BANGKOK, Thailand -– Krungthai COMPASS, a research unit of Krungthai Bank, has forecasted on August 21 that Thailand’s economy will experience limited growth for the remainder of 2024. The organization highlights potential weakness in private consumption and a slowdown in private investment, while exports continue to face pressure from geopolitical conflicts, trade wars, and competition from Chinese products.

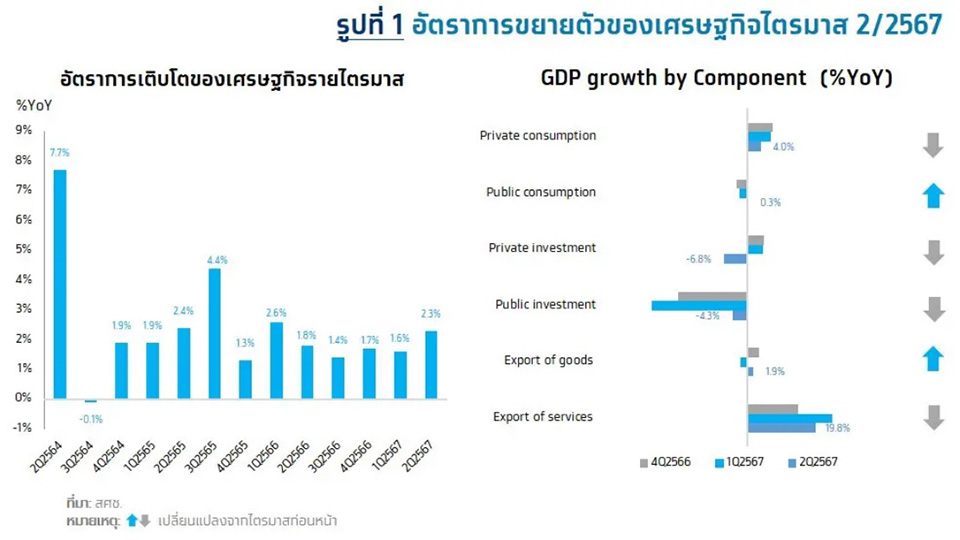

Office of the National Economics and Social Development Council (NESDC) reported that Thailand’s economy grew by 2.3% year-on-year (YoY) in the second quarter of 2024, surpassing analysts’ expectations of 2.1% growth. On a quarter-to-quarter seasonally adjusted basis, growth was recorded at 0.8%. For the first half of the year, GDP expanded by 1.9% YoY. As a result, the NESDC revised its full-year 2024 GDP growth projection to a range of 2.3-2.8% (midpoint at 2.5%), down from its previous estimate of 2.0-3.0% in May.

Krungthai COMPASS views the outlook for Thailand’s economy as fragile. It notes that public consumption and investment have been hampered by delays in the disbursement of the 2024 budget. However, since the beginning of Q3 2024, there have been signs of accelerated government spending, which is expected to become a key driver of economic growth.

Despite this, several challenges remain, particularly in terms of consumption, investment, and exports:

1.Private Consumption: Household consumption may weaken due to high levels of household debt, which are dampening purchasing power. Additionally, consumer confidence has declined, with the Ministry of Commerce’s confidence index in July falling below 50 for the first time in 20 months, indicating a lack of confidence in the economy.

2.Private Investment: Private investment is expected to slow, as businesses face multiple obstacles, including high labor and logistics costs. Structural issues are also hindering competitiveness, causing private investment in Q2 2024 to turn negative for the first time in over two years (10 quarters). Signs of further weakening are evident from declining capital goods imports and a contraction in industrial production.

3.Exports: Thai exports continue to face significant downside risks, including escalating geopolitical tensions and intensifying trade wars, as well as growing competition from Chinese goods. The influx of Chinese products into Thai and ASEAN markets, driven by China’s need to offload surplus production amid geopolitical challenges, has led to a decline in Thailand’s market share in key industries. For example, Thailand’s share of the ASEAN market for electrical appliances dropped from 12.7% in Q1 2023 to 11.5% in Q1 2024, while the share for automobiles fell from 20.9% to 18.7% during the same period.

These factors could negatively impact production, exports, and private investment, potentially stalling the recovery momentum of Thailand’s economy in the coming months. (TNA)