Once again it’s the time when finance experts try to make predictions for the new year.

Global economy is turning Japanese

The global economic backdrop in 2015 remains a debt deflation. This means that private debt reaches levels where further expansion is simply not sustainable; and the reductions in levels of debt and rates of debt-increase act to constrain spending. This leads to economic weakness, falling asset prices and vicious circles. Presently this is being largely masked by artificially stimulated unsustainable asset bubbles.

This is the situation Japan has been in for the last 25 years. The 1980s saw private debt rise to nosebleed levels, then came the 1989 crisis, followed by private debt to GDP continuing to rise – largely as a result of contracting GDP. For the last, lost 2 decades, private debt has been slowly edging down.

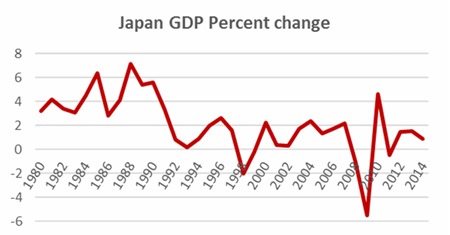

Debt expansion was a period of strong GDP growth and the period of debt reduction has been a period of anaemic often negative GDP growth (see chart 1).

Chart 1 – Source: IMF

Chart 1 – Source: IMF

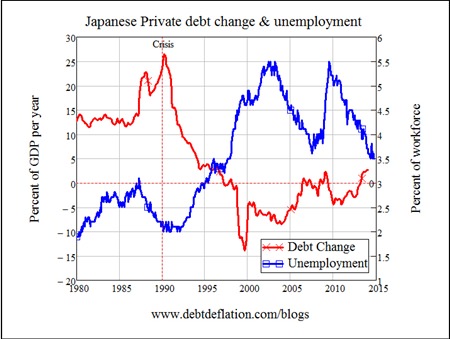

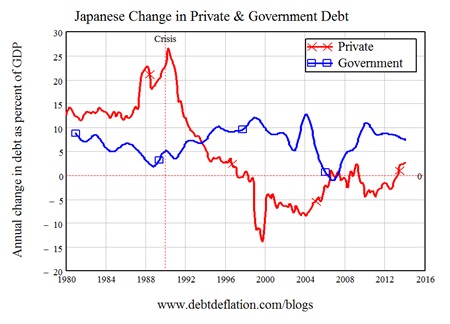

The real key is to compare the GDP variations in chart 1 with changes in private debt shown in charts 2 & 3.

Chart 2

Chart 2

Chart 3

Chart 3

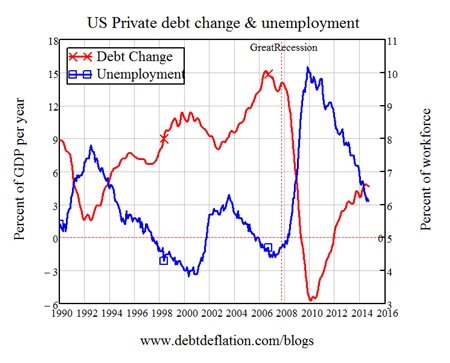

Nowadays, Japan seems once again to be heading into recession. Following similar policies, other developed economies seem to be on the same track; an observation which recently prompted Professor Steve Keen, the Chief Economist of IDEA Economics, where I sit on the Advisory Board, to issue his 2015 Outlook1, whose main theme is that America seems to be turning Japanese (see chart 4).

Chart 4

Chart 4

To avoid this scenario, Central Banks need to avoid the same policy prescriptions and stimulus solutions attempted by Japan over the last quarter of a century.

However, most of them seem reluctant to let go of quantitative easing (QE) and austerity, which only delays the inevitable re-set. Until then, for capital markets and for asset prices, central bank policies remain the only game in town.

Thailand

For Thai capital markets the same 3 challenges identified last year by the Bank of Thailand’s Monetary Policy Committee2 remain as headwinds:

• Political stability

• International trade

• Private debt levels

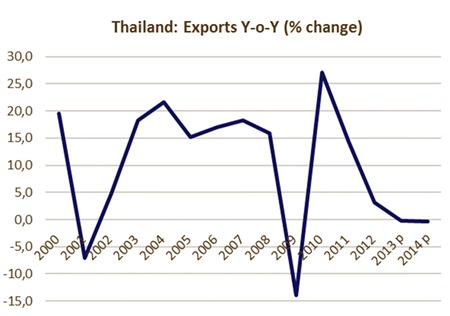

Political stability is always unpredictable, especially in Thailand today. Trade is a much clearer, although not brighter, picture: exports continue to trend down in a weak global backdrop (see chart 5).

Chart 5 – Source: Bank of Thailand

Chart 5 – Source: Bank of Thailand

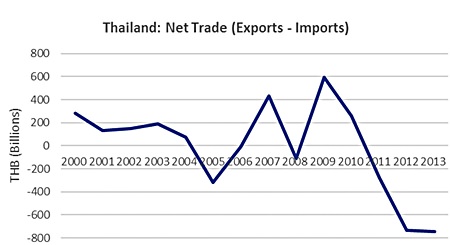

Added to that, the balance of trade looks ominous, bearing in mind its contribution to Thailand’s strong current account. Invisible earnings, such as tourism, seem to be facing understandable headwinds, also increasing the overall balance of payments and current account risks (see chart 6).

Chart 6 – Source: Bank of Thailand

Chart 6 – Source: Bank of Thailand

This is especially a concern as one other bright spot for Thai trade, export growth in the neighbouring LVMC3 countries, may not be able to maintain its previous trajectory.

The idea of increased domestic demand compensating the softer export market has to counter higher consumer debt. Household debt is high and has been the fastest rising in the region – this seems to be unsustainable in its existing form; although the worst levels are at the lowest income groups, and thus require smaller absolute amounts to negate. Any significant improvement in income for households earning below THB 9,000 per month (around US$ 276) would help to improve this ratio, but incomes need a boost.

The Government has approved THB 3.3 trn (US$ 101 bn) of infrastructure projects, which could have both primary and secondary benefits for Thailand (trickle-down into the lowest income sector). If, or when, this happens then, in addition to the direct investment flow and related private-sector opportunities (e.g. in materials, construction, finance), indirect investment flows to consumers would also benefit.

However, it’s far from certain when these disbursements will be effected. The stagger of spending is significant and the delay before the secondary impact is felt means it has to happen quickly to have effect in 2015.

Without this, the aggregate picture would be looking pretty gloomy (not to say that there wouldn’t be very specific opportunities within certain sectors or stocks).

Effects of the AEC

I’m very sceptical of the argument that the inauguration of the ASEAN Economic Community (AEC) will have any noticeable impact in 2015. It will be a long process, and in comparison to the readiness of European Union single market in 1992, ASEAN has a lot to do. Unlike the EU, it does not have a parliament, watchdog or dispute resolution system in place.

The Baht

There are a number of factors that will lead to support for the Baht and others that will drive the Thai currency lower. The Baht will strengthen when:

* It becomes apparent G7 interest rates won’t rise;

* There are periods of ongoing political stability and calm;

* The successful infrastructure disbursement is executed.

* G7 governments and central banks resort to further stimulus measures.

Conversely, Baht will weaken when:

* There are any indications that the BoT may cut interest rates;

* During any political or legitimacy crisis;

* When capital outflows take place ahead of taxation reforms.

Overall, it’s highly likely that we could see swings of +/- 5-10% through the year.

Capital Markets

Ultimately the Thai capital markets are hostage to the rest of the world – leaving the SET and risk assets especially vulnerable to exogenous shocks this year. Thailand is both a cork bobbing uncontrollably in a wide ocean and very much dependent on the domestic story.

Footnotes:

1 http://www.ideaecono mics.org/blog/2015/1/13/

steve-keens-2015-outlook

2 http://www.bot.or.th/Thai /MonetaryPolicy/

Documents/MPC_Minutes_42014.pdf

3 Laos, Vietnam, Myanmar and Cambodia

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |