BANGKOK, Thailand – The Federation of Thai Industries (FTI) reported a sharp decline in automobile production and sales for September 2024, affecting both traditional combustion-engine vehicles and electric vehicles (EVs). Total production fell to 122,277 units, a 25.48% decrease, while domestic sales dropped to 39,048 units, marking a 37.11% decrease, the lowest in 53 months. Sales of Battery Electric Vehicles (BEVs) also declined to just 4,574 units, down 33.53%. The industry is now considering adjusting its targets.

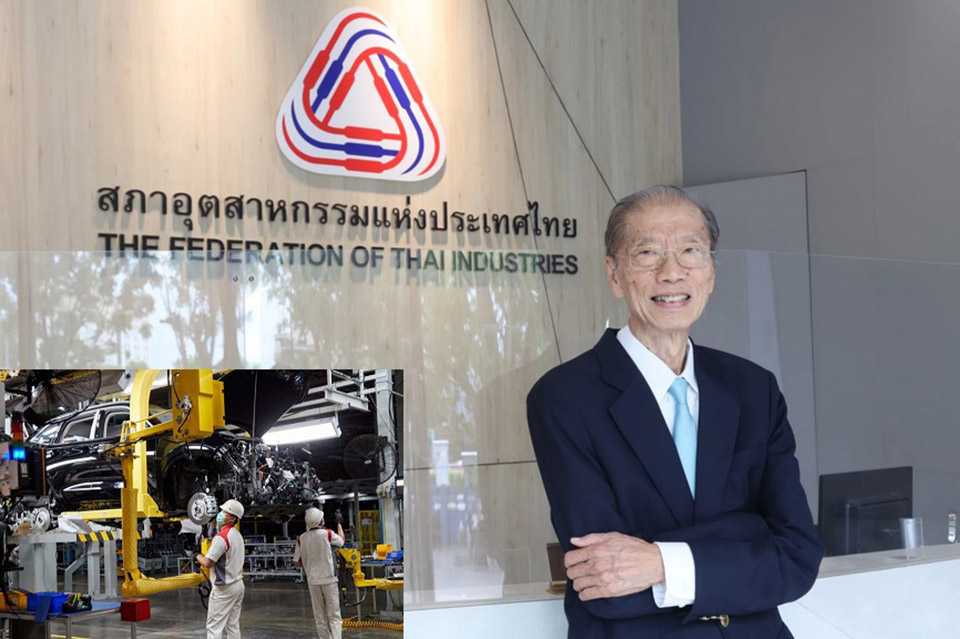

Surapong Paisitpattanapong, Advisor to the President of the Automotive Industry Club and Spokesperson for the FTI’s Automotive Group, on October 24, explained that domestic production, sales, and exports in September were all affected. The total production from January to September 2024 amounted to 1,128,026 units, reflecting an 18.61% drop from the previous year. Specifically, production for export in September reached 87,666 units, accounting for 71.69% of the total output, down by 15.78%. Over the first nine months, export production totaled 774,175 units, a 4.42% decline, while production for domestic sales dropped by 42.31% to 34,611 units.

Domestic vehicle sales in September were the lowest in over four years, decreasing by 13.59% compared to August and by 37.11% year-on-year. This slump was attributed to stricter loan approval processes by banks due to a high level of special mention loans (SM) at 208.575 billion baht and non-performing loans (NPL) at 259.33 billion baht. Additionally, Thailand’s economic growth in Q2 2024 was only 2.3%, and full-year growth is expected to be around 2.7-2.8%. The Manufacturing Production Index (MPI) also contracted by 1.91% in August, indicating weakened consumer purchasing power.

Vehicle exports in September totaled 80,254 units, a 6.75% decrease from August and a 17.67% drop from the previous year. The Middle East conflict, which impacted shipping schedules and reduced consumer spending in key markets, contributed to the export decline. However, exports to Australia saw an increase.

The BEV market also faced a downturn, with 6,606 new registrations in September, down 25.81% year-on-year. Nevertheless, cumulative registrations for the first nine months reached 75,653 units, an 11.67% increase. Plug-in hybrid electric vehicles (PHEVs) saw a 27.76% decline in new registrations, with only 734 units registered in September.

Surapong noted that the industry will meet in November to reassess production and sales targets, potentially reducing the previous export target of 1.15 million units and the domestic sales target of 750,000 units for 2024. Strict lending practices by banks and consumer hesitation over EV pricing, despite falling lithium and battery costs, are expected to influence the decision.

“The high household debt, still at 90% of GDP, is a major concern, and we do not expect it to drop to a healthier level of 80% any time soon. Economic recovery is uncertain, but there is hope for investment growth next year with the Board of Investment (BOI) seeing requests for 700 billion baht in new investments, the highest in a decade. This could drive job creation and reduce household debt, leading to improved credit conditions for auto and real estate markets. However, if bad debts increase and consumer spending remains weak, the manufacturing sector will face continued challenges,” Surapong concluded. (TNA)