It’s fair to say that the Eurozone is in a bit of a mess. The European Central Bank’s answer to this so far has been to push austerity measures1 and introduce quantitative easing (QE).2 In January, before the programme had even begun, renowned QE expert, the University of Southampton’s Prof. Richard Werner, wrote that it was a huge mistake.3 Looking at the latest figures,4 it looks like he’s been proved right.

You may have noticed from previous articles that I’m not a big fan of QE. The US Federal Reserve used the mass bond-buying tool between November 2008 and October 2014 to stimulate the US economy.5 It was regarded as the biggest emergency stimulus package in history and added over USD 3.5 trillion to the Fed’s balance sheet.6

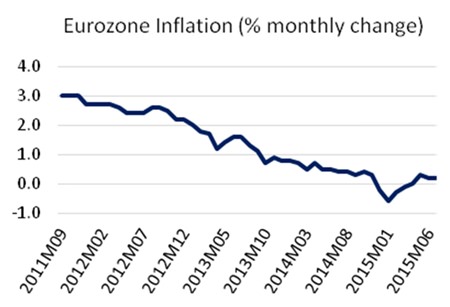

Chart 1 Source: Eurostat.

Chart 1 Source: Eurostat.

To put that number into some form of perspective, that’s roughly the size of the entire German economy7; or if it were converted into real money and distributed evenly amongst US mortgage-holders, each would receive a cheque for USD 73,312.8

The fact that the Fed still feels it necessary to keep continue its now 7-year-old emergency base interest rate of 0.25%9 shows that all that bond buying by the central bank hasn’t worked. Added to that, research so far shows that, whilst America’s bottom 90% (in terms of wealth) has seen average prosperity in a trough since 2009; the richest 1%, however, is now back to where it was in 2006.10

Chart 2 Source: Eurostat.

Chart 2 Source: Eurostat.

In spite of this pretty convincing evidence, the European Central Bank decided to implement its own QE programme (officially called the Public Sector Purchasing Programme – PSPP) as of March this year. This form of QE is what Professor Werner calls a “misguided narrow-track version proposed by the Bank of Japan” and “will fit into that sequence of policy disasters.”11

The problem is that buying bonds at an increased rate will likely keep long-term bond yields at a very low rate, for a long time. That’s because the ECB’s base interest rate (0.05%) is practically zero – as is the case in the US (0.25%) and Japan (0%).12 This yield curve is therefore being flattened, so European banks aren’t motivated to increase lending, which doesn’t help the economy grow and thus defeats the objective of QE in the first place.

This isn’t merely speculation on what may happen: we have already seen this with Japan: it’s been going on for two decades.13 In fact it was Prof. Werner who, back in 1995, proposed QE as a means of helping Japan out of its slump. However, he pointed out that reverse expansion on its own wouldn’t help – it would instead require expansion in back credit creation for GDP transactions by stopping issuing bonds and entering into individual loan contracts.14 That would start a “sharp and sustainable recovery”15 – just what the Eurozone could do with right now.

The ECB hasn’t done that, however. It has continued on its usual path of encouraging boom-bust cycles, crises and recessions. In fact, the Eurozone’s latest monthly figures (see charts 1 & 2) point to this: once again unemployment remains stubbornly high – above 10% since September 2009 – and inflation is dangerously low – September’s estimate is actually a deflation of 0.1%.16

Chart 3 – Debt ratios of households and non-financial corporations (debt as % of GDP)

* Outstanding amount of loans, debt securities, trade credits and pension scheme liabilities

** Outstanding amount of loan liabilities Source: ECB

In spite of some deleveraging, there is still a debt bubble ready to burst in the Eurozone. Thus, with no increase on income to buy goods and no evolution on profit made on those goods, we’re looking at a static economy, with the ECB throwing vast amounts at buying bonds to enable banks to lend and to see if something will stick.

Prof. Werner actually warned about these boom-bust cycles in his book Princes of the Yen in 2003. Yet the ECB is merely continuing to follow the trail blazed by Japan – which has experienced two decades of depression.17 Richard Werner claims that this is because, when it was created in 1998, the ECB wasn’t modelled on the accountable and highly successful Bundesbank,18 but more like the old Reichsbank. He describes the latter as “the world’s least accountable, most independent and powerful – as well as the most disastrous central bank.”19

You can read more from Prof. Werner on his website https://professorwerner. wordpress.com/ and on Twitter @professorwerner

Footnotes:

1 http://www.theguardian.com/business/2014/oct/01/

austerity-eurozone-disaster-joseph-stiglitz

2 https://www.ecb.europa.eu/press/pr/date/2015/html/pr150122_1.en.html

3 Prof. Richard Werner, ECB is about to implement the wrong type of quantitative easing,

http://theconversation.com/ecb-is-about-to-implement-

the-wrong-type-of-quantitative-easing-36543

4 Eurostat

5 http://www.bankrate.com/finance/federal-reserve/financial-crisis-timeline.aspx

6 http://www.bloombergview.com/quicktake/federal-reserve-quantitative-easing-tape

7 ibid

8 QE figure: http://www.bloombergview.com/quicktake/federal-reserve-

quantitative-easing-tape, mortgage owners figure: US Census Bureau

9 http://www.mbmg-investment.com/in-the-media/inthemedia/61

10 http://blogs.lse.ac.uk/usappblog/2014/10/29/the-explosion-in-u-s-

wealth-inequality-has-been-fuelled-by-stagnant-wages-

increasing-debt-and-a-collapse-in-asset-values-for-the-middle-classes/

11 Prof. Richard Werner, ECB is about to implement the wrong type of quantitative easing,

http://theconversation.com/ecb-is-about-to-implement-

the-wrong-type-of-quantitative-easing-36543

12 Federal Reserve, Bank of Japan & ECB

13 http://www.ideaeconomics.org/blog/2015/1/13/steve-keens-2015-outlook

14 http://www.sciencedirect.com/science/article/pii/S0261560614001132

15 Prof. Richard Werner, ECB is about to implement the wrong type of quantitative easing

16 Eurostat

17 Steve Keen’s 2015 Economic Outlook, IDEA Economics www.ideaeconomics.org

18 ibid

19 http://eprints.soton.ac.uk/367252/

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |