Bangkok office rents have seen little change since 2009, but are now starting to rise and have topped the last peak which was 20 years ago.

Park Ventures, the recently completed Grade-A eco office building on the corner of Wireless Road and Ploenchit with direct access to the BTS, is now achieving rents of over THB 850/square metre/month. The last building to achieve this level of rent was GPF Tower, (then Diethelm Tower), on Wireless Road when it was completed in 1992.

James Pitchon, Executive Director of CBRE Thailand believes rentals will continue to increase for the best quality best located buildings. This is backed up by CBRE Research.

Park Ventures office building in Bangkok.

Park Ventures office building in Bangkok.

“The total Bangkok office stock is 8.12 million square metres of which 1.15 million square metres or 14.13% is vacant, but a significant amount of the vacant space is in buildings that are in less popular locations and older buildings that are in some cases technically obsolete.”

“There is only 390,000 square metres under construction due for completion by the end of 2014. Demand is starting to increase, vacancy rates will fall and rents will rise.”

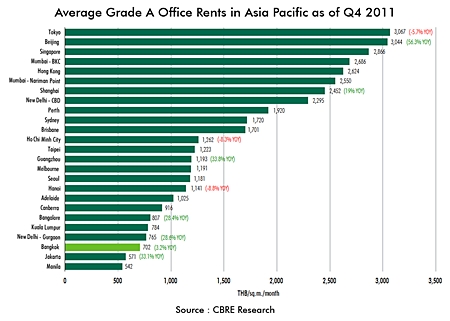

Bangkok office rents have been among the lowest in the Asia Pacific Region along with Wellington, Manila and Jakarta. Grade-A rents in Hong Kong are 7.5 times more expensive than Bangkok, while Singapore and Mumbai are four times more expensive. Regionally, some of these office markets appear to have peaked and are now falling such as Hong Kong, Singapore and Kuala Lumpur.

Rents in Vietnam both in Ho Chi Minh City and Hanoi continue to fall because of the troubled economy and new supply. However, Vietnamese office rents still remain between 60% – 80% more expensive than Bangkok. Conversely, office rents are rising in Bangkok, Manila, Jakarta and most Australian cities.

“Current rental levels in Bangkok make it difficult to build new office projects unless the land has been acquired at below today’s prices. We will only see developers start to build offices when the rent rises above THB 1,000/square metre/month which is why there is only a limited amount of space under construction,” said Pitchon. Also, few listed developers have office expertise, having focused exclusively on residential condos.

CBRE Thailand expects that the rental gap between the best located and best quality buildings and other less attractive developments will start to increase. The highest Grade-A CBD rent is THB 850/square metre/month and the cheapest Grade-B non-CBD rent is around THB 400/square metre/month. This is a very small spread in rentals compared to other cities.

CBRE believes that tenants are increasingly willing to pay a higher rent for the best located buildings that function well.

Office tenants in Bangkok base their choice of office premises on three main criteria- location, especially proximity to mass transit routes, utility i.e. usability and quality of the building, and cost. More companies are treating proximity to a mass transit station, preferably with direct covered access, as a priority. Office buildings next to mass transit stations are getting higher rents than other buildings and will continue to do so.

The usability of the building combines a number of factors, particularly the shape of the floor and floor plate. The most efficient and well laid out offices require column free floors with a window to core depth of 12 to 15 metres and ceiling heights of more than 2.8 metres. This allows tenants complete flexibility in their layout and allows them to accommodate more people in less space while maintaining a good workplace environment.

Average Grade A Office Rents in Asia Pacific as of Q4 2011.

Average Grade A Office Rents in Asia Pacific as of Q4 2011.

Tenants want efficient lifts to minimize waiting times – one of the biggest complaints about old buildings is that the lifts are slow and it can take minutes not seconds to enter a lift at peak times. An efficient air-conditioning system that can maintain a constant temperature in all areas of the office is also important; the air-conditioning systems in many older buildings cannot do this.

Other features are the provision of good security features such as fire safety, turnstiles and destination control lifts. Currently, the new generation of office buildings in Bangkok such as Park Ventures and Sathorn Square are as good in terms of technical specifications as many of the Grade-A developments in Hong Kong, Singapore and Tokyo, but the rentals are a fraction of the costs in these cities.

Cost continues to be a critical determining factor but companies need to balance cost against providing an efficient and attractive work space. Companies are willing to pay for the best location and utility, which is why coupled to the supply and demand situation, CBRE believes that rents will continue to rise notably for the best located best quality buildings.