We’ve just passed the 85th anniversary of Black Tuesday, the pinnacle of the Wall Street Crash, when 16 million shares were traded in one day. Have economists, central banks and governments learnt anything from these events and the aftermath of the 2008 crisis? Economist Prof. Steve Keen thinks not and is concerned about a long-term recession.

According to the US Secretary to the Treasury, “The high tide of prosperity will continue.”1 Yet the German economy is showing signs of weakness, seeing its hard-earned prosperity dwindle because of external economic circumstances and obligations it wished it hadn’t signed up for. Meanwhile, France is evaluating its role in a European Union and in Spain there is discontent amongst academics and businessmen alike over government spending. As Southeast Asian countries attempt to further modernize their economies, there is deadly conflict in Jerusalem and Afghanistan.

The above is a selective summary of events in 1929; although it could easily be used to describe the state of the world over the last five years. One of the many consequences of Black Tuesday was the soaring in US private debt, which in the years following the 1929 crash reached 130% of GDP. That remained a record level until 2009, when it topped 175% of GDP.2

US Generic Government 10-Year Bond Yield (Sept 24-Oct 24, 2014)

Source: Bloomberg

Source: Bloomberg

Prof. Steve Keen is head of the School of Economics, History and Politics at Kingston University, London and a leading advocate of the school of thought that debt, and changes in debt, determine outcomes in economies and markets. He sees the level and growth of private debt as the root explanation for both financial crises:

“A rising level of private debt compared to income ultimately gets to the stage that it is such a burden that, first of all, credit-fuelled growth stops growing because people don’t want to take on any more debt, and secondly, the servicing costs of the debt can overwhelm the economy. That’s what I saw back in 2005. That’s why I said a financial crisis was coming in the very near future.”3

Keen observes that, since 2008, no enduring stability has been created; instead there is another accident waiting to happen, probably in the next 1-4 years. That said, he thinks that this is likely to be just another recession in a long-term cycle of going nowhere for the next couple of decades.4

As a matter of fact, just two weeks ago the 10-year US Treasury Bond yield dropped so quickly (see chart) that one bank’s representatives elected to switch off its computers which automatically generated buy and sell quotes, for fear of losses and being left with unwanted stock.5

Speaking on Bloomberg Surveillance,6 LPL Financials Fixed Income strategist Anthony Valeri saw this as “Eye-catching to say the least”, and said that it spoke to the illiquidity in the market. “We knew that corporate markets were on the illiquid side,” he said, “but to see those types of moves in the Treasury market, which we hadn’t seen an intra-day move like that since the fall of 2008. […] It just shows that some of these moves can be exacerbated to the up or the downside. In 2013 we saw it to the high side, and here in 2014 we saw it to the low side.”

According to Valeri, analysts are giving up on their forecasts, “3% annual yield on 10-year bonds isn’t going to happen in 2014. They are lowering it by consensus to around 2.5%.” Valeri says that yields will be probably be within in the 2.0-2.3% range to the end of the year.

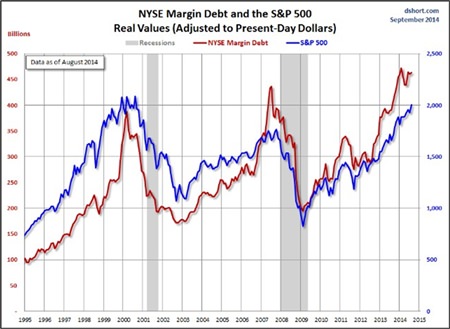

Marginal debt is at an all-time high (see chart) and last week, a drop in the markets may once again have exposed some fragility: there were rumours that at least one hedge fund was forced to liquidate.

All this comes while the Federal Open Market Committee7 carries on regardless, in the mistaken belief that the Fed’s QE money-creation policy is actually working.

Footnotes:

1 Andrew W. Mellon, Secretary of the Treasury, September 1929, as quoted in John Kenneth Galbraith (1954), The Great Crash 1929, Mariner Books; Reprint edition (September 10, 2009)

2 Crash, Boom, Pop! Economics and the Financial Crisis come to Comics, IDEA Economics Press Release, October 23, 2014

3 idem

4 WTF – What the Future holds, MBMG Update, November 5, 2013

5 http://www.bloomberg. com/news/2014-10-26/treasury-liquidity-squeeze-seen-in-dealer-who-shut- off-machine.html

6 Bloomberg Surveillance, October 23, 2014

7 http://www.federalreserve .gov/newsevents/press/monetary/20140917a.htm

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Private Equity Services, Corporate Services, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |