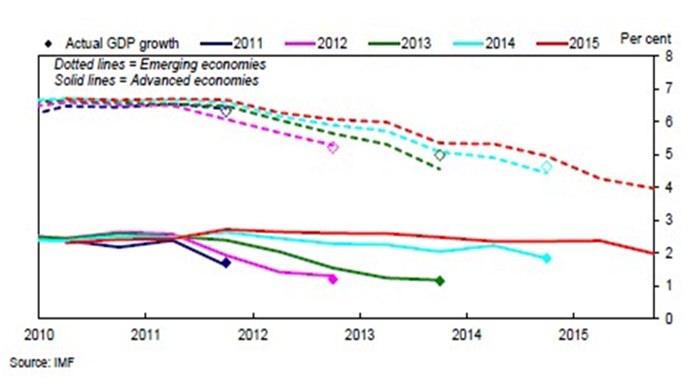

Serial Growth Disappointments

This all sounds great. Yet, after five years of easing (which was stopped last year) and seven years and counting of emergency low interest rates, the US economy isn’t in much better shape than before. Even the fed has admitted that easing did not provide Bernanke’s famous economic boost.5

It’s hardly a great surprise if you think about it. I can’t imagine millions people going out to buy lots of consumer goods just because Microsoft went up 3 points the previous day. Sadly, it’s clear from the actions of other central banks that there’s a herd mentality among the world’s central bankers. As my IDEA Economics colleague Prof. Steve Keen put it, central banks have “exhausted the capacity to use the wrong tools but the right ones are still sitting there and they’re ignoring them.”6

That makes the Bank of International Settlements’ – the central bankers’ central bank – recent suggestion, that it may be a good idea to focus on financial stability,7 all the more stupefying. After all, if that’s suddenly the new recommendation, what on earth was the plan beforehand, when spending trillions of dollars on bond-buying and making it cheaper to accumulate yet more debt – the very thing that brought about the global financial crisis in the first place?8

With all that considered, even if we suspend belief and imagine that the massive amount of liquidity and the free-for-all in corporate borrowing, stock markets in these zero-interest and especially negative-interest rate countries should be booming.

But they’re not. In fact, they’ve been getting a bit of a hammering recently – especially the negative-interest countries. Even if we only look as far as the week before the fallout of the UK’s vote to leave the EU, we can see the trend (see chart 1).

In the US, the S&P 500 and Dow are slightly down from their May 2015 peaks but the NASDAQ is significantly lower at 8.3% during that period. The Russell 2000 has dropped a disconcerting 11.6%; although such small-cap indices do tend to rise and fall sharply. Alarmingly, the S&P 500 P/E Ratio over 12 months up to 17th June is a huge 23.9: that’s slightly up from 22.8 a year ago and way north of its historical median of 14.6.9

Away from the US, we can see markets inside the CAC 40 (Paris), DAX (Frankfurt), IBEX (Madrid) and MIB (Milan) – all located inside the Eurozone – have all dropped by more than 20% since May 2015. The Euro Stoxx 600 Banking index, which covers banks both inside and outside the Eurozone was down a critical 39%.10

Back in March, ECB president Mario Draghi used all the tools he thought (and seemingly still thinks) he has at his disposal by dropping the ECB’s base rate to -0.4%11 and increasing stimulus12 – but the markets still dropped.13 Infuriatingly, Draghi’s failed attempt came three weeks after Bank of England Governor Mark Carney admitted the underperformance of the global economy “is a reminder that demand stimulus on its own can do little to counteract longer-term forces of demographic change and productivity growth.”14 The chart Carney showed during that speech illustrates the point perfectly (see chart 2).

Over four months on from Carney’s admission, we’re still in the same zero/negative-interest-rate scenario. This begs the question as to what it will take for central bankers to remove their heads from the sand.

Perhaps the impending downfall of the European Union may actually do this; although I suspect it will take a full-blown post-EU-collapse Minksy Moment-style crisis to finally make so many central bank ‘experts’ realise that they’ve been wrong for so long.

Footnotes:

1 www.ideaeconomics.org 2015 Outlook

2 Rates from Federal Reserve, Bank of England, Bank of Canada, SNB/BNS, Danmarks Nationalbank, Sveriges Riksbank

3 http://wolfstreet.com/2016/06/19/global-stocks-nirp-negative-interest-rate-rout/

4 http://www.washingtonpost.com/wp-dyn/content/article/2010/11/03/AR2010110307372.html

5 http://www.cnbc.com/2015/08/18/st-louis-fed-official-no-evidence-qe-boosted-economy.html

6 https://www.youtube.com/watch?v=7OSHu80IXi0&feature=youtu.be&t=3m45s

7 http://boomfinanceandeconomics.com/

8 www.ideaeconomics.org 2015 Outlook

9 http://wolfstreet.com/2016/06/19/global-stocks-nirp-negative-interest-rate-rout/

10 idem

11 http://www.bloomberg.com/quicktake/negative-interest-rates

12 http://wolfstreet.com/2016/06/19/global-stocks-nirp-negative-interest-rate-rout/

14 www.bankofengland.co.uk/publications/Pages/speeches/2016/885.aspx

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |