If you dream of sun, sand and sea but you’re worried about spending your entire pension inside a couple of years, Southeast Asia is one of the best places to retire… isn’t it?

World Rankings

Where would you like to live when you retire? I’ve recently come across a couple of interesting articles which cover this topic. The first, by International Living, went as far as to make a ranking for retirement destinations around the world.1 The second, from Investopedia,made a comparison between Thailand and Vietnam.2

What I noticed about the International Living piece was that it gave percentage marks in eight different categories. Ecuador (1st), Mexico (3rd) and Colombia (8th) all ranked above tenth-placed Thailand. As it is a US-based publication, I imagine that proximity and awareness of these Latin American countries plays a part in the fitting in score, and agreements between these states and the US factor into the benefits and discounts total.

Crime and safety rates

Curiously, there was no particular weighting, so points for infrastructure and the above-mentioned fitting in carried equal importance to those of healthcare. Also, safety and crime were not included – factors which I personally value very highly.

That brought me to look at the comparison website Numbeo,3 which analyses surveys and costings for cities and countries throughout the world. According to this website, the perception of safety in Thailand is much higher than Ecuador, Mexico and Colombia and the crime rate is much lower – something which I’d suspected. In fact, in these two variables Thailand outscores Australia, the UK and the US; as well as neighbouring Cambodia, Malaysia and Vietnam.

Healthcare and cost of living

The Land of Smiles also scores exceptionally well on healthcare. In fact it ranks fifth in the world, according to Numbeo’s Healthcare Index,4 which factors in (among others) the overall quality of the healthcare system, healthcare professionals, equipment, staff, doctors, and cost. With a score of 80.73, Thailand easily outscores Australia (72.72), the UK (73.68) and the US (67.13).

Retirement also means that you may find yourself with less income, yet more time to spend it. Thus cost of living can be a crucial part of your decision where to live in retirement. It’s no secret that Thailand offers a relatively low cost – just going for a meal out exposes that. In fact government statistics suggest that, at the last count in 2012, there were around 96,000 migrants aged 50 or above living in Thailand. Around a third of those were aged 60 or more.5 Those statistics don’t define what a migrant is, so they may not even factor in those people who live six months a year or less in Thailand or those with other specific personal circumstances.

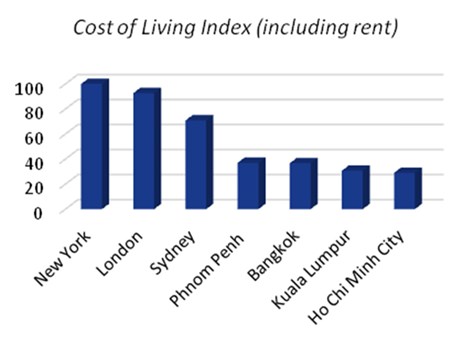

If we compare the largest cities in several countries, we can see how true the assumption about Thailand is. Numbeo’s Cost of Living Index (including rent) measures local consumer price indices for products and services including groceries, restaurants, transportation and utilities. Bangkok’s score is almost a third of that of New York and just short of half that of Sydney (see chart).

Source: Numbeo.com

Source: Numbeo.com

Thailand and Vietnam

The Investopedia article caught my eye as it talks specifically about Vietnam as an alternative to Thailand. Both Hanoi and Ho Chi Minh City are pleasant cities to be in, with their excellent cuisine, street cafés, wide pavements and beautiful architectural sights.

Since Vietnam began economic reforms just under thirty years ago, it has made huge strides in terms of development. GDP per capita is expected to be eight times greater in 2015 than it was in 1986. Whilst Numbeo doesn’t give Vietnam a healthcare index rating, International Living puts it at 76 points, compared with Thailand’s 89 and Malaysia’s score of 94. In terms of cost of living including rent, Numbeo charts Ho Chi Minh City as still cheaper than Bangkok; yet in terms of crime and safety, it fares better than Malaysia but worse than the US, for example.

Heart and head

All of these costings and ratings act merely as a guide. In the end it boils down to personal circumstances and preferences. Health insurance premiums don’t just take into account where you live but also your age and health. Your nationality may make one country easier to get a visa to live in, as well as go in and out of, than another.

In Thailand, for example, one available visa is the Retirement (Non-immigrant “O”) Visa, designed for foreigners over 50 who have held a minimum of THB 800,000 in their bank account for at least the past 3 months; or transfer a retirement income of at least THB 65,000 into Thailand every month. This visa is renewable annually and to obtain it you’ll have to pay an initial fee of THB 1,900 and, once received, apply for a re-entry permit. For more information on this, ask an independent expert.

All that aside, some people prefer the atmosphere of one place rather than another for whatever reason. To avoid future headaches it is, however, crucial that when deciding where’s best for you to retire, the decision is made with the head as well as the heart – so it’s best discussing the facts with an expert before deciding.

Nevertheless, it pays tribute to the economic stability of Southeast Asia that the region has become so popular with retirees.

Footnotes:

1 http://internationalliving.com/2015/01/the-best-places-to-retire-2015/

2 http://www.investopedia.com/articles/personal-finance/

111015/thailand-vs-vietnam-which-better-retirees.asp

3 www.numbeo.com

4 http://www.numbeo.com/health-care/rankings_by_country.jsp

5 http://web.nso.go.th/en/survey/migrat/data/561121_ Statistica.pdf

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |