In Mid-August Thailand’s National Economic and Social Development Board published GDP figures for the 2nd quarter of 20161 – and they were impressive.

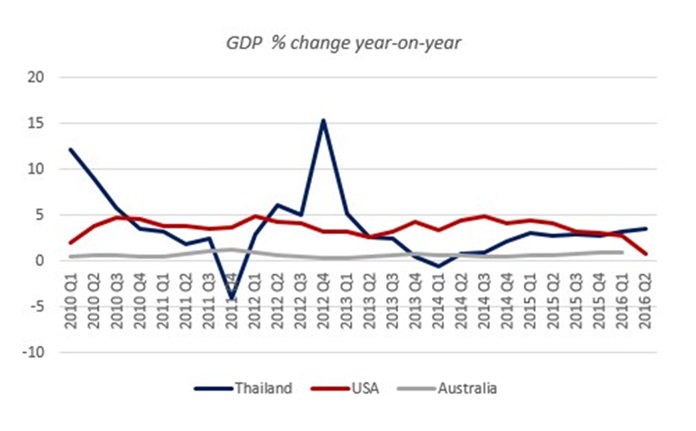

The Land of Smiles’ production was up 3.5% on Q2 of last year, following on from a year-on-year increase of 3.2% in Q1. This is particularly indicative of the strength of Thailand’s economy for two reasons: its performance in comparison with major economies; and because the country has an export-oriented economy.

For almost two years, production has been increasing at a faster rate than Australia and has recently begun to outperform the US (see chart 1).

Exports account for over 69% of the GDP (2014 figures2). The country mainly exports manufactured goods (86% of total shipments) – particularly electronics (14%) and vehicles (13%). Agricultural goods, mainly rice and rubber, represent 8% of the export market.3 The kingdom’s major export partners are China (12%), Japan (10%), the United States (10%) and the European Union (9.5%), machinery and equipment (7.5%) and foodstuffs (7.5%) being the most important.4

In this poor global trade environment, Thai exports have suffered, like those of most other nations. Exports from Thailand decreased slightly by 0.1% year-on-year to USD18,150 million in June of 2016 (but not as bad as market expectations of a 2.02% decline) following a 4.40% drop in May, marking the third straight month of year-on-year falls. Outbound shipments shrank to China (-11.9%), followed by Japan (-3.8%). However, in contrast, exports were up to the US (+4.7%) and Europe (+0.9%).

From January to June 2016, exports increased by 5.8% in terms of price and 5.2% in value compared with the first half of 2015 (see chart 2). Although this was somewhat to do with currency values: for example, the Baht, in the first half of this year, was 6.4% stronger in H1 2016 than in H1 2015.5 In fact the volume of exports in H1 2016 was in fact slightly down (0.1%) on H1 2015 (see chart 2).

Thai Exports

Exports in Thailand averaged USD9,648.32 Million from 1991 until 2016, reaching an all-time high of USD21,227.12 million in August of 2011 and a record low of USD1,997 million in February of 1991.6 Although, when looking at this 25-year period we have to take into account that Baht values have fluctuated some 116% over this time.7

So against a very difficult multi-year backdrop, that worsened significantly during H2 last year when China’s slowdown started to have a greater impact,8 exports seem to have stabilised; yet they remain vulnerable and this puts pressure on the other drivers.

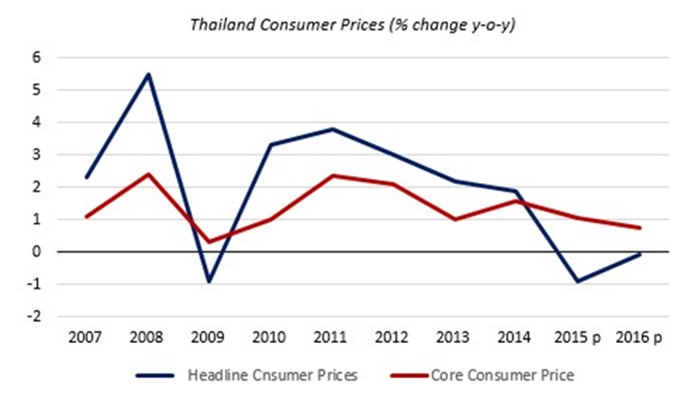

Also the results are very impressive in view of Thai disinflation – there’s very little inflation component to the GDP growth. It’s much more akin to ‘real’ growth.

What’s more, the consumption component of GDP is also challenged – high consumer debt, especially in the lowest income quintile9 and also the lowest incomes facing headwinds because of this year’s drought conditions10 (remember around 42% of the Thai workforce is still in agriculture11) declined, so consumption contribution to GDP remains difficult and lower consumption12 and weak exports also constrain the private investment component of GDP.

The two bright spots had been tourism and the public sector investment and expenditures. Although the stability expected following the referendum should be seen as a positive towards enabling the NESDB’s revised annual target of 3%-3.5% growth13 – which given that Thailand is currently experiencing deflation, is a real challenge. It should also allow the government to continue to focus on implementation of its infrastructure plan without too many distractions. However, the news of attacks in tourist areas that have left several people dead and scores injured since mid-August could be a real challenge to the tourism component unless this can be shaken off quite quickly. If not, that would be further pressure on public sector investment to raise GDP. Whilst the NESDB claims that the explosions are unlikely to affect economic growth,14 it’s far too early to know or even predict.

On the bright side, the acceptance of the new constitution through the referendum, clears the path to implement a lot of the investment. The fear was that with a negative referendum result, there would have been distractions to the implementation of the investment plan.

That said, I agree with Kasikorn Bank director and head of market & economic research Kobsidthi Silpachai’s analysis when he said that, now we have made the step towards a new constitution, in the coming sixteen months leading up to an eventual general election in Thailand, the economy will probably continue to have the same kind of economic activity dependency on both government spending and tourism.15

That dependency on two main variables means, despite the relatively good results, we cannot too carried away.

Footnotes:

1 http://www.nesdb.go.th/nesdb_th/ewt_dl_link.php?nid=5169

2 World Bank

3 TradingEconomics.com, August 2016

4 idem

5 OANDA.com

6 NESDB

7 OANDA.com

8 http://www.bangkokpost.com/learning/work/915645/china-slowdown-effect-on-thailand-until-2017

9 https://www.bot.or.th/Thai/MonetaryPolicy/ArticleAnd Research/SymposiumDocument/Paper4_2557.pdf

11 World Bank

12 Thailand: consumption the weak link DBS Group Research 25 January, 2016

13 http://www.oxfordbusinessgroup.com/news/thai-economy-looks-strong-first-quarter-results

15 http://video.cnbc.com/gallery/?video=3000541135

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |