Hua Hin inland area is now a key focus for developers due to increasing land costs in the coastal areas according to a property report on the Hua Hin residential market by Colliers International Thailand.

Supply overhang in Hua Hin inland risks being exacerbated by an influx of new supply over the coming years. Good quality developments can overcome this challenge.

This photo shows a property at the Banyan Village and Golf Resort in Hua Hin. (Photo/Banyan Hua Hin)

This photo shows a property at the Banyan Village and Golf Resort in Hua Hin. (Photo/Banyan Hua Hin)

Retirement communities could be an important niche for the market in the coming years due to retiring babyboomers from Europe and an increasingly aging Thai population. Hua Hin’s mountainous location close to the sea is a compelling one.

The growth of new retailing centres in Hua Hin means the district is becoming ever more popular for visitors and Cha Am risks being left out of the tourist rush due to the lack of attractions and a centre.

Condominiums represent by far the main source of supply in the Hua Hin – Cha Am – Pranburi area. Landed development only really took off in 2006 after developers looked at land away from the coast and into the hillsides targeting the foreign market for villas and affordable second homes for Thais. Coastal locations have always been most sought after and therefore high land prices mean that condominiums become the most feasible option.

As land prices increased in the coastal areas after the recovery from the Asian Financial Crisis, developers looked elsewhere for suitable land and hence the growth of the inland areas of Hua Hin. Either these were in the less attractive lowland areas catering to lower income buyers or in the hills often with a sea view that were in the higher priced brackets and targeted European buyers.

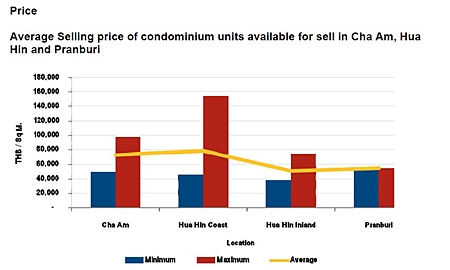

The average selling price in the Hua Hin Coast area is the highest at more than THB 78,000 per sq m., although the maximum selling price in the area is approximately 150,000 per sq m and the minimum price starts at THB 46,000 per sq m. Cha Am records a similar average figure as many of the projects are located closer to the sea than in Hua Hin and in close proximity to the centre. Hua Hin Inland has lower prices due to its distance from the coast and the less well known developers while the remoteness of Pranburi accounts for the lower prices in that district.

The average selling price in the Hua Hin Coast area is the highest at more than THB 78,000 per sq m., although the maximum selling price in the area is approximately 150,000 per sq m and the minimum price starts at THB 46,000 per sq m. Cha Am records a similar average figure as many of the projects are located closer to the sea than in Hua Hin and in close proximity to the centre. Hua Hin Inland has lower prices due to its distance from the coast and the less well known developers while the remoteness of Pranburi accounts for the lower prices in that district.

Are “Little Switzerlands” a thing of the past?

It sounded like a recipe for success. Develop a villa development on land in the hills above the coast of Hua Hin and target one nationality. Hence “Little Swedens and Germanys were created which allowed for easy communication through a common language and a feeling of togetherness.

The reality is somewhat different according to Antony Picon, Associate Director of Research at Colliers International Thailand. “These communities are somewhat isolated and residents’ social lives can often be limited to a small group of people and personality clashes result”, he said.

Picon pointed out that within the communities there can be peer pressure to act the same way like they do in their own countries. “People choose to live away from their home country for many reasons and escaping from the confines of their home country is one of them but they end up out of the frying pan into the fire”, he added.

In fact high net worth individuals tend to gravitate towards multinational projects even into retirement. Picon believes that such buyers are normally very international in perspective and comfortable in more than one language. “They are more than happy living with people from different nationalities due to their previous cosmopolitan lifestyle and this enhances their experience of living in such communities”, he pointed out.

With such nationality based developments starting to be out of favour, residents find it tough reselling their units. “It would be difficult selling a unit in little Sweden to someone outside that country for example”, Picon added.

Ghost towns and construction sites

The image of a villa in a pleasant community in the mountains overlooking the coast of Hua Hin might be a picture of paradise. However this image can be put sharply out of focus due to phasing of the project and the neglect of a proper rental system according to Antony Picon.

The first problem relates ironically to an event that happened far away in Phuket in 2004. “After the tsunami that ravaged the island many developers turned their attention to alternatives, especially Samui and Hua Hin”, said Picon. This led to much land acquisition and the launching of new projects including villa developments in the hillsides. However Phuket bounced back, western currencies fell and Lehman Brothers happened.

“This pulled the rug under the market and developers were left with a mix of completed and partly constructed units and plenty of unsold land”, Picon said.

The market has picked up and people are buying again but not to the same degree. There Picon is concerned with the livability of various projects. “The market is likely to simmer for some years and so you are likely to see ongoing construction within projects for some time to come. What this means is that an occupier of a villa will have the vision of his “paradise” home being surrounded by rebar, cement and construction workers for the foreseeable future”, he warned.

Some developers are also focusing too much attention on sales and construction with rental programmes being an afterthought and this could spell problems in the future according to Picon. “The main concern is that buyers do not put their units into a rental programme and then only visit their properties for a few weeks a year in many cases”, Picon explained. When many buyers act in a similar fashion then for most of the time the development will be deserted.

Picon pointed out that for any resident or renter who remains this can be a depressing experience. “They like to be in a quiet and peaceful environment but not a deserted one and the atmosphere can become eerie and such a ghost town effect will create a vicious circle with the remaining residents packing their bags”, he added.

Picon suggested a proper rental programme is put in place from the start and buyers urged to take this up or even in some cases buyers having only the option of a pooling system with a time limit put on their own use of the property. Another option is for a certain number of units to be retained by the developer or an investor for rental purposes only.

The Scandinavian connection in Hua Hin

The district of Hua Hin is particularly attractive to Scandinavian visitors accounting for nearly 44% of foreign hotel guests in 2010. Also in terms of residential purchases this group accounts for the biggest market although interestingly Sweden, Norway and Denmark represent a significant buying market but not Finland, despite recording the highest number of visitors out of the four countries.

There are a number of reasons for the connection according to Patima Jeerapaet, Managing Director of Colliers International Thailand. “Scandinavian travel operators were particularly active in Hua Hin in the 1990’s and the Swedish monarch Carl XVI Gustaf makes regular visits to Hua Hin thus cementing a strong bond between the two countries” he said.

In general Scandinavians tend to be more family orientated but independent minded and also prefer the outdoor lifestyle. “This is what could lead them to Hua Hin rather than the other more commercial resorts in Thailand” added Patima.

As a result not only are many Scandinavians purchasing property in Hua Hin but also a number of developers hail from the region. The social security systems in these countries allow for generous retirement provisions and this will mean that many of the retiring babyboomers in Scandinavia will have the capital to buy a second home in order to escape the Arctic winter weather. (Source Colliers International Thailand).