Risk On Risk Off

A successful asset allocation strategy goes further than just

allocating assets to broad asset classes. Allocation within these classes is

also vitally important. Unfortunately this is not as simple as following a

quantitative model. It is of great importance to have a fundamental

understanding of the current situation to start with in order to structure each

component of the broader allocation correctly.

To illustrate this, we look at a common perception within

currencies and commodities that some investors hold without assessing the

fundamental backdrop, namely the “flight to safety” premise, where they believe

Gold and the US Dollar gain in ‘risk off’ periods. The chart shows the Japanese

Yen relative to US D over eight bear markets since the mid 1980’s. The Japanese

Yen provides positive returns in these periods, which shows that it offered

better protection than the USD. However, the Yen is not a perfect hedge, as when

the IT bubble burst, it did not offer much, if any, protection at all. Gold also

only offered positive returns in 10 out of the 13 US bear markets since 1970.

The asset class where most investors attempt to get exposure

to high Beta during periods of ‘risk on’ and low Beta during periods of ‘risk

off’ is equity. Within this asset class there is the perception that some

sectors clearly do the trick better than others. As above, this holds true to an

extent on average, but the results of this strategy can be vastly improved with

a deeper understanding of whatever the current market is at the time.

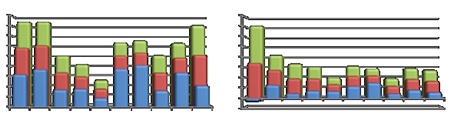

The bar charts here depict the average return (middle bar) of

each sector during all ‘risk off’ (bear) and ‘risk on’ (bull) markets over the

past 20 years as a ratio to the general market as a proxy for its Beta. To give

a sense of the reliability of this relationship we plot plus (back bar) and

minus (front bar) one standard deviation from the average. The smaller the

range, the more reliable the average will be as a guide to action.

Reading from left to right the columns are: Technology,

Financials, Energy, Healthcare, Staples, Consumer Discretionary, Industrials,

Utilities, Materials, Telecoms.

Whilst some average results are hardly surprising (such as

staples, healthcare and energy offering downside protection), dispersion on many

is quite wide. Tech stocks would have been a leveraged play on the downside at

some stages, whilst being negatively correlated when markets rallied at other

times. Also the consumer discretionary sector underperformed on the down and the

up side at different periods. Industrials and materials are not biased one way

or the other on average and financials does offer a leveraged play in general as

anticipated, but this does not always work and disparities are large.

In a nutshell, this analysis suggests that quantitative

analysis is not effective if not backed by fundamental reasoning, which can be

different every time the wheel comes around. Therefore, whilst diversification

is very important, it is how it is allocated that will bring you in the extra

comfort and reward.

|

The above data and research was compiled from

sources believed to be reliable. However, neither MBMG International Ltd

nor its officers can accept any liability for any errors or omissions in

the above article nor bear any responsibility for any losses achieved as

a result of any actions taken or not taken as a consequence of reading

the above article. For more information please contact Graham Macdonald

on [email protected] |