The US Dollar is particularly strong at the moment – especially against emerging markets currencies. Whilst currency exchange tends to ebb and flow like any other market, this may just be more than a short-term trend.

Just like stock-picking, playing the short-term markets has never been an interest of mine. I’ve always found it a risky business that not even a seasoned trader can rationalize. So when currency markets sway one way or the other on a given day, I take note merely to see if a pattern is emerging.

With that in mind, the last recent months have seen the US Dollar become increasingly strong in exchange for currencies in emerging markets. For example, in August two years ago a single greenback would buy you 31 Thai Baht; nowadays you’ll get close to 35 THB.

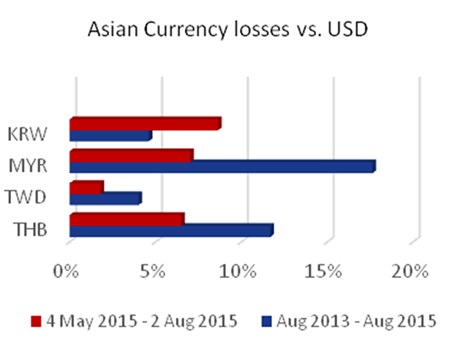

Chart 1 Source: Oanda

Chart 1 Source: Oanda

This is no flash-in-the-pan – these drops in value have been consistent and prolonged. Asian emerging market currencies, compared with August 2013, reveal the extent of the USD’s strength (see chart 1). In fact, the last three months alone have seen huge shifts for the Thai Baht (6.49% down), Malaysian Ringgit (7.02%) and Korean Won (8.64%).

Apart from making a meal out and a shopping spree in Thailand even cheaper for my American friends, this prolonged strength has opened up other opportunities.

On a macro scale, emerging market economies become more competitive in such situations, as their exports are cheaper once translated into USD. For corporate and private investors, this can also be a time to invest in the likes of Thailand, Korea and Taiwan; be it in tangible items, such as property, or in anticipating the local currency to get stronger at a later date.

However, the length of the Dollar’s strength is making governments nervous, as they worry prolonged weakness against the greenback will provoke inflation.1 Given that the US and other major economies have extremely low levels of inflation themselves, price rises in emerging market economies could deter foreign investment from entering into the country.

The timing couldn’t be worse: global growth is decelerating – the US economy contracted by 0.7% year-on-year in Q1 20152 and growth in China – the world’s second largest economy – is slowing,3 whilst its government is trying everything (in vain) to control the economy and markets.4

Future prospects don’t look that good for emerging markets either. US Federal Reserve Chair Janet Yellen has stated that she expects the Fed to raise its base interest rate this September5 – the rate has been close to zero for almost seven years. This move could attract global investors who were staying out of low-yield America, for apparently higher-risk, higher-yield emerging markets.6

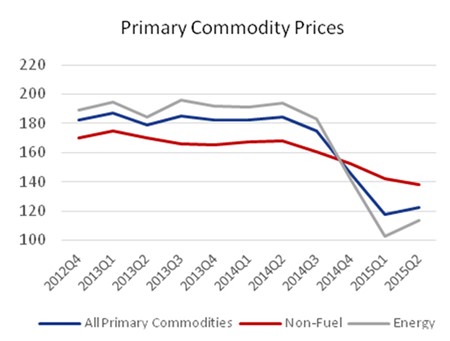

Added to that, commodity prices, which have helped emerging-market economies in recent years, have been on the slide for several months (see chart 2). The slowdown in China, a major buyer of commodities7, has exacerbated this bleak outlook.

Chart 2 Index: 2005=100 Source: IMF Commodity Market Monthly, July 2015

Chart 2 Index: 2005=100 Source: IMF Commodity Market Monthly, July 2015

Of course, like other markets, nothing is forever. Asian emerging market currencies may seem like they are in free-fall against the US Dollar now but the Korean Won and Taiwanese New Dollar are in fact at similar levels to five years ago.

Outside of Asia, governments are intervening to try and correct the slide of their currencies. Mexico, South Africa and Turkey have either increased interest rates or announced an end to quantitative easing. Inadvertently, that could well stave off the threat of debt deflation in itself and move towards a brighter economic future;8 yet it may also redress the balance with the USD.

Having said that, it would be wrong for governments and central banks to concentrate purely on the exchange rate with the US Dollar. The US is still the world’s largest national economy in terms of nominal GDP9, so its currency cannot be ignored; yet it’s also important to get a sense of perspective by looking at neighbouring trading partners’ currencies.

Chart 3 Source: Oanda

Chart 3 Source: Oanda

The Thai Baht has been week of late vis-à-vis the Ringgit and Filipino Peso. As with the USD value, rather than merely looking at the currency charts, it’s important to examine the economy as a whole if we are to understand the long-term perspective. In June, the Bank of Thailand lowered its forecast for the country’s 2015 growth from 3.8% to 3% flat.10 However, as I mentioned recently,11 I believe Thailand has better economic fundamentals than Malaysia or the Philippines and that in the longer term it looks better placed. That said, a currency roller coaster ride could be on the cards. A short-term reversal of the stronger Dollar is a distinct possibility; yet any form of liquidity or market crisis could see a dramatic return to far greater Dollar strength than we’ve seen lately. That could come before calm ultimately descends and the Baht makes a sustained recovery from levels much weaker than today.

As for the USD: not even the Federal Reserve can accurately predict what will happen – despite its belief to the contrary.12 The eventual rise in the base interest rate may attract investment in the short term but, like quantitative easing, the move may prove to be merely a walking stick for stock and currency markets rather than full rehabilitation. After all, a strong currency should not be confused with a strong economy – people want Dollars for a variety of different reasons.

In fact, a strong Dollar may prevent US growth. On the back of the stock market crash in China and concerted attempts by Chinese policy makers to weaken the RMB (“widen the band”), the USD recently took a sharp rise in value against the RMB. It’s too early to say whether this will last. If it does, it’s worth noting that a bit less than 20% of US imports come from China.13 Thus a strong Dollar vs. RMB won’t help move the American economy from its bear minimum rate of inflation or its stagnant levels of economic activity – which is exactly what needs to happen for the US economy to avoid ‘turning Japanese’, as Steve Keen – my colleague at IDEA Economics – puts it.14

Footnotes:

1 http://www.bloomberg.com/news/articles/2015-07-31/

angst-levels-rise-as-emerging-market-currency-dive-gathers-steam

2 http://blogs.wsj.com/briefly/2015/05/29/why-u-s-gdp-shrank-at-a-glance/

3 http://www.wsj.com/articles/china-first-quarter-growth-

slowest-in-six-years-at-7-1429064535

4 http://www.mbmg-investment.com/in-the-media/inthemedia/54

5 http://www.bloomberg.com/news/articles/2015-07-31/

angst-levels-rise-as-emerging-market-currency-dive-gathers-steam

6 ibid

7 http://www.businessinsider.com/r-china-becomes-

worlds-top-crude-buyer-despite-economy-stuttering-2015-5

8 See Steve Keen’s 2015 Outlook, for further details see www.ideaeconomics.org

9 IMF World Economic Outlook, April 2015

10 http://www.aseanbriefing.com/news/2015/06/26/thailand

economic-growth-to-be-curtailed-in-2015-2016-to-be-brighter.html

11 http://www.mbmg-investment.com/in-the-media/inthemedia/54

12 http://www.zerohedge.com/news/2015-05-25/ron-paul-

rages-janet-yellen-right-she-can%E2%80%99t-predict-future

13 US Census Bureau, 2013

14 Steve Keen’s 2015 Outlook, IDEA Economics, www.ideaeconomics.org

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |