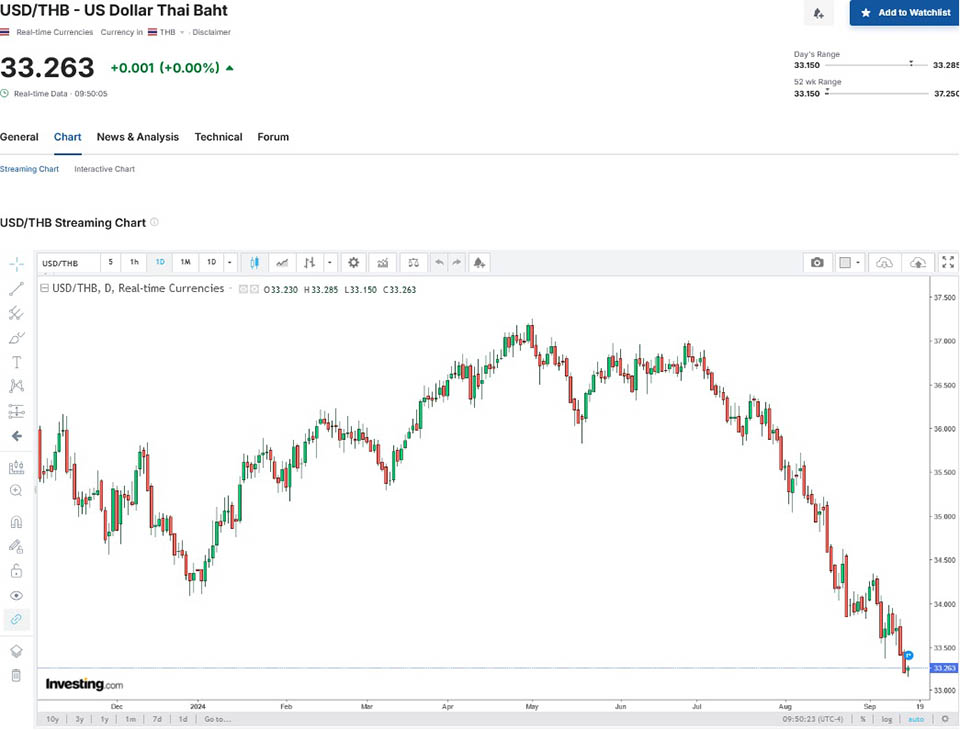

BANGKOK, Thailand – Market Strategist for Krungthai GLOBAL MARKETS, Poon Panichpibool, revealed that the baht opened at 33.21 per dollar, strengthening from the previous week’s close of 33.33 per dollar, September 16. The expected trading range for the baht is 33.10-33.30 per dollar, while the weekly range is projected to be 33.00-34.10 per dollar.

The baht has been gradually appreciating since Friday, moving within the range of 33.20-33.39 per dollar. This strengthening trend follows the weakening of the U.S. dollar, driven by market speculation that the Federal Reserve (Fed) might accelerate interest rate cuts at its upcoming September meeting. This belief has also pushed gold prices to new all-time highs.

Last week, the U.S. dollar weakened after former Fed officials and advisors voiced support for faster rate cuts in the September Federal Open Market Committee (FOMC) meeting.

For this week, Krungthai advises caution as volatility in financial markets may increase due to the upcoming central bank meetings of the Fed, Bank of England (BOE), and Bank of Japan (BOJ).

The baht is expected to weaken if the Fed does not proceed with aggressive rate cuts and the new “Dot Plot” projection does not indicate the sharp cuts anticipated by the market. Investors should closely monitor foreign fund flows, commodity prices—especially gold—and the Chinese yuan (CNY) following China’s recent underwhelming economic data.

As for the U.S. dollar, its movement will depend on the Fed’s monetary policy stance. The dollar could strengthen if the Fed refrains from accelerating rate cuts and signals a cautious approach. However, the dollar might face some pressure if the pound (GBP) and yen (JPY) strengthen, particularly if the BOE avoids cutting rates and the BOJ moves forward with interest rate hikes.

Photo1: The strengthening trend follows the weakening of the U.S. dollar, driven by market speculation that the Federal Reserve (Fed) might accelerate interest rate cuts at its upcoming September meeting.