It’s an asylum run by the inmates

– Ernest Borgnine, on Hollywood

Here we go again! The hints are there but whether the decision-makers at the Federal Reserve will actually raise their base interest rate up from the minimal 0.25%1 remains to be seen. Despite all the conflicting opinions and data, they may stay put again.

Whenever the Federal Open Market Committee (FOMC) announces its latest decision on interest rates, it sounds increasingly like a cigarette chain-smoker talking to a doctor. It makes well-intentioned declarations that it wants to quit minimal rates but puts the actual reality off until next time.

This has been going on since March, initially leading commentators to believe that the Fed rate would go up in June.2 Then, in May, Fed Chair Janet Yellen admitted that this wasn’t going to happen but hinted it would do sometime later in the year.3 I thought that, by the September meeting, all this commotion had led the Fed to talk itself into a corner, whereby it would have to raise some rates to take the pressure off; even if it were an increase in some less-significant measure – like increasing the Interest on Excessive Reserves rate – rather than the actual Fed base rate.4

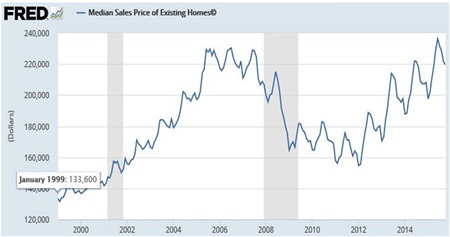

Source: US National Association of Realtors.

Source: US National Association of Realtors.

Instead the FOMC decided to stick with the emergency levels (some emergency after nearly seven years!), citing “recent global economic and financial developments”5 – in other words, concern about the faltering Chinese economy. Then came the late October and – yes, you guessed it – the status quo was maintained with the Fed’s official statement more-or-less saying “We’ll quit next year, honest.” The exact wording suggested it was still waiting for those all-important employment and inflations statistics: “In determining whether it will be appropriate to raise the target range at its next meeting, the committee will assess progress – both realized and expected – toward its objectives of maximum employment and 2% inflation.”6

But, hang on. Why are unemployment and inflation the only two determinants? Added to that, is it even realistic to raise inflation by following up a quantitative easing programme with a zero interest-rate policy? After all, that’s exactly what the Bank of Japan did, leading the Japanese economy into a debt-deflation cycle it has yet to emerge from, some 25 years on.7

For me, one really useful indicator is the sector which played a major role in starting off the global financial crisis in the first place – property. It paints a revealing picture of the state of the US economy because it shows the public taste for taking on debt to buy more. After all, the low interest rates are designed to encourage people to consume, thus kick-starting the economy.8

The problem is that US housing market charts show one good period for house prices, followed by a bad period. Since 2008, the regular seasonal peaks and troughs have become more and more exaggerated each year (see chart 1). Consequently, despite the Fed trying to help, real estate in the US looks like facing far greater headwinds than seem to be realised.

To be continued…

Footnotes:

1 Federal Reserve

2 http://www.businessinsider.com/federal-

reserve-window-to-raise-rates-2015-4

3 http://www.wsj.com/articles/yellen-says-fed-on-

track-to-raise-rates-this-year-1432314091

4 http://www.mbmg-investment.com/in-the-media/inthemedia/60

5 http://www.theguardian.com/business/2015/sep/24/janet-y

ellen-expects-federal-reserve-raise-interest-rates-by-end-of-year

6 http://www.reuters.com/article/2015/10/29/us-usa-fed-

idUSKCN0SM0BJ20151029#mDh9Qd0l6PhdOVqx.99

7 Steve Keen’s 2015 Outlook, IDEA Economics http://www.ideaeconomics.org/

8 http://www.bankofengland.co.uk/monetarypolicy/pages/how.aspx

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |