There are many theories of how to calculate the amount of money you need to retire. Despite the plethora of formulae and algorithms, it primarily takes a clear head and accurate, detailed planning to get it right.

I once heard about a civil servant lawyer who celebrated his birthday every year by holding a big party, at which he would make a toast by declaring how many years left he had until retirement. Needless to say, as he worked in the public sector, he knew his retirement date years in advance.

In some ways, knowledge of the day you have to retire is a blessing – it’s an immovable target. For those who have to decide by themselves though, it can be difficult trying to determine at what point they’ll have enough savings to live life the way they would like to.

I recently read an article calling that optimum age the magic number.1 This apt terminology comes from the world of baseball, where it means the number of games a team has to win in order to secure a first-place finish. A retirement magic number differs for each person, of course, and the article suggests – accompanied by several charts and graphs – that people should aim to have accumulated ten times their final salary before ending their career. It’s suggested that this is broken down as follows:

* Have a year’s salary saved by the time you’re 30

* By 40, aim to have three times your salary saved

* At 50, six times your salary saved

* By 60, eight times your salary

* By full retirement, at 67 years old for example, your savings should be at 10 times your salary

No metric fits perfectly into everyone’s life and this plan certainly makes a lot of assumptions. Firstly, it assumes that everyone is able to save at the same rate. But what if the investments you’ve made undergo a major market correction? Or if we have a sustained period without income? Plus nobody knows how long we will live.

Also, the author is American and has thus based the theory on salary levels and living expenses in the US. It would be highly different if you had worked several years in high-salary countries, then later came here to Thailand, where the cost of living is quite clearly much lower.2

It is also based on the assumption that earned income stops as soon as you hit retirement. Some people nowadays continue to receive income, be it through a part-time role, consulting or directorships.

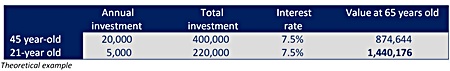

Subject to all these caveats, provided we don’t apply the plan too rigidly, it can be a reasonable yardstick for retirement planning. There’s no doubt that the sooner we start saving for retirement, the better. That’s not just because saving for longer means more money saved. Thanks to compound interest, the future value of money invested today is greater at retirement than an amount invested several years down the line. For example, if a 45 year-old starts to invest USD 20,000 a year and a 21 year-old invests USD 5,000 a year at the same interest rate until they are 65, the result is as shown in the box:

Again, personal circumstances mean that not everyone can realistically start saving in their twenties or even their thirties.

That highlights the point that there is no one-size-fits-all formula to finance. There are probably as many financial planning methods out there as there are exercise regimes or diet plans. Just like a diet or exercise regime, a retirement plan should be tailored specifically to your objectives, requirements and priorities. There’s no point in setting out a plan to which, soon afterwards, it becomes obvious you can’t realistically contribute the full amount each month.

Similarly, it’d be a wasted opportunity if the contributions are too low and extra cash is spent unnecessarily. A well-thought-out retirement savings plan makes it easier to apply the pay yourself first principle. This means allotting a portion of your income to savings, with the same mind-set as if the payment were as mandatory as a tax bill. Adopting that mentality helps keep money aside for your retirement, instead of using it on the gold-plated deluxe version of the latest gadget.

In addition to a realistic, balanced calculation of how much of your monthly income you can save, you need to find the savings product which suits you best. There are so many available that this can be a complicated task. The small print of many popular savings products is an unnecessary way to deflect investors off the scent – the language in which they’ve written is often so obscure that 10-feet tall print wouldn’t make it any easier to understand. But would a straightforward savings account do the job? Do you want to look at something that provides an opportunity of growth? Are you prepared to risk some of those savings for a chance to make a higher return?

If so, it is especially important in the current economic climate to look at how you should allocate assets to avoid being too exposed in the event of a major economic event, such as another global financial crisis. Many investors have become quite blasé about risk because the two multi-year global stock market corrections of 50% or more in the last twenty years both quickly reversed and markets hit new highs. They should be aware that when something similar happened following World War I the third correction wasn’t so forgiving. In fact it took US equity market investors in 1929 until well after World War II to regain the same index levels.

All-in-all, rather than merely using a rule of thumb, such as calculating how many times your salary you should accumulate, it’s better to work out a more detailed plan that is totally relevant to you, your objectives and your current lifestyle. As Dr Amaju Loving, assistant professor of financial planning at The American College of Financial Services, put it:3

If you apply [rules of thumb] without professional advice and some form of precision over longer periods of time, you may be getting farther and farther away from spending goals you want to have in retirement.

But if you actually sit down with a professional, they can run simulations to show you the percentage of time your portfolio is likely to fail, and you can do concrete things to make sure to withstand your retirement.

I couldn’t agree more. This is why I believe an individual cash flow plan, with a range of outcomes, is essential along with a plainly understandable savings arrangement with easily understood outcomes and well defined rises.

Footnotes:

1 http://www.cnbc.com/2016/02/11/whats-the-magic-number-for-your-retirement-savings.html?__source= newsletter%7Cyourwealth

2 www.numbeo.com

3 http://www.cnbc.com/2016/02/11/whats-the-magic-number-for-your-retirement-savings.html?__source= newsletter%7Cyourwealth

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |