The condominium market in Pattaya has remained relatively strong over the last six months, following the solid performance of the previous year, according to a new report issued by property management services company Knight Frank Thailand.

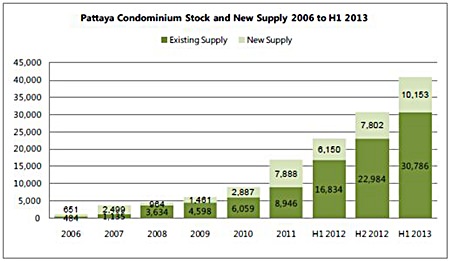

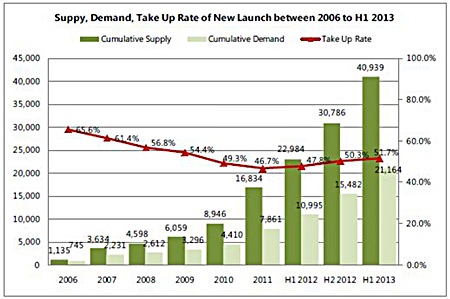

The additional supply has amounted to around 10,153 units, making up a total supply of 40,939 units as of H1 2013. The take-up rate in all locations increased to 51.7% from 50.3% in the second half of last year. The average selling price of high-rise units was particularly higher than those in a low-rise building; this is because high-rise buildings boast sea view premiums.

Indications show no slowing down for Pattaya’s burgeoning condominium market.

Indications show no slowing down for Pattaya’s burgeoning condominium market.

The Pratumnak area in south Pattaya recorded the highest average selling price during 1H 2013 at around THB 96,286 per square metre. Among other locations, new low-rise projects in Jomtien commanded the highest prices due to their good facilities and amenities.

Pattaya Condominium Stock and New Supply 2006 to H1 2013.

Pattaya Condominium Stock and New Supply 2006 to H1 2013.

Pattaya has become one of the most desirable seaside locations, says the report. It is easily accessible to major destinations in Asia, supported by the government’s infrastructure investments, including the upgrade of U-Tapao Airport’s capacity to five million passengers per annum, as well as the planned high-speed rail link connecting Bangkok to Pattaya, which will help drive traffic to the resort city. In addition, Pattaya has also become an international business hub for the impending ASEAN community, attracting investors from overseas. Also, the number of international and local tourists has been increasing steadily.

Supply Trend

There were approximately 40,939 condominium units in the Pattaya condo market as of mid-2013. This new supply included about 10,153 condominium units from 20 projects that were introduced to the market during the first half of 2013 – an increase by 32.9% since the end of 2012.

Supply, Demand, Take-up Rate of New Launches between 2006 to H1 2013.

Supply, Demand, Take-up Rate of New Launches between 2006 to H1 2013.

This year, there are many listed developers entering and developing condominium projects in the Pattaya market, including SC Asset PLC., Sansiri PLC., Supalai PLC., Quality Houses PLC., and NC Housing PLC. NC Housing, Supalai and Sansiri have developed projects in north Pattaya, whereas Quality Houses and SC Asset have developed projects in south Pattaya. All of these new projects are quite a distance to the beach; however, the developed areas are quite convenient as they are located in close proximity to many of the city’s facilities and amenities. Four of the five listed developers have developed high-rise condominium projects; only NC Housing has chosen to pursue a low-rise project.

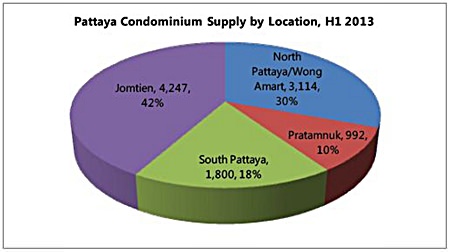

The majority of new supply added during the first half of this year was concentrated in the Jomtien area, with about 42% of the total new supply. The largest-scale condominium project was Seven Seas Condo Resort Jomtien. Located on a large 15-rai plot of land on Soi Chaiyapruk, just 350 metres from the beach, the project consists of eight low-rise buildings of eight floors each, with a total of 1,450 units.

Pattaya Condominium Supply by Location, H1 2013.

Pattaya Condominium Supply by Location, H1 2013.

The north Pattaya/Wongamart area attained the second-most popular slot, with a total number of new launches at around 3,114 units or about 30% of the total new launches. This area is considered a peaceful location favoured by Thai condominium buyers. It is also quite a new area for condominium development for both local and Bangkok-based condominium developers. The largest condominium project in this area was Supalai Mare@Pattaya, a 35-storey high-rise with 1,154 units.

The total number of new launches in south Pattaya was 1,800 units, or 18% of the total new launches. The south Pattaya area is considered to be a busy location due to its many shopping malls, restaurants, and entertainment spots. It is thus more crowded and not as attractive for residential development as other areas; the total number of new launches in Pratumnak accounted for only 992 units, or 10% of the total new launches.

Demand Trend

The demand of Pattaya condominium units as of the end H1 2013 totaled 21,614 units, representing a take-up rate of 51.7%. This take-up rate increased in H1 2013, from just 50.3% by the end of 2012.

There were approximately 5,682 units sold during the first half of 2013. The demand was high in the budget condominium segment, where the selling price was in the range of THB 1 million to THB 2 million per unit for compact unit sizes of around 25 to 30 square metres. The buyers are predominantly Thais working in the Eastern Seaboard, Bangkokians who desire a second seaside home, and Russians who want an escape from the winter in their home country.

Pricing Trend

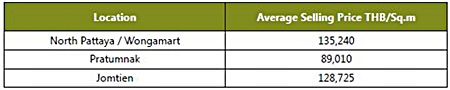

The selling prices of condominiums in Pattaya vary according to location and views. There are some high-rise projects located further from the beach that still boast sea views. The highest selling price was in north Pattaya, an area favoured by Thais who reside principally in Bangkok. Most of the condominium projects in this area located near the beach, providing sea views, sold for over THB 130,000 per square metre. Other projects in north Pattaya, with no sea views, sold in the range of THB 55,108 to THB 71,250 per square metre.

Most sea view projects being launched during the first half of 2013 were located in the Jomtien and Pratumnak areas. The selling price of newly launched sea view condominiums in Jomtien was in the range of THB 91,372 to THB 140,000 per square metre. The average selling price in Pratumnak increased from THB 77,610 per square metre in 2012 to THB 89,010 per square metre in H1 2013.

Outlook

The report concludes by saying that Pattaya has a promising future as a key market for Thai condominium development. It is riding on the property boom, adding 1,890 new residential units that are scheduled to launch during the third quarter of 2013.

Average Selling Price per Sq.m. of Sea View Condominium in Pattaya, H1 2013.

Average Selling Price per Sq.m. of Sea View Condominium in Pattaya, H1 2013.

Emerging locations from Jomtien to Na Jomtien are set to be major development sites, driven by a myriad of factors that give the area a number of advantages over other locations in Pattaya; these factors include improving road connections of a second road that runs parallel to Jomtien Beach Road for about 400 metres, and many new attractions such as the Jomtien market; two water parks – Ramayana, the biggest water park in Southeast Asia and Cartoon Network Amazone, which are due to open later this year; and the Grand Kingdom shopping mall, that will draw families with young children and shoppers to this area.

There will be new demand for Pattaya condominiums from local Thai buyers, particularly for projects located in north Pattaya/Wongamart, due to the many restaurants, retail outlets, and shopping malls that are already in place. The more tranquil condominium projects situated in Jomtien are very popular for visitors from Russia and Scandinavia who are looking for affordable condominium units in this holiday destination as a second or vacation home.

(Source: Knight Frank Thailand)