To buy or not to buy, that is the question. Also, what currency to use? From a fundamental point of view, in the short term it can be argued that the US Dollar (USD) may be technically oversold and so due for a bounce. However, the long term trend is down for the USD and up for most Asian currencies.

Also, there is a chance of a financial Armageddon over the medium term. If this happens there is a reasonable chance of a massive readjustment of the USD. Should this occur then the peak for the USD may well coincide with the trough for asset prices in Asia and this would be the perfect buying opportunity.

People based in Thailand and remunerated in baht should focus on the local currency as the baht is be expected to continue to strengthen over the long term but, as stated above, there is a risk that we will see a flight to the greenback at some point in the next two years presenting a better opportunity to sell USD or to buy baht at something like a 20% lower rate versus the USD than today. However, this is far from being a certainty. Nevertheless, over the long term baht will get stronger against the USD.

Hedging against a baht correction is another option, but this requires expertise in both timing and selecting the correct hedge. There are a number of products in the market which hedge in baht, the Singapore dollar as well as most of the major currencies. These have the ability to access offshore assets in baht. Also there are covered bond funds which currently yield about 7% a year in baht.

By taking exposure to globally diversified portfolios in this way baht investors are able to diversify risk across global assets without taking currency risk.

Perhaps the investors facing the toughest decision now are those who live and work locally but have their salaries, savings and investments in their national currencies. For example, in the past four years the spending power of British expats based in Thailand who are remunerated in Sterling has declined by about 40. Those earning in USD have seen a decline of about one-third over the same period.

If you are in this boat and plan to stay in Thailand or the region for the foreseeable future, then you need to take a position which gives you the best return for your baht. Holding onto Western currencies indefinitely is increasingly unlikely to deliver this.

The golden rule is that your income-producing assets should be held in or hedged to your currency of expenditure.

Expats planning to return to their home countries could benefit from investing in emerging market currencies now, assuming these will continue to appreciate at a faster rate than USD or EUR.

Another investment option is property. The USD to baht exchange rate is about 30 at the moment. If there is a market correction of about 20% then that would be a good time to bring money in to buy property. Keep it for a few years and, provided the baht has got stronger again, even if you only sell it for what you bought it for then you could make a nice profit in the base currency.

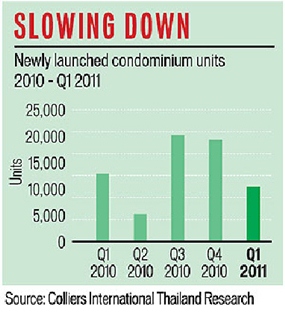

Colliers International Thailand has just announced that any concerns over an overheating condo market have been allayed as there was a drop of about 46% in new launches. They also cite the Bank of Thailand’s new loan-to-value curbs on mortgage lending and the steady rise in interest rates has helped to restrain the breakneck pace of launches.

Executive Chairman Simon Landy stated, “While the strength of the baht has certainly been having some negative impact on the appetite for Thai property among foreign buyers, it is no longer a new issue and many investors have come to terms with the new level. As a result of this and the cooling of the political temperature since last year, there has certainly been more foreign interest in Thai property, but not back to the levels pre-2006. On the other hand, many Thai-based investors are taking the opportunity presented by the Thai baht and the easing of offshore remittance rules by the Bank of Thailand to invest overseas…and this has accelerated with increased demand for residential, commercial and hotel properties.”

So, it all depends what you want to do. A strong baht can help but it can also hinder.

The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on graham@mbmg-international.com