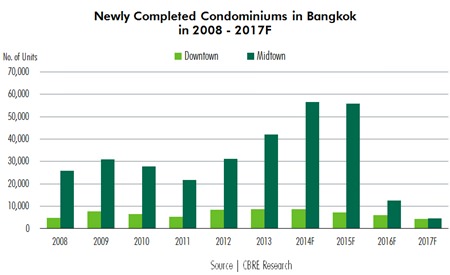

Authorities and commentators may have shown a recent concern about oversupply in the Bangkok condominium market, but leading property management and advisory company CBRE Thailand believes that the Central Business District (CBD) condominium market in Bangkok is in a very different situation to the midtown and suburban areas.

Their findings indicate a limited new supply in the core downtown markets of Sukhumvit, Lumpini, Sathorn, Phayathai and the Riverside. There are just over 100,000 completed condominium units in these areas and a further 26,000 units under construction due to be completed over the next three years. The total existing and new supply in the core downtown market accounts for less than 20% of the total condominium supply in Bangkok.

“There is very little built-but-unsold inventory of developers in completed buildings. For example, several years ago the owner of two towers at Millennium Residence was selling the remaining units at a discounted rate. These have all been sold and now we see more buyers than sellers for units in this project,” said Pornpimol Phuengkhuankhan, Head of Residential Sales Services Ad Hoc of CBRE Thailand. “This is typical of the situation in many of the best quality, most sought after condominiums where CBRE sees few units being offered for resale,” she added.

Despite the political turmoil in the first half of 2014, there have been record-breaking land transactions in the centre of Bangkok. For instance, it was reported that Q House, a public listed property developer, paid a price of between 1.7 – 1.8 million baht per square wah for a 3 rai (4,800 square metres) site on the corner of Sukhumvit Soi 6 to build a luxury condominium.

Rising land prices mean that any new condominium development will be more expensive than past projects. This should will help push up prices in the best completed buildings.

Bangkok is a complicated market and prices for existing condominium projects are not just determined by location. Each building has its own individual market dynamics based on age, quality of design, specification, number of units being offered for sale and popularity among tenants, making the building attractive to buy-to-rent investors. The result is that prices for buildings in similar locations can be very different.

In some locations, CBRE has seen examples of vendors struggling to sell units in a twenty-year old building at more than 50,000 baht per square metre while owners of units in more recently completed buildings less than 100 metres away are selling at over 130,000 baht per square metre.

Expatriate rents are also rising for the first time in over twenty years because of the rising number of foreigners working in Bangkok. Many foreign tenants want to rent two and three-bedroom units and the supply of two and three-bedroom apartment (single ownership) and condominium (multi-ownership ) buildings is not growing. Only 2% of the condominiums under construction in the downtown area will be three-bedroom units.

As rents increase, sale prices for those condominiums most popular with expatriate tenants will also rise, especially in an environment where there are low rates of return on other investments. Few banks are offering interest rates better than 2% per annum on one-year time deposits and property offers a better yield together with the possibility of capital appreciation.

“Anyone expecting condominium prices to fall in the downtown area due to the political turmoil is likely to be disappointed and there is more chance of pricing rising rather than falling,” concluded James Pitchon, Executive Director of CBRE Thailand.