Thailand’s resort destinations of Phuket and Samui have taken a page from the iconic television show Survivor’s playbook during the country’s prolonged political crisis. Sharp increases in direct airlift to the two islands has seen tourism prosper in what could best be termed as Outwit, Outplay and Outlast.

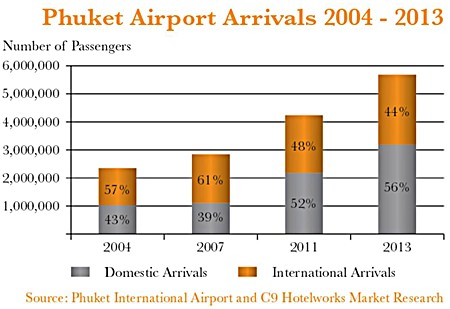

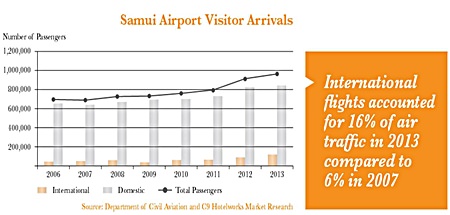

According to new research by consulting firm C9 Hotelworks, international passenger arrivals to Phuket rose 26% in 2013, while Samui shot up 37% in year-on-year growth. Looking inside the numbers the emerging markets of Mainland China and Russia are key drivers of demand, with each posting gains into Phuket at 67% and 41% last year respectively. Download both reports here: Phuket Hotel Market Update 2013 <http://www. c9hotelworks.com/downloads/phuket-hotel-market-update-2014-03.pdf> and Samui Hotel Market Update 2013 <http://www.c9hotel works.com/downloads/samui-hotel-market-update-2014-03.pdf>

Bill Barnett, Managing Director of C9 Hotelworks.

Bill Barnett, Managing Director of C9 Hotelworks.

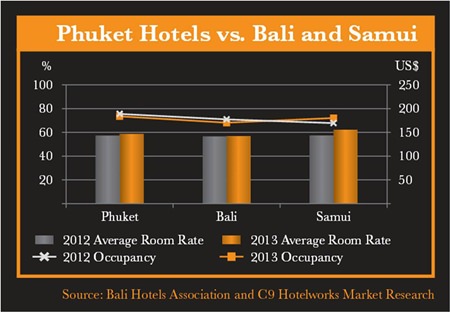

While Thai politics have made headline news globally, data from STR Global saw Bangkok hotels register a 26% Y-o-Y decline in January occupancy due to the impact. Conversely the two resort markets compared to Bali which experienced a high-trajectory growth trend over the previous four years outperformed their Indonesian counterpart for the full year in term of market wide occupancy and average rate.

Bali’s international passenger arrivals posted a 9% growth in 2013, but the gains were absorbed into a mounting number of new hotel rooms that has the local industry concerned with looming oversupply.

Speaking on the current situation, C9’s Managing Director Bill Barnett said, “Phuket and Samui have been broadly insulated from the situation in the nation’s capital, as overseas flight traffic remains on an upward path. Phuket’s occupancy last year was 74% with Samui closely following with 73%. More importantly the latter saw a record high 1.7 million visitors in 2013, with 88% of these coming internationally.”

C9’s research has pinpointed airlift as a main component of sustainable tourism growth to Thailand’s resort markets noting that Samui’s private airport limitation on stated capacity has been bypassed with the nearby international aviation facility in Surat Thani.

Over the past two years, annualized passenger arrivals has swung upwards by 38% and 32%, boosted by a combination of domestic and direct overseas fights, which has effectively created a Plan B stimulator for the island’s blossoming tourism sector.

“Looking skyward remains the most prolific economic gauge for Phuket and Samui,” adds Barnett, commenting on the trading horizon for the remainder of 2014. “Feedback from hotels remains positive given the dynamics of a shorter term booking horizon. Historical trading trends have shown the potential to claw back any lost business due to external events within a compressed time period.”