Office rents have spiked for the first time ever in the history of Bangkok to over THB 1,000 per square metre per month, according to leading international property consultant CBRE Thailand. Although the new record high was, for now, only a single transaction and for a fully furnished office, this is indicative of the rapid improvement in Bangkok’s office market in the last quarter of 2012.

The two leading grade A buildings, Park Ventures Ecoplex and Sathorn Square, are now close to full. Although space is still available at both properties today, users requiring larger spaces are close to making binding commitments, which will take occupancy at both buildings to well above 90%, possibly filling all the remaining space.

An artist’s impression of the AIA Capital Center, a 35 storey Grade A office tower due for completion in 2014.

An artist’s impression of the AIA Capital Center, a 35 storey Grade A office tower due for completion in 2014.

This changes the dynamics of the office market and, for large tenants seeking contiguous floors in modern grade A buildings, space can now only be taken as a result of future vacancies. More significantly, landlords are not under pressure at this time to agree to concessions or to negotiate discounts for individual tenants as they are not critical to their overall income stream. In fact, many landlords will be raising rents on renewals in line with the latest open market rents.

Out of the 26 buildings in the Bangkok’s central business district (CBD) that CBRE classifies as being grade A, eleven are already 100% occupied and the rest are nearly all at least 90% occupied.

“Lack of choice and limited availability of space are also becoming pronounced factors in the market and we have the following advice to give office tenants,” said David Simister, Chairman of CBRE Thailand.

Looking two to three years ahead, there will be a further round of prime grade A projects developed. Bhiraj Tower, a grade A office development with 47,000 square metres of lettable area, located on Sukhumvit Road opposite the Emporium with direct connection to the BTS Promphong station will be completed in 2014. AIA Sathorn Tower, a grade A office building with 38,500 square metres of lettable space will be completed in 2015. AIA Capital Center, a grade A office development with 54,000 square metres of lettable area, located on Ratchadapisek Road, close to the MRT Thai Cultural Center station will be completed in 2014. G Land Tower a grade A office development with 65,000 square metres of lettable area, located at the corner of Ratchadapisek -Rama IX Roads will be completed in 2014.

However, these new projects are all just starting construction, so they will offer no immediate relief to the limited supply for at least the next 24 months. During that time, CBRE predicts that CBD rents will continue to increase and demand will increase due to companies expanding and new entrants to the market – all of which will mean that rents will only move in one direction

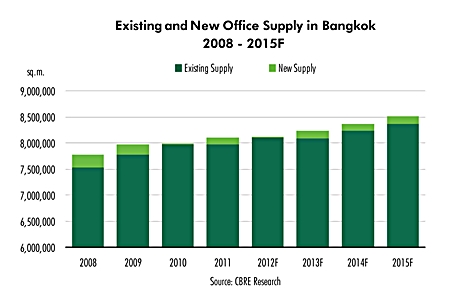

Existing and new office supply in Bangkok.

Existing and new office supply in Bangkok.

“Therefore, tenants seeking to renew leases, expand or relocate would do well to address their needs as soon as possible. Alternatively, they need to come up with a strategy to seek early-bird deals at the new office stock that is scheduled to come on stream from late 2014 onwards,” concluded Nithipat Tongpun, Executive Director and Head of Office Services at CBRE Thailand.

(Source CBRE Thailand Ltd.)