As things stand now, it might seem that there is no light at the end of the tunnel – in investment terms at any rate. American government debt has been downgraded, the euro zone is about to go into its second recession in five years, the US’s fragile recovery is in serious danger of stalling and China’s transition to a more balanced, consumption-led economy is more than challenging its double-digit growth history. Given this environment, why would anybody want to buy equities? After all, globally equities lost 40% in 2008, and whilst this has been recovered to a large degree, it has taken five years to do so! Japan has never even come close to revisiting the heady heights of the Nikkei in 1989. This option does not really seem like a great source of stable, inflation beating returns does it?

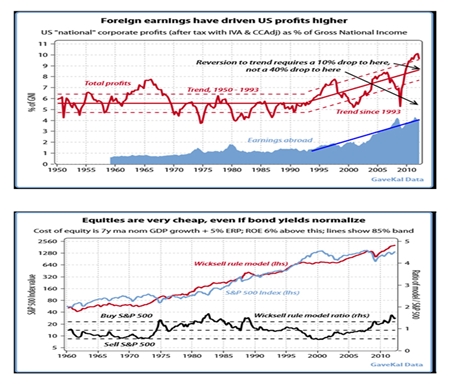

However, there are actually some very compelling arguments for holding equities right now (or rather, more accurately, holding US equities) – at least for the short to medium term. One of MitonOptimal’s research providers – Gavekal – recently put out a piece that makes a persuasive case for this particular asset class. Their conclusions are based on the old-school approach of valuing a company by discounting its future earnings at an appropriately risk adjusted rate. They argued that companies are actually in a very strong space right now. Their profit margins, and consequently their returns on equity (ROE), are extremely high and the low interest rate environment means the fair value of the S&P 500 is more than double its current level (3200 vs 1331).

Source: Gavekal, June 2012

Source: Gavekal, June 2012

Not everyone is convinced, “That’s naïve!” scoff those that disagree. They believe that, “Profit margins must revert to trend and current rates are in a bubble – they must also increase to offer real returns at some point in time.”

The Gavekal authors agree about both points but identify firstly that the internationalization, to emerging markets, of earnings of the S&P firms has put it onto a positive trend and so the downwards revision is in the order of 10%, not 40%. Secondly, whilst a reversion of government bond yields to long run averages of GDP growth (the Wicksell rule) will lead to a reduction in the fair value estimate to 2064 that is still about 55% above the current levels. If both happen, the fair value estimate is 1660 – still 24% higher than current levels.

Has this theory worked in the past? Back testing of the eight buy-signals since 1960 based on the Wicksell rule shows that equities have generated annualized average returns of between 17% and 19% over the one, three and five year periods following the buy decision. It does seem to work.

Does this want us to run out and buy more equities? Not really. We get the point that equities are cheap right now, but also believe that they will not revert to the mean immediately. There is a lot of bad news depressing their price and whilst it will go away eventually, it won’t do so immediately.

We continue to hold equities, although these holdings have been cut recently. When we deem the time is right for our risk level to go back to 5 (the neutral position), or even higher, we will boost these exposures and ride the wave that should be coming.

| The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on graham@mbmg-international.com |