Recently gold went through the roof and then fell off it.

What to do? Is this a blip or has gold now reached its peak? What happened was

down to many reasons but the basic ones are: profit taking, increased margin

requirements and a ridiculous amount of speculation in the market. However, the

price crash does not change the fundamentals of the economy. The fact is there

is too much paper money being printed and inserted into the money supply. This

means that no matter what short term speculation happens - the fundamentals in

the economy behind these metals will never change.

Frank Holmes on www. usfunds.com gave a good insight when he said that certain

people thought gold was in a bubble when it reached USD250 p.oz and whilst there

has certainly been some volatility over the last decade or so it has managed to

break through the USD1,500 barrier. That is 500% - not bad over the time period.

However, is this a bubble or sustainable growth? If you believe Rodney Sullivan

of CFA Digest who has done research into the history of market bubbles over the

last four hundred years you would not say it is a bubble. Sullivan has

discovered three important factors in the forty seven major bubbles since 1600.

These are:

-

New ideas which are seen as a benefit to people in general

-

New ideas which are seen as a benefit to people in general

- Investors getting excited when these new ideas are taken on by society and so

bring in speculators

- Excess leverage by the aforementioned speculators which then brings in more

money until the bubble bursts

Gold does not really conform with any of these points. However, there are some

good points which show why, despite the recent fallback, gold will continue to

rise in price:

1. When gold got to over USD1,400, Credit Suisse said there was nothing to worry

about as this was only a Standard Deviation (SD) of 0.7 from when it was under

USD1,000. This is nothing when you consider the average SD in recent bubbles -

Japanese equities in the mid-1980s, dot.com in the late 1990’s and Goldman Sachs

Commodity Index in 2005 - was 5.3. When gold shot up in 1979, the SD was over 10

which is much more than where we are at the moment. See Graph 1.

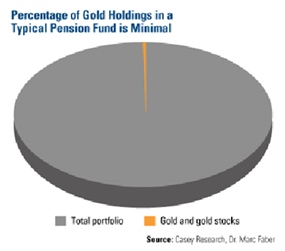

2. People who own gold are not just those evil speculators. Eric Sprott of the

Canadian company, Sprott Asset Management, actually shows that gold is still

under-sold. Although there was a 30% rise in gold holding during 2010 when

compared to a percentage of worldwide financial assets, this has only gone up by

less than 0.75% and this is only really due to the fact of how much gold has

gone up, not by the rise in actual investment. Sprott has calculated that the

actual new investment into gold bullion over the last decade or so is about

USD250 billion. This is nothing when compared to nearly USD100 trillion that has

been invested in other financial assets since 2000. Going hand in hand with this

is that institutional investments, especially things like pension funds, in gold

are still comparatively small. See Graph 2.

3. If the US Dollar reduces in value this should only be good

for gold as it will mean a higher price. Despite recent volatility gold should

continue on its upward climb for the foreseeable future. The trade weighted

dollar index (DXY) is only just more than the lows seen towards the end of 2009

and is only 8% more than the nadir of March 2008.

BCA Research believes that the US Dollar’s apparent weakness is being pushed by

four important reasons:

a) The possibility of China letting the Reminbi appreciate when the US dollar is

weak

b) The possibility of the European Central Bank increasing rates again

c) The expansion of the Federal Reserve balance sheet during QE2

d) Real interest rates remaining low combined with fears of inflation

Gold will always benefit when there is a problem between a country’s fiscal and

monetary policy. This is what is happening at the moment in the US and elsewhere

and gold is the benefactor.

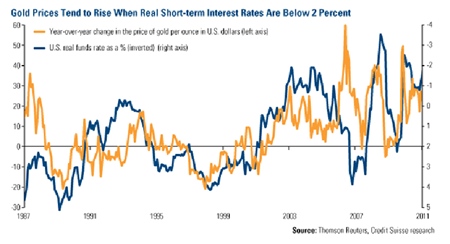

4. It is the normally the way that when there is a rise in deficit spending,

printing presses going 24/7 and low interest rates, the rate of inflation will

be higher than the nominal rate. Gold always benefits when this happens.

GFMS CEO Paul Walker was interviewed recently in MineWeb. He said that,

“Ultra-low interest rates, macro-economic dislocation, fears of global

imbalances…the wrath of these things still remain solidly in place and that’s

really the bedrock of the gold bull rally.”

5. When put together, the economies of Eurozone, Great Britain and the US have a

combined USD6.3 trillion of excess leverage. This means that each of their

central banks will have to keep real interest rates at extremely low levels.

This makes things good for gold - as seen from Graph 3.

6. So far we have just been blaming the west. However, it must be remembered

that as the wealth of eastern nations increases then so does the attraction of

gold to the people in those countries. The more gold they buy the more demand

there is and so up goes the price.

7. Lots of people talk about the G7 but we should also consider the E7 which

comprises the top seven countries with the most people. What is noticeable is

that the G7 is responsible for half of the global GDP but only has 10% of the

world’s population. However, the E7 make up half the world’s population but only

contributes 18% of GDP. Why is this significant? Well, money supply and GDP per

capita is rising much faster in the E7 than it is in the G7. In fact it is

almost eighteen percent against 3.7%. If the money supply growth is generally

more than fifteen percent it usually bodes well for gold.

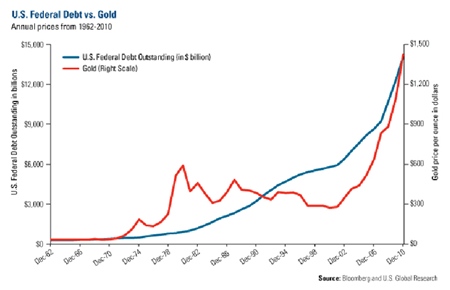

8. As things stand at the moment, the US deficit looks to be around USD1.5

trillion. Graph 4 shows how this affects the price of gold when compared to US

debt.

So, the future for gold looks nice and rosy but for how long? Credit Suisse

believe gold will be at USD1,550 by the end of the year whereas BCA thinks it

could be as high as USD1,600. There is no doubt the current gold bull market

will end. Indeed, George Soros recently sold all of his gold but many people

believe this is too early. There is too much volatility in other asset classes

at the moment for gold not to be important and so it should still be part of

your portfolio but make sure you can get rid of it quick if necessary.

|

The above data and research was compiled from sources

believed to be reliable. However, neither MBMG International Ltd nor its

officers can accept any liability for any errors or omissions in the above

article nor bear any responsibility for any losses achieved as a result of any

actions taken or not taken as a consequence of reading the above article. For

more information please contact Graham Macdonald on [email protected]

|