November is a time of year when many Europeans and Americans reflect on Armistice Day, a commemoration of the end of the First World War. Having grown up in the UK, I have a childhood memory of the autumn turning to winter and putting on my overcoat on a frosty morning, poppy firmly attached to the lapel.

2014 is of course especially poignant as we commemorate the centenary of the outbreak of that dreadful war. It seems that every modern historian has his/her own theory as to why it all began, what the implicated governments’ motives were. That debate will never be resolved, yet a few times since the centenary commemorations began in July, it has crossed my mind what the world was like before war broke in 1914, and how the future would have looked if the peace had been kept.

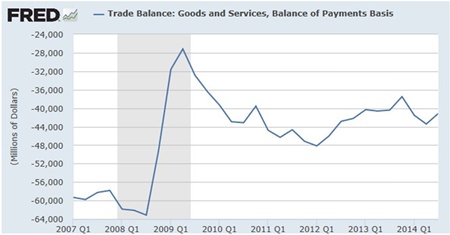

Source: FRED and US Department of Commerce

Source: FRED and US Department of Commerce

One interesting theory, from Scottish-born Harvard professor Niall Ferguson,1 is that if the British government had said no to war, at that fateful cabinet meeting on 4th August 1914, the outcome would have been different – even if all the other powers had mobilized troops.

Ferguson points out that Britain was not obliged to declare war on Germany and without its intervention, the Germans could have quickly won the war and created a European union, without the catastrophic loss of life on all sides. Whilst this may seem like mere speculation, it’s worth considering that part of the German government’s war aims was to create a European economic association, dominated by Germany of course.2

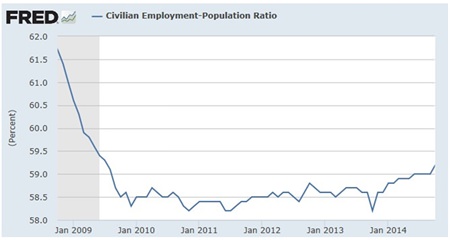

Source: FRED and US Department of Labor: Bureau of Labor Statistics

Source: FRED and US Department of Labor: Bureau of Labor Statistics

Had that become a reality, there may not have been the level of resentment, which pulled the delegates at the resulting Paris Peace Conference away from the task of creating a new peaceful world, back to the demons of the recent past. In his excellent eyewitness account of the peace talks John Maynard Keynes’ observed that the French delegation was out for revenge for defeats in 1871 and 1914 – led by the crusty Tigre, Prime Minister Georges Clemenceau.3

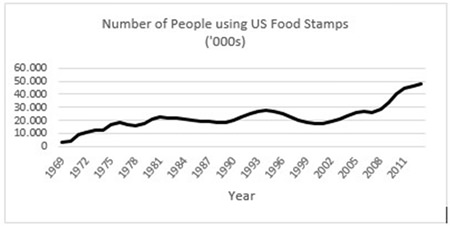

Source: USDA

Source: USDA

Keynes became dismayed about the future, commenting: “The proceedings of Paris all had this air of extraordinary importance and unimportance at the same time. The decisions seemed charged with consequences to the future of human society; yet the air whispered that the word was not flesh, that it was futile, insignificant, of no effect, dissociated from events; and one felt most strongly the impression, described by Tolstoy in War and Peace or by Hardy in The Dynasts, of events marching on to their fated conclusion uninfluenced and unaffected by the cerebrations of Statesmen in Council.”

It makes you realize how tragic the two world wars really were when considering where we are today. Just like in the summer of 1914, the global economy is struggling – a look at US trade, employment and the number of people requiring food stamps shows the current situation.

Back in 1914, the Austrian ultimatum to Serbia caused global financial panic and a liquidity crisis on, amongst others, the London Stock Exchange as investors rushed to turn cash into gold.4 As for the US, the economy was in recession.5 Just as in 1939, economic woe relieved demand for American goods after the outbreak of war.

A century later, we find ourselves in a global economic downturn with no end in sight. Not only that, Europe is relying heavily on Germany to help out6, while analysts call for it to reduce its intervention.7 Not only that but today, as in 1919, policy leaders appear to be carrying on regardless of the reality in front of their eyes, with a dismissive air of inevitability. In spite of finally abandoning its Quantitative Easing money-printing programme, the Federal Reserve is yet to come up with a credible solution to, or even recognition of, the debt crisis. Like Keynes in 1919, there are some highly credible economists shouting from the rooftops that this is an opportunity and a necessity to start a fresh approach to the world before we hit another crisis. Among them are Steve Keene, Ann Pettifor, James K. Galbraith and Michael Hudson who are part of IDEA Economics8, an institute of which I am an advisory board member.

Given that economics failed to predict the Global Financial Crisis – the biggest economic event in generations, failed to repair the damage and still fails to provide relief to real businesses and real people in the aftermath, IDEA has based its approach on three basic principles: debt matters, money matters and the economy is dynamic.

‘Debt matters’ means that stagnation and decline will continue until we actually deal with the debt. ‘Money matters’ is the point that credit creates money, not a central bank: continued unmanaged money creation by banks (e.g. when lending) will continue crises and instability. ‘The economy is dynamic’ principle is the observation that the economic theory of equilibrium (i.e. the automatic return to normal) is not supported by either logic or evidence.

We cannot rely on equilibrium or a third world war to solve the next economic crisis. It’s time to change our perspective and use 2008 as a lesson of how not to structure our modern economy. We can’t afford to let the opportunity slip through our fingers this time.

There’s a cyclicality in debt and inequality that has tended to result in war for as long as mankind has organized itself into competing societies – a global conflict in the coming decades would be cyclically consistent with this. We therefore need to break this cycle if war is to be avoided – the proliferation implications of nuclear holocaust by themselves probably only amount to a limited not an absolute deterrent. For the deterrent to be absolute we need to combine a version of nuclear horror with a healthy respect and remembrance for all those who put their lives on the line in the belief that they were fighting wars to end all wars.

Footnotes:

1 N. Ferguson, Virtual History: Alternatives and Counterfactuals (1997).

2 B. Tuchman, The Guns of August (1962), p.315

3 J M Keynes, The Economic Consequences of the Peace (1919)

4 http://www.telegraph.co.uk/finance/personalfinance/investing/

11113621/Edward-Bonham-Carter-The-forgotten-financial-crisis-of

-1914-has-parallels-100-years-on.html

5 http://www.nber.org/digest/jan05/w10580.html

6 http://www.spiegel.de/international/germany/german-economic-

growth-helps-move-euro-zone-out-of-recession-a-916553.html

7 http://www.telegraph.co.uk/finance/economics/11160944 /

Eurozone-in-crisis-Germany-could-enter-third-recession-in-six-years.html

8 http://www.ideaeconomics.org/

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Private Equity Services, Corporate Services, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |