So why should investors invest in small cap shares, especially those in the riskier area of the market, namely emerging markets?

Have we not forgotten the lessons of 2008 in which liquidity became so scarce and small cap shares collapsed as investors ran for the exits?

Investors need to be aware of this as liquidity remains an issue – especially in smaller emerging markets. However, this also creates an opportunity as investors shy away from these shares leading them to sometimes trade on lower multiples, or not be researched at all.

By now most market participants are terribly familiar with why emerging markets offer long term investment opportunities, be it strong growth, lack of debt, resources, rich economies, etc.

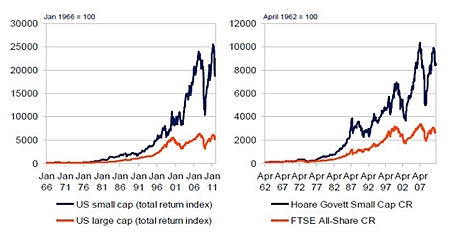

Small Cap Performance

Source: Schroders, April 2012

Source: Schroders, April 2012

What many investors may not be aware of is that small cap investing might be the better way to achieve returns from this long term economic growth story.

In a recent meeting with Matthew Dobbs of Schroders, this point was made incredibly clear. Just to give the meeting some colour, Matthew Dobbs is quite easily one of the most impressive fund managers around; an out the box thinker, who truly sees life from a different perspective.

It was largely due his passion and knowledge on small cap companies that he piqued my interest in emerging market small cap investing. Matthew is the Head of Global and International Small Cap Equities at Schroders and runs a number of successful funds.

In a well diversified equity portfolio, small cap shares deserve a place, especially if one has a longer term view (as can be seen by the huge outperformance over the long run in the Small Cap Performance chart this page).

Small cap shares concentrated in emerging markets also offer the investors a more balanced approach to investing in these economies, as they tend to cover a greater mix of sectors, unlike the indices which tend to be dominated by a few large players.

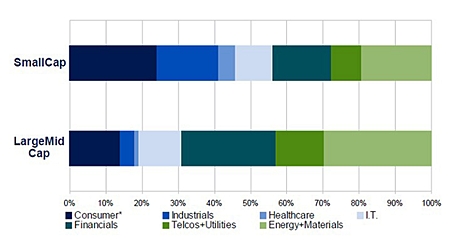

S&P Breakdown – Emerging markets

Source: Schroders, April 2012

Source: Schroders, April 2012

To illustrate this point, the Russian index is dominated by five companies which make up about 45% of the market, with three of the largest being state owned, namely Gazprom, the world’s largest gas producer, Sberbank, the largest Russian bank, and Rosneft.

China is a little less concentrated, with its top five companies making up a bit less than 30% of the market, four of them being PetroChina, Bank of China, China Construction Bank and the Agricultural Bank of China.

It is not only the concentration of a few large companies that dominate emerging stock markets, but it is also the fact that the top end of the markets is predominantly in either finance or commodities, usually oil. The S&P Breakdown shows how much more heterogeneous the small cap sectors are in emerging markets.

A very important point to note for those wanting to invest in emerging markets is that small cap shares tend to be more domestically focused and 80% are less directly impacted by currencies and global trade.

Furthermore, if one considers the rise of the middle class in emerging markets, with predictions showing that by 2030 over 90% of the world’s middle class consumers will reside in the developing markets, relative to 50% today, the case for emerging market small cap becomes even stronger.

There is also a huge choice, some of 2,894 potential investee companies, 1,747 of which have market capitalisations in excess of $300m (including Developed Asia).

Small cap shares offer investors an earlier stage in their growth path. Remember, Microsoft and Apple were not always the behemoths they are today. Small caps also offer a purer exposure to new technologies, products and market segments. What is also important is that this sector of the equity space also offers the ability to buy focused and directly incentivised management, as many would have been born out of private companies.

Looking at all the positives for investing in emerging market small cap stocks, one would be inclined to have a fairly large portion of one’s portfolio allocated to this segment of the market. However, valuations relative to large cap stocks are not as cheap as they used to be and hence one needs to be aware that the margin of safety is less than it used to be.

Investors need to be aware that when investing in small caps stocks there is risk and, what is more, emerging market stocks also offer risk and here you have a scenario of small cap emerging market stocks! So please be careful.

But if we are going into a world of slower growth for developed economies then it is more than conceivable that most of the growth will be harnessed in emerging markets. So, taking a bit of a risk, provided it is part of a well diversified equity portfolio should reward investors.

| The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected] |