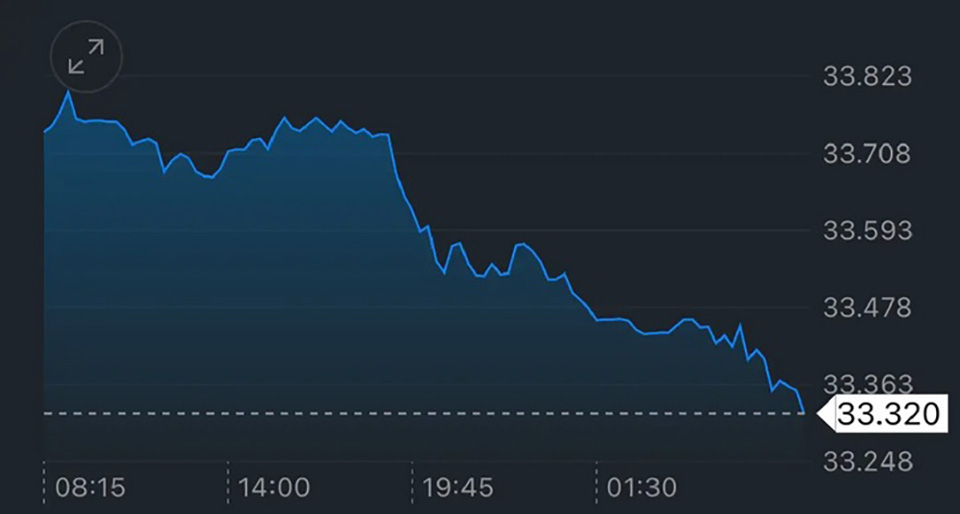

BANGKOK, Thailand – The Thai baht opened stronger on September 13 at 33.40 per US dollar, up from the previous day’s close of 33.75. Krungthai Global Markets strategist, Poon Panichpibul, attributes the baht’s appreciation to a weaker dollar following underwhelming US production data. Market sentiment now anticipates that the Federal Reserve (Fed) may accelerate interest rate cuts both this year and next.

Poon noted that the baht’s trading range is expected to be between 33.25 and 33.50 per dollar, though he warns of potential volatility as the market digests key US economic reports.

Dollar Weakness and Euro Strength: Since last night, the baht has consistently strengthened, breaching the 33.50 per dollar support level. This comes as the dollar depreciated following lower-than-expected US Producer Price Index (PPI) data for August. The report has fueled market expectations that the Fed could speed up rate cuts in the near future.

In addition, the euro (EUR) has also strengthened after the European Central Bank (ECB) lowered its deposit facility rate to 3.50%, as expected. However, the ECB did not signal a clear intention to continue cutting rates, leading markets to believe the ECB may not be as aggressive as the Fed in rate reductions.

Gold Sales and Market Influence: The stronger baht was further supported by profit-taking in gold markets. Gold prices hit a new all-time high, driven by the dollar’s depreciation and increased purchases from Commodity Trading Advisors (CTAs) using trend-following strategies. This profit-taking in gold has bolstered the baht’s value.

Baht Outlook: Poon acknowledged that the baht’s recent strength contradicts earlier technical predictions of a potential weakening trend. With gold prices breaking through resistance levels and setting new records, the baht’s appreciation may continue, but the market could still be overestimating the pace of Fed rate cuts. There is a risk that market participants might have to reassess their expectations next week if the Fed’s new Dot Plot does not align with hopes for accelerated rate cuts. This could cause the dollar and US 10-year bond yields to rise, which would likely pressure both gold prices and the baht.

Technically, despite the recent appreciation, the daily chart of USD/THB shows a bullish divergence in the RSI indicator. However, MACD and Stochastic indicators suggest the baht could continue to strengthen in the short term, possibly stabilizing around 33.30 before gradually weakening. Much will depend on the outcome of the upcoming Fed meeting.

Short-Term Factors and Risks: During the day, the baht may continue to strengthen, supported by global market risk-on sentiment and further gold profit-taking. However, some demand for the dollar from importers and commodity transactions, such as oil purchases, could slow the baht’s appreciation.

Volatility is expected after US economic data is released, including consumer confidence and inflation expectations reports. These could influence market perceptions of future Fed rate decisions and trigger dollar movement.

Overall, Poon emphasized that the baht is likely to remain volatile, responding to changing factors such as shifts in Fed interest rate expectations or adjustments in dollar holdings. Market participants are advised to use a variety of risk management tools, including options or local currency hedging strategies, to better navigate exchange rate fluctuations.