Bangkok, July 27, 2012 – The Tourism Authority of Thailand (TAT) has carried out a broad-based consumer research study in five key European markets in order to better understand how they perceive Thailand and what “buttons” need to be pressed to maintain visitor flows.

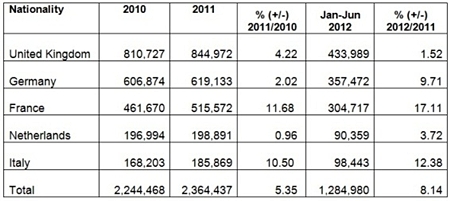

The five markets are the United Kingdom, Germany, France, Italy and the Netherlands. Together they comprised a total of 2,364,437 visitor arrivals in 2011, up 5.35 % over 2010. (See details in chart below)

TAT Governor Suraphon Svetasreni said, “We felt it was time to refresh our own ideas and perceptions of what the new generation of travellers think about Thailand and its desirability as a destination for holidays, business or MICE events. Many things are changing these days, including demographics, technologies and income levels. There is also considerable competition from both new and emerging destinations.

“Although the European markets are generally doing well, and we will maintain a strong marketing presence across Europe, this study was designed to help us better target our future marketing efforts so that we continue to target the right customers with the right product at the right price at the right time. A more targeted approach will help us make cost-effective use of our budgets in these challenging times,” the Governor said.

Focused on new customers from the five countries who have never visited Thailand, the study showed that the awareness levels of Thailand differed from country to country.

Said Mr Suraphon, “The survey was designed to probe details about their intentions to visit Thailand in future, competitive analysis with other destinations, booking patterns, price sensitivity and other such critical decision-making criteria. We found that we can no longer adopt a common strategy across all countries. We need to adopt a specific strategy for each country to reflect on the nature of the population, level of awareness of Thailand, and the unique characteristics of each market.”

For example, it was found that more than half of the survey respondents and interviewees from the United Kingdom, France and Germany know Thailand reasonably well in terms of geographical location and are aware of some of its iconic tourism products such as culture and cuisine. On the other hand, the awareness levels were lower in Italy and Netherlands, especially in terms of the tourism products.

In the UK market, it was found that the cost of travel and Thai cultural heritage are important factors in the decision-making process. Also word-of-mouth marketing was important.

In France, it was found that the awareness levels of Thailand were high and that visitors had a greater propensity to make their own bookings rather than use a travel agent. They also have longer booking periods than the UK market.

In Germany, it was found that China was a more desirable destination in Asia than Thailand. German travellers are also becoming more inclined towards direct-bookings and often plan their trips six months in advance.

In Italy, Thai tourism marketing campaigns will have to focus more on awareness-building and use the travel agents to influence consumer decision-making.

In the Netherlands, there was greater awareness of Indonesia, a former Dutch colony. Hence, it was felt that Thailand needed to stress its own beautiful beaches and the “Thainess” factor to attract stopover traffic.

Said the Governor, “We learned a lot from the research and will be happy to share it with our friends and partners in order to help them improve their own marketing strategies for Thailand.”

Tourist arrivals to Thailand from the five European countries in the research study, 2010-2012: