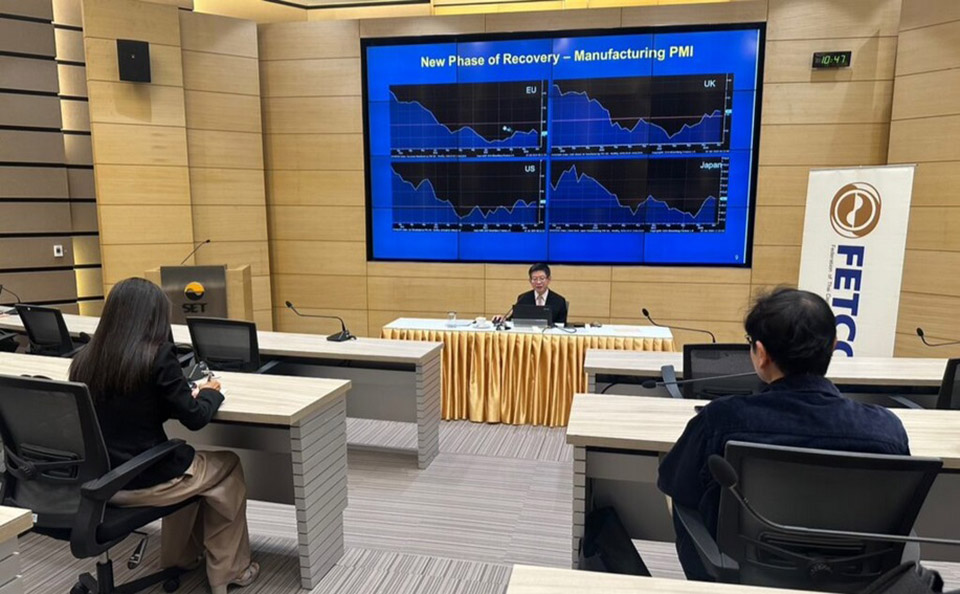

BANGKOK, Thailand – The Federation of Thai Capital Market Organizations (FETCO) has reported a rise in investor confidence, driven by government stimulus measures and signs of economic recovery, September 9. However, concerns about political instability and domestic economic downturns remain key factors dampening investor sentiment. FETCO Chairman, Kobsak Phutrakul, indicated that the Digital Wallet initiative for vulnerable groups could stimulate the economy in the short term.

In August 2024, FETCO’s Investor Confidence Index reached 132.51, entering the “hot” zone. This surge was primarily due to government economic stimulus measures, including clearer political developments and a recovering domestic economy. The index revealed growing confidence across all investor groups, particularly among individual investors, where confidence surged by 73.6% to 144.26.

The stock market (SET Index) experienced volatility in early August, dipping below 1,300 points due to political uncertainty, despite positive news of Thailand’s GDP growth of 2.3% in Q2/2024, fueled by tourism, private consumption, and exports. However, in the latter half of the month, the SET Index recovered after the appointment of Thailand’s 31st Prime Minister and the rollout of a government stimulus plan, including a 10,000-baht digital wallet distribution for vulnerable groups.

By the end of August, the SET Index closed at 1,359.07, up 2.9% from the previous month.

Looking ahead, factors such as the Federal Reserve’s monetary policy and regional geopolitical tensions will be crucial. Domestically, the focus is on the new government’s economic policies, including the 150 billion baht Vayupak Fund and the 60 billion baht ThaiESG Fund, which are expected to inject over 200 billion baht into the market.

Kobsak emphasized that while the Thai economy could grow by 3% this year, the key challenge is maintaining economic policy continuity. The Digital Wallet program for vulnerable groups could provide immediate economic benefits but must be straightforward and efficient. In the long term, investment in technology infrastructure and large-scale projects will be vital for sustained economic growth. Additionally, banks should collaborate with the government to support SMEs and vulnerable groups to ensure broader economic participation. (TNA)