Ron Cartey, Chief Business Development Officer with 3TNetwork Company, shared some insightful information with the Pattaya City Expats Club at their December 9 meeting. Ron usually provides consultancy advice to corporations and individuals that wish to either expand their current operations or have a desire to expand their personal portfolio. Ron has a successful international consultancy career including over twenty-five years’ experience as a professional international speaker and leadership coach plus an extensive corporate experience linked to his current business development expertise in the crypto space and Forex markets.

His topic was “How Not to be Separated from Your Money” with tips on money management, including some pitfalls and solutions. He said that much of what he will share relates to his personal experiences and will be governed by two principles: (1) What you don’t use, you lose and (2) Listen to the professionals. Further, that they both apply to “health” and “wealth”. Although he did not spend much time on “health”, he did emphasize that one should get off the couch and embrace life’s storms. For “wealth”, he said to embrace the inner entrepreneur in you and give it your best.

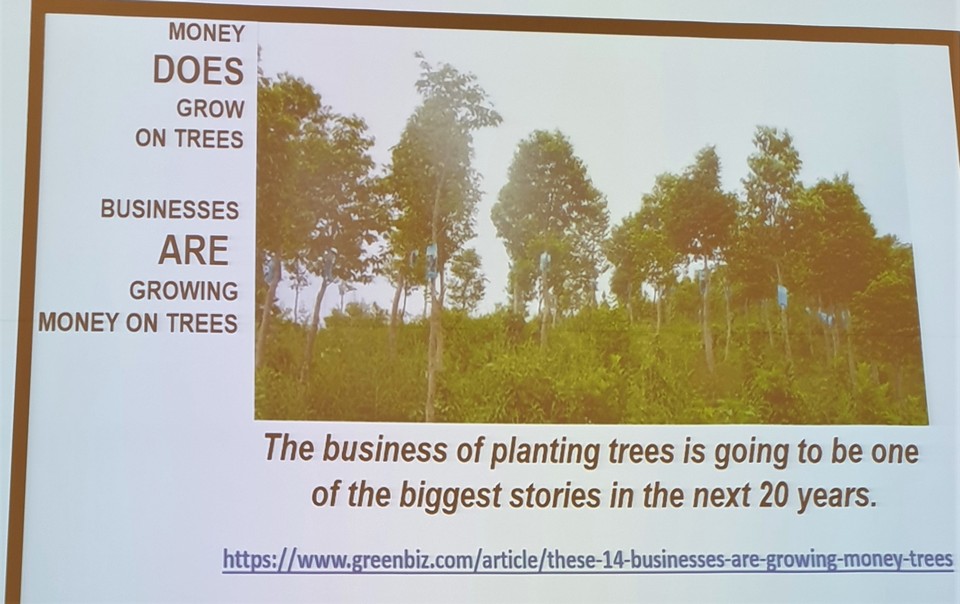

He asked, what can you do with money? The answer: you can spend, save, give, or invest it. He recommends investing because if you’re not growing it, it’s shrinking. Further, investing helps to cover the effects of inflation, increase in the cost of living, and unexpected events. Doing so also provides for a stress-free retirement.

He then mentioned the different uses for money. These included meeting basic living expenses, meeting those needed for your lifestyle, covering retirement, and speculative. The latter being what is available for investing. But he mentioned there are pitfalls, which is one reason you use speculative money. He said to be careful, but not fearful. In a rush to make some investments, there is the danger of falling into traps. Ron then provided some red flags you need to watch for as they are most likely scams to separate you from your money.

Red Flag 1 – “Common to hear of opportunities that promise a daily or monthly rate of return. The allure of overnight riches is a tantalizing proposition for anyone, and that can foster an impulsive motivation to participate in such schemes.” Ron noted that every investment carries some degree of risk, which is reflected in the rate of return you can expect to receive. The general rule of thumb is that it is close to impossible to generate consistent returns. Offering fixed returns requires a constant revenue source, so unless a product or service is sold to substantiate their revenues, the only way to sustain high, guaranteed profit rates is through new members. Ron said the best thing to do when you hear claims of “Earn a fixed amount of returns daily!” is RUN!

Red Flag 2 – Send Money Now! Scam artists often tell their victims that this is a once-in-a-lifetime offer and it will be gone tomorrow. Ron recommended you avoid such entreaties – don’t let sudden impulse take over. So, you should resist the pressure to invest quickly and take the time you need to investigate before investing money. At this point, he told how he lost US$10,000 because he didn’t follow this advice and let a “colleague” talk him into investing immediately.

Red Flag 3 – Flowery Language – An investment will make “Incredible Gains,” it is a “Breakout Stock Pick” or has “Huge Upside & Almost No Risk!” Ron said claims like these are hallmarks of extreme risk or outright fraud.

Red Flag 4 – Join as a customer and buy $XX, then enroll personally 3 customers, then upgrade buying the xxxxxxxx Pack for $XX. This is most likely a Ponzi scheme. When new funding/investor slows down – the scheme collapses.

He provided this link for information about common scams: https://www.usa.gov/common-scams-frauds

Ron followed these red flags with some advice on how to invest your money wisely. He mentioned that the general rules for investing are: (1) Only use “learning money” – money that you can “live without;” (2) look and learn as it can be very lucrative so long as people know how to go about it, and (3) those who invest in the right way, with the right help and guidance, will get good returns.

He then listed three methods in how to invest; by one’s own efforts such as trying to make money in the market, or by joining enthusiastic amateurs to make money in strong markets, or using competent professionals to make money in all markets. He then listed the pluses and minuses of each method. His advice was to “use the professionals” because they combine expertise with recorded history. But, in doing so, for your own safety and security, be sure you control how your money is invested.

After the presentation, MC Les Edmonds brought everyone up to date on latest events followed by Brian Maxey conducting the Open Forum, where attendees can make comments or ask questions about expat living in Thailand, especially Pattaya.

For more information visit the PCEC’s website at https://pcec.club/

To view a video of the presentation, visit: How not to be separated from your money