We have just completed our annual review of our neutral strategic asset allocations and, basically, the executive summary is that we have increased our core fund’s neutral global equity exposure from 30% long and 10% long / short upwards to 35% and 10% respectively thus giving a total of forty five percent.

This is at the expense of Government Bond exposure, which we have now reduced from 15% to 10% on a long term neutral basis. Whilst the move may appear small it will have a material impact on the tactical asset allocation moves and risk management within the overall portfolio on a daily and monthly basis.

This comes from an annual review based on our expected ten year forecast returns optimized within the portfolio. It is important to know that it does not change very often. The neutral long global equity exposure was effectively reduced in 1999/2000 from 50% to 30% and has remained there until now. We have always believed that strategic asset allocation is not static asset allocation based on averages, but is driven by asset class valuation. We see risk in terms of making absolute not relative returns. An efficient frontier portfolio based only on historical standard deviations alone would have produced the same static allocation for global equities for the 1990s and 2000’s.

However, in one decade the S&P produced 400% returns and the other 0%. No further explanation is needed.

For those who have not read GMO’s James Montier’s white paper entitled “I want to break free or Strategic Asset allocation # Static Asset Allocation” please contact me for a copy as it explains this whole subject much more clearly than I ever could.

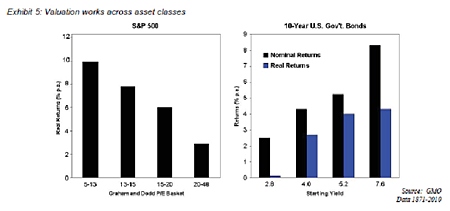

Valuation of asset classes matters greatly. The chart below from GMO’s report illustrates the point very clearly. For global equities (using S&P500 as proxy) if your allocation when PE valuations are 20-48 times ten year average earnings you can expect 2% per annum real returns as against 10% per annum real returns if you buy on PE multiples of 5-13 times etc.

For Government Bonds, if you buy at a starting yield of 2.8% on 10 year US T Bond you get 0% real return on a 10 year view versus buying at 7.6% yield equals 4% real returns for the next 10 years. Go figure.

Whilst global earnings still reflect the highest profit margins in multiple decades, and the European Debt crisis is far from solved, we believe the ten year expected real returns are very close to the left hand axis in each chart above and a Strategic Asset Allocation shift is required.

In conclusion, global equities are much better value than they were ten years ago, government bonds offer terrible value with zero real return, if not negative on a 10 year view and gold has nearly achieved its valuation target but is probably not quite there.

For our cautious to balanced portfolio to have had the same benchmark asset allocation to any of these asset classes over the past twenty years is ludicrous, but that is what most efficient frontiers produce. The standard deviation remains the same but the returns vary wildly. As stated before, no further explanation is required. Basically, when it comes to funds there are lies, damned lies and statistics. Rather than drown yourself in figures that are produced by the people who want you to buy their fund, look at independent research and select the funds you feel comfortable with and match your own investment requirements – especially when it comes to risk/reward ratio.

| The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on graham@mbmg-international.com |