After the crash, the Dow Jones Industrial Average (DJIA) has recovered. So everything is ok, right? Well, not quite.

Monday 24th August apparently saw the most volatile session ever in the almost 120 years of the DJIA (in terms of the successive point swings).1 The next day was the biggest reversal since 2009, as the markets’ putative rally turned sharply and headed south.2

For every point swing on the US and other global indices there seems to have been thousands of words of commentary published; yet the overall effect of this seems to do little to help clarify the situation. The cacophony of the commentaries simply added to the noise of the markets.

Having said that, this shouldn’t come as too much of a surprise: it seems that many people didn’t expect it or understand what was happening; and everyone miscommunicates to some extent when under pressure.

There are some interesting examples:

Chief investment strategist at Janney Montgomery Scott, Mark Luschini’s description was unfathomable. He said a negative close “would be a set up to grind sideways to work out this process, if this rally and enthusiasm can’t last I think it’s an indicator (of that consternation).”3

Kevin Mahn, chief investment officer at Hennion and Walsh came up with the equally unhelpful comment, “I think obviously the market sold off far more than it should have.”4 Maybe someone should tell the market just how much it should sell off.

My favourite, though, was chief investment officer at Tower Bridge Advisors, James Meyer’s comment on the morning rally: some of the things “bothering markets yesterday were China and collapsing commodity prices and both of those have given us some relief and when I look at China I don’t look at the Shanghai market. I look at the Hong Kong market.”5 I suspect that many Hong Kong citizens and quite a few geography teachers might be perplexed by that view!

There have been a raft of equally unhelpful but much more reassuring sounding comments about how such corrections are all part and parcel of the long-term process of making money from capital markets and nothing to be unduly concerned about or out of the ordinary.

Amongst all the edicts investors should heed, one stands out above all others: it’s time in the market that builds returns, not timing the market.6 As USA Today’s Matt Krantz put it, “[…] a five-year period should be enough time for a long-term investor to be made whole even in a bad market.”7

Whilst I don’t believe that it’s possible to consistently, accurately forecast market short-term direction, I do feel that economic conditions can impact markets – especially in extremis. I’ve been saying for some time that the conditions we face nowadays are in fact in extremis. Prof Steve Keen, my colleague at IDEA Economics, also alluded to this in the Is America Turning Japanese part of his 2015 Outlook.8 The view that markets always bounce back within five years is both misleading and dangerous.

Despite the Fed and BEA’s declarations that the US economy is back on its feet9 there have been clear signs of debt deflation in the US – as well as in other economies around the world. Thus, these conditions shouldn’t really surprise anyone; yet it they have. Many, for that matter.10

Of course, I wasn’t the only one expecting this: Richard Champion of Canaccord and RMG’s Stewart Richardson suggest several reasons why there is so much world market volatility right now.11 Some of the commentary out there certainly falls into the category of stating the bleeding obvious (even if it wasn’t apparently obvious before the crisis). For those who have been caught out, lessons in catching falling knives may be of more use than after-the-event writing, such as Liz Ann Sonders’s piece for Schwab12.

Tempting as it may be to dismiss those who didn’t see the current malaise coming, this retrospective advice is of little help now. What we do need to know, though, is where we stand and where we may be going. Here’s my view:

Long-term positioning

I’m no trader and to me long-term positioning is key. The collapse in the markets isn’t a sudden blending flash, so much as an inevitable outcome of impending debt deflation. I expect to see policy responses to try to avert this; though this may merely delay and make the eventual debt deflationary scenario even worse.

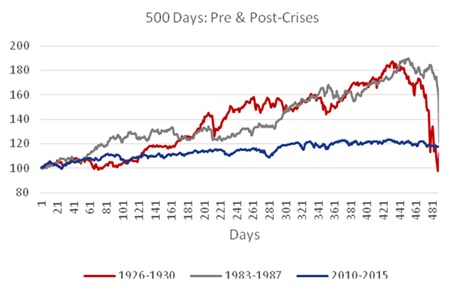

If this happens, it would mean that medium-term equity investing (5 years or so) would contain the inherent risk that markets will be very significantly lower in 5 years than they are today – even after this correction. Also, any strategy that fails to acknowledge this would be taking huge risks. As Chart 1 shows, the pattern of Dow Jones Industrial Average values in the days leading to the crises of 1929 and 1987 look frighteningly similar – corrections occurred just weeks before a more sustained drop hit. Thus, seeing a relatively small correction as an opportunity to buy totally misses the point that we are approaching the precipice. Having said that, such a correction is significant enough to warrant an overall re-appraisal of relative asset values.

Chart 1 – Index: 50 days before final reading = 100 – Source: NYSE

Chart 1 – Index: 50 days before final reading = 100 – Source: NYSE

The right approach

The last time that stocks were great value was when the S&P touched the memorable 666-point in 2009 – since then as the S&P has rallied 200%, I’ve been more alarmed about the risks building up at ever-higher valuations and have advised how to take risk off the table.

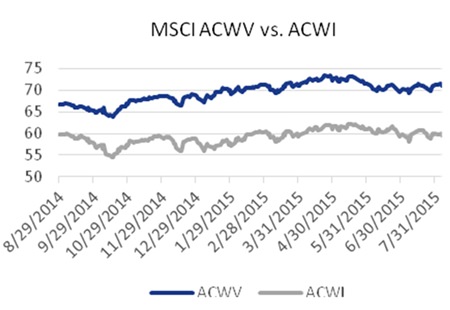

A good way is to use long/short managers; another is absolute return; and a further method is volatility-constrained investments – the unconstrained index is down by over 10% since the end of July, whereas the minimum volatility version of the index is much less effected (see chart 2).

Chart 2 – Source: MSCI

Chart 2 – Source: MSCI

Risk, not return

The way forward is to take a defined, focused investing approach, designed around realistic appraisals of risk, married to the investor’s risk profile. That’s easier said than done but it is absolutely the right method.

The overriding danger is that, because the markets are experiencing what could well be a slight correction, it is all too tempting in times like this to take a heuristic approach13 – i.e. the assumption that what goes down must eventually come back up.

Rather than make such a perilous assumption, it is wise to understand that, at any time, we can control risk but we can only influence return. Consequently, focusing on return is always wrong, whatever the scenario.

Footnotes:

1 http://tacenergy.com/tac-market-talk/

2 http://www.cnbc.com/2015/08/25/markets-rallied-and-then-tanked-at-the-close.html

3 http://www.cnbc.com/2015/08/25/us-markets-attempt-recovery.html

4 idem

5 idem

6 http://www.businessinsider.com/investing-is-about-time-in-

the-market-not-market-timing-2014-10#ixzz3jzwxj8w4

7 http://www.usatoday.com/story/money/markets/

2015/08/28/what—long-term-investing-stocks/71282392/

8 http://www.ideaeconomics.org/

9 http://www.cnbc.com/2015/04/10/how-does-the-fed-raise-interest-rates.html,

http://www.ft.com/intl/cms/s/0/3529a77c-36b5-11e5-b05b-b01debd57852.html#axzz3k NMw6g5O

10 http://marketrealist.com/2015/07/chinese-equities-in-freefall/

11 http://www.canaccordgenuity.com/documents/non searchable/August_

2015/Articles/The_Return_of_ Volatility%20_Market_Update.pdf & http://www.rmginvestment.com/

investment-bulletins_detail_249_A-Brutal-Week-in-Markets—What-Next

12 http://www.schwab.com/public/schwab/nn/articles

/Panic-Is-Not-a-Strategy-Nor-Is-Greed

13 http://heuristics.behaviouralfinance.net/representativeness/

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |